Europe invested €27 billion in new wind farms in 2018, which will finance a record amount of future new wind energy capacity, according to WindEurope’s annual report. The amount invested is similar to previous years, but, thanks to cost reduction, especially in offshore wind, it will finance a record 16.7 GW of new wind capacity.

As explained, 1 MW of new onshore wind capacity now requires only €1.4m capital expenditure, down from €2m in 2015. And 1 MW of new offshore wind capacity requires €2.5m, down from €4.5m in 2015.

Most of the future new capacity for which investments were announced last year was onshore wind: 12.5 GW. Offshore wind accounted for 4.2 GW, though 38.5% of the amounts invested.

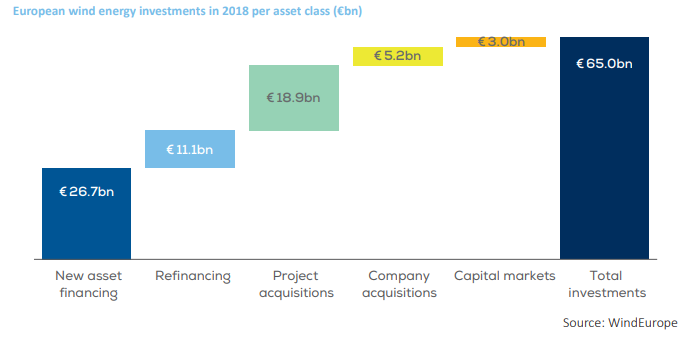

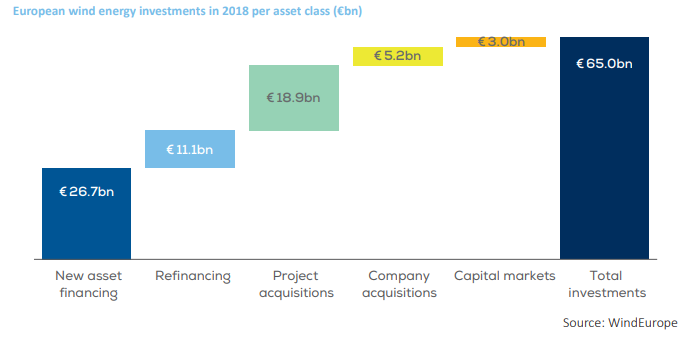

Meanwhile, a further €24.1 billion was invested in the acquisition of wind farms including projects under development and of companies involved in wind energy. This is much more than in previous years.

The maturity of wind energy and the competitiveness of the sector have brought in more investors as equity partners in projects, particularly from financial services. As investors become more confident about wind energy, they can price risk more accurately and invest earlier in projects.

Findings

- Europe invested €27 billion in new wind farms in 2018, financing a record amount of future new wind energy capacity

- Investments in wind energy in Europe in 2018 will finance 16.7 GW of new capacity

- 190 wind farms across 22 different countries in Europe reached Final Investment Decision last year

- €24.1 billion was invested last year in the acquisition of wind farms including projects under development and of companies involved in wind

- Wind energy represented 60% of all investments in power generation capacity last year.

2018 annual figures

- Europe raised a record total of €65bn for the construction of new wind farms, refinancing operations, project and company acquisitions as well as public market fundraising. • Less than half of this, €26.7bn, was investments in new wind farms. However, due to cost reductions in new project financing, 2018 was a record year for new capacity financed (16.7 GW). 12.5 GW of new capacity was financed for onshore projects and 4.2 GW for offshore.

- Investment in new onshore wind projects was a record €16.4bn, 38% of the total new power investments in Europe. Investment in new offshore wind farms totaled €10.3bn (24% of total new power investments).

- Project acquisitions, where investors purchase (a share of) a wind energy project whether in operation or under development, doubled in value in 2018 to €18.9bn, from €9bn in 2017. These were the main drivers of growth in wind energy investments.

- Banks extended a record €26.9bn in non-recourse debt for the construction and refinancing of wind farms. • Wind energy was the largest investment opportunity in the power sector in Europe.

Country highlights

- Investment flows in 2018 were less geographically concentrated than 2017, with 22 countries announcing Final Investment Decisions (FIDs) compared to 20 countries in 2017 and 16 in 2016.

- Northern and Western Europe still hold the biggest bulk of new investments. The UK and Sweden account for 35% of the new FIDs announced in 2018.

- Investments in South East Europe (SEE) remain low. With a total of €1bn, the SEE region represents only 4% of the total new assets financed in Europe, down from 16% in 2017.

- In the UK, the Moray East (950 MW) and Triton Knoll (860 MW) offshore wind farms reached FID. In the Netherlands, Borssele III and IV Offshore Wind Farms (731.5 MW) reached FID.

- The largest onshore wind farm to reach FID in 2018 was Nysater in Sweden, with a capacity of 475 MW.

Investment trends

Investment trends

- The low interest rate environment, plus a large number of lenders looking to invest, continues to provide favourable conditions to drive the take up of new debt and the refinancing of existing debt.

- Capital for new assets is being raised with more debt than ever before. Projects raised 90% of their capital with debt in 2018 (on a project finance basis).

- 2018 was a record year for refinancing with €11bn of activity, driven by 4 large offshore wind farms refinancing their debts on completion of the construction phase.

- New investments in offshore wind in 2018 were dominated by project finance transactions. This differs from previous years where offshore financing was dominated by balance sheet transactions (corporate finance).

- Banks are more comfortable with the risks associated with the offshore market facilitating the take up of new offshore projects on a project finance or nonrecourse basis.

Cost reduction means investors now get more MW per euro they invest. And lenders are more comfortable with the risks so the costs of finance are falling too. But Europe needs to keep investing significant amounts in wind if it’s going to meet its 32% renewables target for 2030. The money is out there. But there aren’t enough bankable projects. One problem is permitting: the processes are slower and more complex than they were. Another problem is the lack of visibility today on governments’ plans for renewables. The National Energy Plans they have to write this year are key to resolving this. If they’re clear and ambitious this’ll provide investment signals which will make projects happen,

…said WindEurope CEO Giles Dickson.

Explore more herebelow:

Investment trends

Investment trends