Industry coalition SEA-LNG analysis showed that LNG dual-fuel vessels provide the lowest compliance cost for meeting EU and IMO decarbonisation regulations.

SEA-LNG has undertaken analysis based on a modelled mid-sized, 14,000 TEU container vessel. This analysis is in the form of both a single vessel and also an eight-vessel fleet operating the Rotterdam – Singapore trade route over the period 2025 to 2040. The analysis focuses on the LNG, methanol, and ammonia fuel pathways and compares their compliance costs against the default of using VLSFO (very low sulphur fuel oil).

Furthermore, it uses the specifications for main and auxiliary engines published by the main marine engine manufacturers MAN Energy Solutions, Wärtsilä and WinDG.

Key takeaways from the SEA-LNG analysis of container vessel and fleet scenarios operating on the Rotterdam to Singapore trade route in the period 2025 to 2040 are as follows:

- Operational costs are likely to be significantly higher for fleet operators under IMO and EU decarbonisation regulations.

- The use of LNG, methanol and ammonia dual-fuel engine technologies can reduce compliance costs.

- An LNG dual-fuel vessel provides the lowest cost compliance solution. This is driven by the fact that it has lower GHG emissions than VLSFO in its fossil form and vessels can avoid using relatively expensive MGO (marine gas oil) for ECA (Emission Control Area) compliance.

- FuelEU Maritime will have a major impact on how fleet operators run their alternatively fueled vessels. Operators will offset non-compliance by traditionally fuelled (VLSFO) vessels by ramping up the quantity of green fuels they burn in alternatively fueled vessels to generate FuelEU Maritime credits.

It’s our mission to provide objective data and analysis to support owners and operators in decision-making at this critical juncture for shipping. As greenhouse gas emissions become subject to increasingly stringent regulation, the industry needs cost-effective solutions to meet its decarbonisation goals.

…said Steve Esau, Chief Operating Officer, SEA-LNG.

Esau continued by stating that his study clearly illustrates that the LNG pathway is a cost-effective way to meet regulatory compliance targets now and in the future.

Key GHG emissions regulations

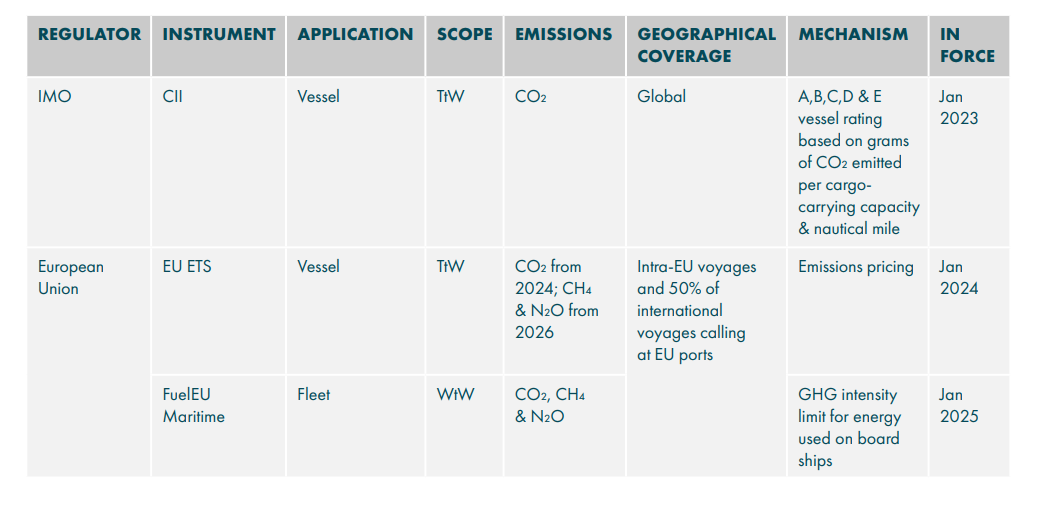

The regulations driving the shipping industry decarbonisation:

These regulations vary in terms of application, scope, emissions, geographical coverage and mechanism. Some regulations are linked to whole lifecycle emissions of marine fuels from well to wake (WtW), while others only consider emissions onboard from the tank to wake (TtW). The emissions regulated include just carbon dioxide (CO2), or multiple GHG including methane (CH4) and Nitrous oxide (N2O).

In analysing their impacts, it was also needed to take into account the impact of local emissions regulations such as SECAs (Sulphur Emission Control Areas) and

NECAs (Nitrogen Oxides Emission Control Areas) which regulate SOX (sulphuroxide) and NOX (nitrogen oxide) emissions, and the EU’s Onshore Power Supply (OPS) mandates at core TEN-T (Trans-European Transport Network) European ports which start to come into effect from 2030 onwards.