Whether a ship is to be inspected, it’s a decision based on specific MoU procedures. Commonly, if a ship is inspected once in a MoU and the inspection ended without any severe findings, then the ship will be inspected again within the inspection window set by each MoU. However, excluding the Follow Up Inspections and looking through the data, we may see some very interesting findings that will provide a new set of lens to see the world.

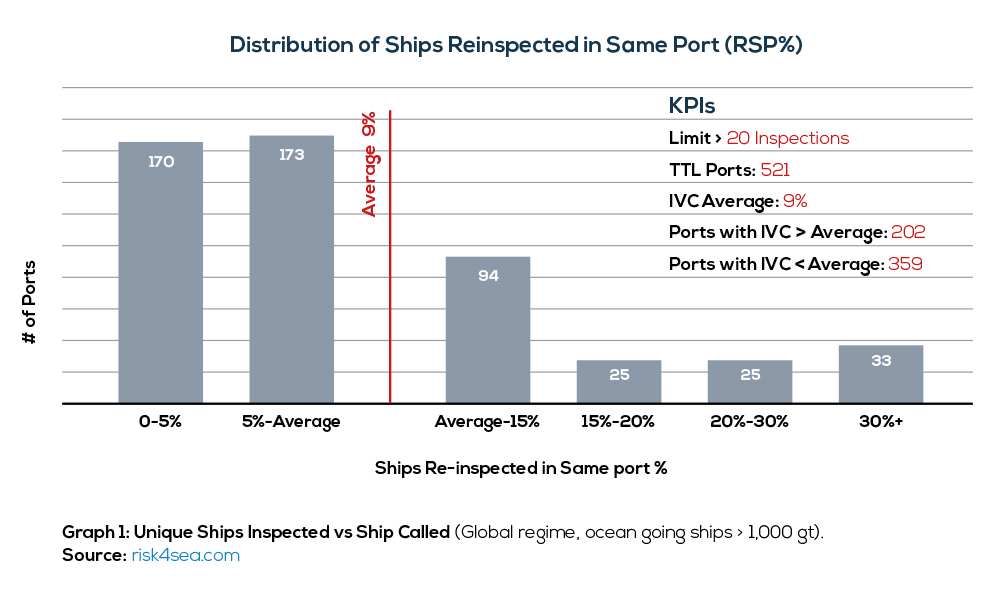

Graph 1 outlines the distribution of ports in the global regime of the Ship Re-inspection rate in the Same Port (RSP %), with some very interesting findings for all ship types.

RSP% = Unique Ships Reinspected in Same Port in the last 12 months (excl. Follow up Inspections) ÷ Unique Ships Inspected in Port in the last 12 months

→ RSP of 100% means that every ship called in the port that has been inspected, has been re-inspected within 12 months from previous inspection in the same port.

Graph 1 clearly illustrates that the significant portion of the ports (i.e. 230 ports or 44% of the sample) has a RSP% in the range of 0-5% which is the expected range. However the remaining 56% of the ports, representing a significant figure of 291 ports have a figure in excess of 5% with a figure of 209 ports even above average and a number of 64 ports in excess of 20%. The status of top 20 ports in terms of inspections, re-inspection and detention rates is properly demonstrated in Table 1 for all ship types for the CY 2021.

| Port | Country | Inspections | Unique Ships Inspected | Ships Re-inspected

(L12M) |

Detention in terms of Rate | RSP% | |

| 1 | Novorossiisk | Russia | 1,297 | 1,039 | 314 | 6.71% | 30.22% |

| 2 | Vladivostok | Russia | 949 | 369 | 159 | 1.79% | 43.09% |

| 3 | Alexandria | Egypt | 668 | 608 | 81 | 0% | 13.32% |

| 4 | Port Hedland, WA | Australia | 647 | 488 | 56 | 4.48% | 11.48% |

| 5 | Lagos | Nigeria | 642 | 571 | 115 | 0.78% | 20.14% |

| 6 | Tianjin | China | 593 | 447 | 31 | 0.67% | 6.94% |

| 7 | Rotterdam | Netherlands | 513 | 511 | 4 | 1.75% | 0.78% |

| 8 | New Orleans, Louisiana | USA | 506 | 489 | 26 | 0.79% | 5.32% |

| 9 | Aliaga | Turkey | 503 | 450 | 27 | 1.59% | 6.00% |

| 10 | Antwerp | Belgium | 501 | 496 | 13 | 6.99% | 2.62% |

| 11 | Manila | Philippines | 453 | 385 | 78 | 0.22% | 20.26% |

| 12 | Mykolaiv | Ukraine | 444 | 426 | 51 | 0.68% | 11.97% |

| 13 | Singapore | Singapore | 443 | 422 | 33 | 0% | 7.82% |

| 14 | Quangninh | Vietnam | 438 | 411 | 62 | 0% | 15.09% |

| 15 | Nakhodka | Russia | 435 | 260 | 73 | 3.68% | 28.08%R |

| 16 | Mersin | Turkey | 435 | 368 | 39 | 3.22% | 10.60% |

| 17 | Fremantle, WA | Australia | 407 | 294 | 45 | 3.19% | 15.31% |

| 18 | Vostochny | Russia | 404 | 279 | 52 | 1.24% | 18.64% |

| 19 | Gresik | Indonesia | 404 | 371 | 54 | 0% | 14.56% |

| 20 | New York | USA | 402 | 383 | 44 | 0% | 11.49% |

Table 1: RSP % (L12M), Selected Ports, CY 2021, source: risk4sea.com

Key Highlights

- 14 out of 20 ports have a PSR percentage above the average of 9 %, while ports like Novorossisk and Port Hedland, also, have an increased Detention ratio.

- Rotterdam, a key port for world shipping, has a PSR % close to 0%.

It is significant to understand the possible reasons behind the increased percentage of re-inspections in specific ports. For starters, the Port’s PSC culture plays an important role, since main ports operate as almost independent organizations both in commercial aspects and PSC procedures. Furthermore, the increased efficiency and availability of PSC personnel can affect the percentage of re-inspections in the same port. Finally, regarding large ports where ships may stay for operations for several days, provide the opportunity to PSC authorities to spread the number and time of inspections.

Concluding, ship managers should keep in mind that the inspection window open date calculated on the basis of past inspections, ship and manager performance in the subject MoU may not always be an effective indicator for whether their ships will be inspected. That is the reason why the use of the RSP index along with the combination of advanced stats like the Ship Inspection vs Ship Call rate may assist in the decision-making process regarding the readiness for a probable PSC inspection during a port call.