Rates for shipping containers from Asia to the US surged as the deadline to avoid a strike at US Gulf and East Coast ports nears – while rates for liquid chemical tankers were flat to softer as ship owners await contract nominations, according to Independent Commodity Intelligence Services (ICIS).

Container rates

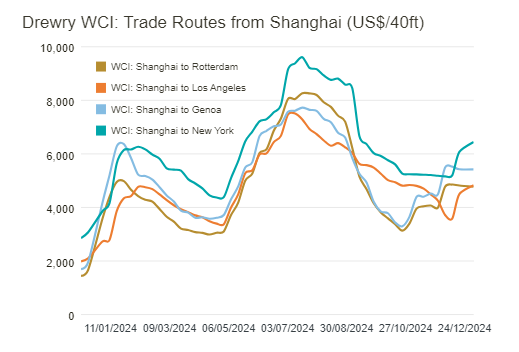

Global average rates for shipping container rose by 3% this week, according to Drewry, with rates to both US coasts topping that. Rates from Shanghai to New York rose by 6% and rates from Shanghai to Los Angeles rose by 7%.

Furthermore, Drewry expects rates on the transpacific trade to rise in the coming week, driven by front-loading ahead of the looming International Longshoremen’s Association (ILA) port strike in January and the anticipated tariff hikes under the incoming Trump Administration.

Container ships and costs for shipping containers are relevant to the chemical industry because while most chemicals are liquids and are shipped in tankers, container ships transport polymers, such as polyethylene (PE) and polypropylene (PP), are shipped in pellets. They also transport liquid chemicals in isotanks and a strike could have a direct impact on US PE exports.

Year-to-date through November, PE exports accounted for 46.6% of overall PE sales with an average of 2.4 billion lb/month. Through October, 73% of seaborne US PE exports utilized ports that are facing the work stoppage threat.

Liquid tanker rates

US chemical tanker freight rates held steady for most trade lanes this week, with only a few exceptions. Commentary was quiet again amid the start of the new year as most players are still on extended holidays. However, the USG to Brazil and West Coast India is starting 2025 off slightly lower. From the USG to India, there has been a slow start to the new year with limited activity on the market. There is some prompt space available for few prospects to fill.

Moreover, most contract of affreightment (COA) charterers are or have been nominating their cargoes to move in January, while the spot market is virtually nonexistent.

From the USG to Rotterdam, rates are facing some downward pressure in the new year compared to where they were at the end of December. It is likely that the market will pick back up in the next couple of weeks. Freight rates remain steady and will likely stay unchanged for the beginning of the year.