According to the latest report by Lloyd’s Register Maritime Decarbonisation Hub, e-ammonia might become the most widely used marine fuel among hydrogen-based fuels, while liquefied bio-methane is expected to lead among biofuels.

More specifically, the Future of Maritime Fuels report reviews a broad variety of fuel mix estimates and identifies two potential transportation paths: hydrogen-based fuels and biofuels. The research also assesses the energy supply system dynamics in various scenarios, taking into consideration predicted supply and other sector fuel needs.

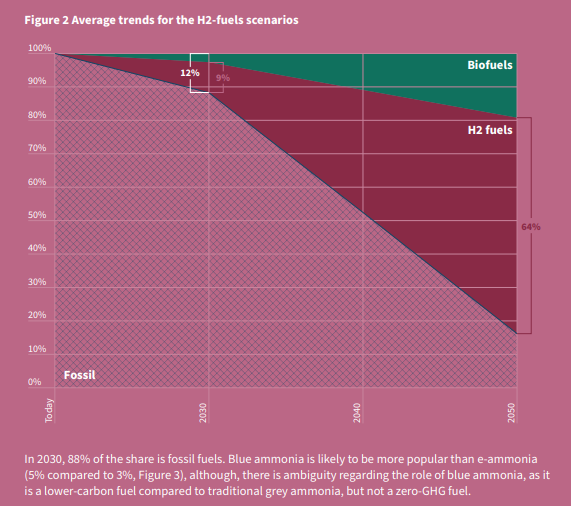

#1 Hydrogen-based scenarios

The shipping industry is expected to become the largest user of clean ammonia by 2050, with an average share of 46%. E-ammonia is expected to become the most highly adopted maritime fuel in the long term, with an average market share of 35% by 2050.

The shipping industry’s consumption of blue and e-ammonia is expected to increase from 0.79 EJ in 2030 to 6.06 EJ in 2050, making it the largest user of ammonia compared to other sectors. The hydrogen required to supply ammonia could represent 3.7%-7% of the expected global hydrogen demand in 2030 and 8.3%-17.5% in 2050.

While there is little concern about the technical potential of producing hydrogen due to renewable energy sources, the key supply challenge is the ability to scale production at the required pace.

If the shipping industry becomes the largest user of clean ammonia, it will need to drive development for supply infrastructure and show leadership in securing adequate scaling.

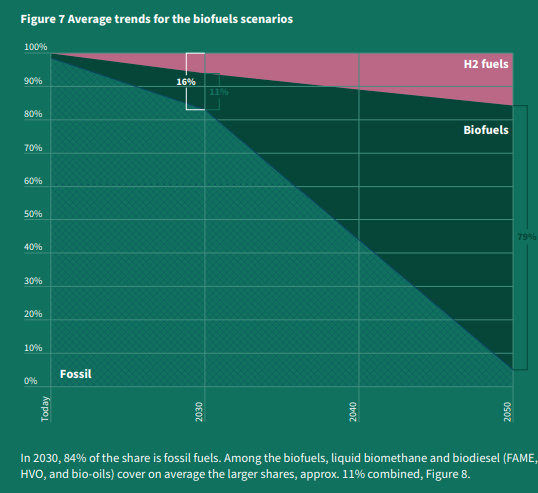

#2 Biofuel-based scenarios

Bio and renewable diesel, including liquefied biomethane, are expected to become the most widely adopted maritime fuels in the long term. Liquefied biomethane is projected to capture an average 34% market share by 2050, with varying market shares due to future prices and supply limits.

The average share of liquefied biomethane will result in significant energy demands, such as increasing from 0.5 EJ in 2030 to 4.58 EJ in 2050. However, the expected supply for shipping is expected to fall short, indicating either high demand or shipping’s larger share in the global biomethane market.

The shipping industry’s role in driving the global biomethane market dynamics could become crucial, although it is unlikely that biomethane will become a dominant maritime fuel.

#3 Methanol

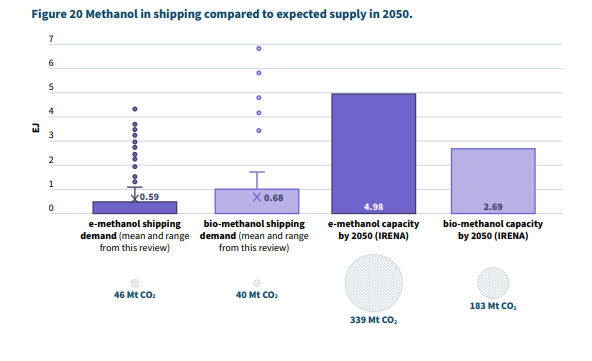

Methanol is expected to have a lower market share than ammonia and biomethane, contradicting the increasing ordering of dual-fuel methanol vessels. By 2050, combined bio and e-methanol will capture 13.4% of total shipping fuel.

Biomethanol is projected to have a higher uptake (8.6%) than e-methanol (4.8%), with a market share of 43% by 2050. This results in lower energy demands compared to ammonia and liquefied biomethane.

The expected supply of both bio and e-methanol should meet demand, but demand estimates are relatively low. If the shipping industry becomes a major user of methanol, it will need to drive the development of economically viable biomethanol and e-methanol options.

#4 Alternative approach

Following the analysis of different fuel mix projections, the report identifies avenues for further exploration, such as deeper examination of fuel supply dynamics and their integration with existing fleet models, as well as cross-sector collaboration to enrich the industry’s understanding of shipping’s multifaceted fuel transition as it navigates towards greener horizons.

To remind, the recently published Maritime Forecast to 2050 by DNV found that the shipping sector would have difficulties in procuring an adequate supply of carbon-neutral fuels. Therefore, DNV suggested that that it is essential for industry stakeholders to demonstrate flexibility and explore several alternatives in order to mitigate emissions.

For meaningful progress, stakeholders across the maritime supply chain need to take on leadership in shaping alternative multi-fuel strategies and catalyse investment cases through strategic partnerships and collaborations.

… said Charles Haskell, Director, LR Maritime Decarbonisation Hub

According to Carlo Raucci, Decarbonisation Consultant, LR Maritime Decarbonisation Hub, their scrutiny of fuel mix projections shows that investors and shipowners will face the dilemma of choosing from different alternative fuel pathways.

It is uncertain if one category of fuel will dominate the maritime fuel mix in the short and long-term, and investors face risks, such as stranded assets, which have limited the investment readiness level of low to zero-carbon fuels, Carlo Raucci added.

Therefore, first movers’ initiatives such as green shipping corridors, will be pivotal in reducing the uncertainty by scoping out multi-sector fuel supply projections that could potentially help to aggregate demand and lower risks

… concluded Carlo Raucci