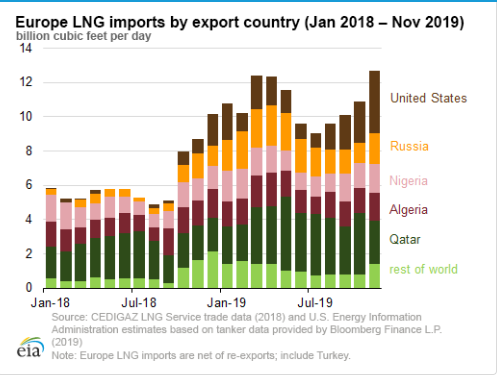

The U.S. Energy Information Administration (EIA) in its recent natural gas update, showed that Europe’s imports of liquefied natural gas (LNG) have marked a steady increase since last October, while have set a new monthly record of 12.7 billion cubic feet per day (Bcf/d) for November 2019.

To be more specific, the above-mentioned record involves a 51% utilization of Europe-wide regasification capacity, including Turkey as well.

From January until November 2019, the Europe’s LNG imports marked 11 Bcf/d, meaning the highest level for its LNG imports ever recorded, which surpasses the previous one of 8 Bcf/d (annual average) set in 2011.

Although the LNG imports into Europe have been noticed to be low in recent years, this year Europe’s spot natural gas prices declined to a 10-year low providing incentives for increased electric generation from natural gas-fired power plants.

The intense growth in the power generation field along with the reduce of natural gas production in the UK and the Netherlands, demanded larger volumes of natural gas imports by pipeline and as LNG.

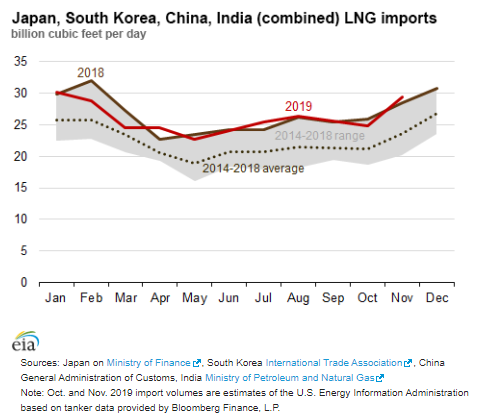

At the same time, reduced demand of LNG in Asia has resulted more destination-flexible LNG cargoes that were shipped to Europe.

For the 2019, three LNG suppliers to Europe-Qatar, the United States and Russia have risen their LNG exports to the region by a combined 3.7 Bcf/d in the first quarter of 2019, in comparison with LNG exports to Europe by these suppliers in 2018.

As for the United States, noticed the largest increase as its LNG exports grew from 0.4 Bcf/d in 2018 to 1.8 Bcf/d in the first 11 months of 2019, following there was Russia (1.3 Bcf/d increase), and Qatar (1.0 Bcf/d increase).

Several Europe’s suppliers, such as Nigeria, Trinidad & Tobago, and Algeria noted an increase in their LNG exports by 0.3 Bcf/d each in 2019 (January–November) compared with the annual average for 2018.

As EIA further showed, major Asian LNG consumers like Japan, China, South Korea and India imported an estimated 26.1 Bcf/d of LNG through January and November 2019, 0.7 Bcf/d, 3% less comparing to 2018.

Specifically, Japan and South Korea lowered their LNG imports by 0.8 Bcf/d and 0.6 Bcf/d, respectively, from January until November 2019. Concluding, China’s LNG imports marked a slight growth in comparison with the 40% increase from 2017 to 2018.