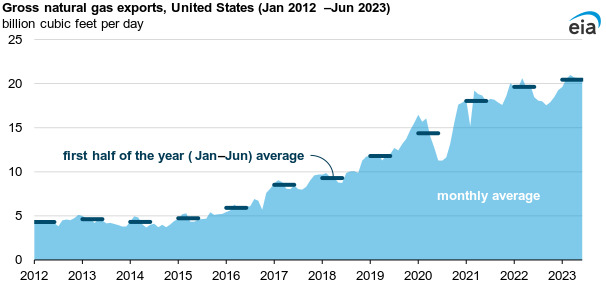

The United States exported more natural gas in the first half of 2023 (1H23) than it did in the same period of any previous year. Natural gas exports averaged 20.4 billion cubic feet per day (Bcf/d), 4% (0.8 Bcf/d) more than in 1H22, according to EIA’s Natural Gas Monthly.

Liquefied natural gas (LNG) exports largely drove the continued growth in total natural gas exports, although natural gas exports by pipeline also increased. The United States began exporting LNG from the Lower 48 states in 2016 when Sabine Pass LNG—the first LNG export terminal in the Lower 48 states—came online.

The United States became a net natural gas exporter (natural gas exports exceeded natural gas imports) in 2017 for the first time since 1957. In May 2023, U.S. net natural gas exports as LNG and by pipeline averaged a monthly record of 13.6 Bcf/d.

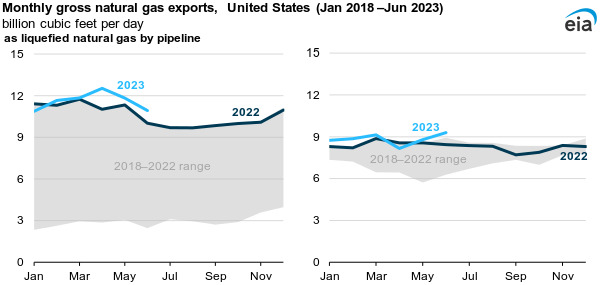

LNG exports. In 1H23, U.S. LNG exports averaged 11.6 Bcf/d, making the United States the world’s top LNG exporting country. U.S. LNG exports in 1H23 increased 4% (0.5 Bcf/d) compared with the same period in 2022, despite declining in May and June.

In 1H23, U.S. natural gas pipeline exports to Canada and Mexico increased 4% (0.3 Bcf/d) compared with 1H22, averaging 8.8 Bcf/d. Net natural gas exports by pipeline, particularly to Mexico, contributed to record-high natural gas exports. U.S. natural gas exports by pipeline to Mexico reached a monthly high of 6.8 Bcf/d in June and accounted for about 66% of total U.S. pipeline exports from January through June.

Furthermore, Mexico increased natural gas imports from the United States in 1H23 to meet electric power sector demand, which has been increasing since 2018. Since 2019, natural gas pipeline exports from West Texas to Mexico have grown steadily as more connecting pipelines in Central and Southwest Mexico have been placed in service.

U.S. natural gas imports by pipeline, which are primarily from Canada, declined by 5% (0.4 Bcf/d) in 1H23 compared with 1H22, to 7.9 Bcf/d. Imports from Canada help support seasonal fluctuations in natural gas consumption in the United States and generally peak in January or February, with a smaller peak in the summer months. A mild winter, combined with wildfires in Western Canada that disrupted natural gas deliveries to the United States this spring, contributed to lower natural gas imports in 1H23 compared with 1H22.