The number and impact of major and total hull losses has remained low since 2016, a trend that continues into the first half of 2018, according to figures by the Nordic Association of Marine Insurers (Cefor).

The overall claims frequency continues its positive trend and stabilizes at a relatively low level, and total loss frequency reached a minimum again in the first half of 2018, and continues thus the last year’s trend with some oscillation at low levels.

Insured values dropped on average 2.5% on 2018 renewals. The improvement compared to the previous years is especially due to some recovery in the supply/offshore segment in 2018, following a recovery in the bulk market in 2017. However, it should be noted that there is an increasing gap between the development of vessel values as compared to the average vessel size, and the income may be influence by many factors.

Highlights

- Total losses: The frequency of total losses reached thus far in 2018 its lowest level since 1996.

Although it is too early to conclude for the whole year 2018, the general trend over the last eight years has been a stabilization of the total loss frequency at low levels, with some oscillation between 0.05% and 0.10%. This stabilization followed a continuous reduction towards the current level in the years prior to 2010.

- Major losses: The impact of major losses continues to be low.

-In the first half of 2018, three losses exceeding USD 10 million were reported.

-This compares to five such losses in the first 6 months of 2017, and two in the first six months of 2016.

-Since 2015, no losses have been reported exceeding USD 30 million.

-The largest loss since 2015 occurred in 2017 and had a cost of USD 26 million, the second largest in the 1st quarter of 2018 at a cost of USD 25 million.

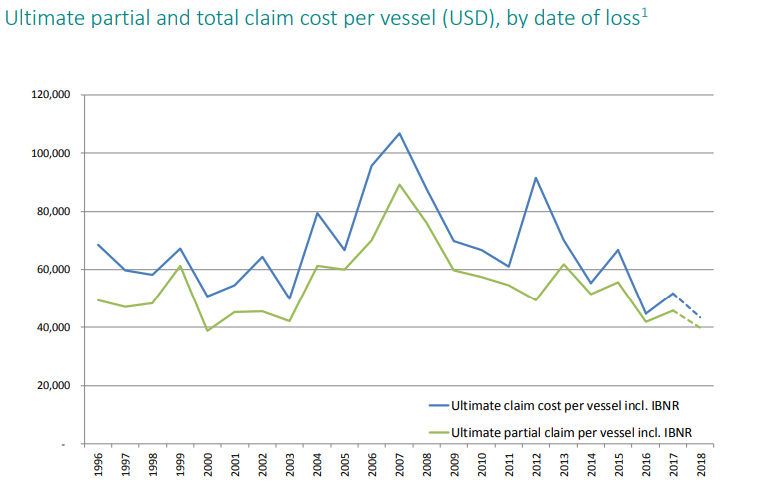

- Claim cost per vessel, excluding total losses: Per June, the 2018 claim cost per vessel, excluding total losses, was similar as in 2016 and 2017.

2017 showed a slightly higher cost mainly due to the occurrence of two major losses exceeding USD 20 million. Nevertheless, the claim cost per vessel in all three years reflects a lower level than the preceding ten years.

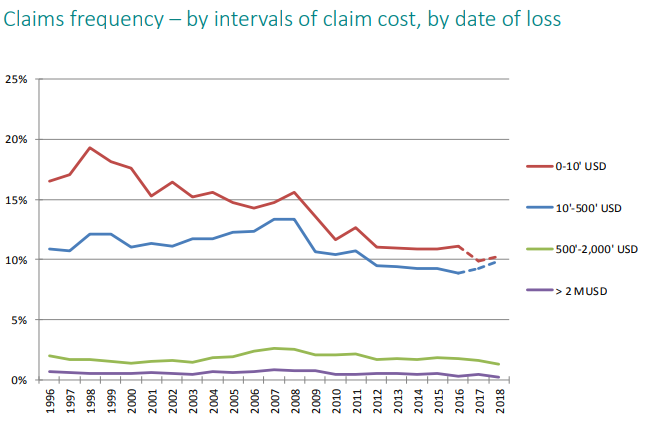

- Claims frequency: The overall claims frequency has been very stable around 22% since 2012, and this positive trend continues into 2018.

- Insured values: Renewals in 2018 have thus far shown less reduction in the insured values than renewals in the previous years.

-The drop in 2018 was only 2.5%, compared to an average drop in values of 5.7% in 2017, 7.5% in 2016 and 9.3% in 2015.

-The improvement is influenced by a recovery of the bulker market from 2017, followed by some recovery in the supply/offshore market in 2018.

The average value of the whole portfolio is influenced by the continued inflow of highvalue newbuilt vessels, but recent years showed an increasing mismatch in the evolution of the average vessel sizes as compared to the average insured values.

- Portfolio:

-Vessels with IMO-number: 274,325 vessel years since 1985 (2017: 16,333 vessels, 2018: 10,911 vessels registered as of 30 June).

-NoMIS statistics reflect roughly 26% of the total world fleet of vessels above 1,000 gross tons, and 45% of vessels above 10,000 gross ton.

Explore more herebelow: