The Q4 2023 Shipping Market Overview & Outlook from BIMCO has been released which features an analysis of the tanker shipping market regarding supply and demand.

Demand

According to Niels Rasmussen, chief analyst at BIMCO, the crude tanker market will end 2023 with cargo volume growth of between 0.5% and 1.5% but see tonne miles increase between 4.5% and 5.5%. Cargo volume growth is predicted to accelerate to between 2% and 3% in 2024 and moderate to between 1% and 2% in 2025.

As sailing distances are expected to continue to increase, we forecast that tonne miles will grow between 4% and 5% in 2024 and between 2% and 3% in 2025.

Our forecast is for cargo volume growth in the product tanker market to end 2023 between 1% and 2%, to accelerate to between 3% and 4% in 2024, and to slow to between 0.5% and 1.5% in 2025.

..stated Niels Rasmussen.

We predict that sailing distances will increase throughout the period and that tonne miles demand will grow between 5% and 6% in both 2023 and 2024 and between 1.5% and 2.5% in 2025.

..added.

Supply

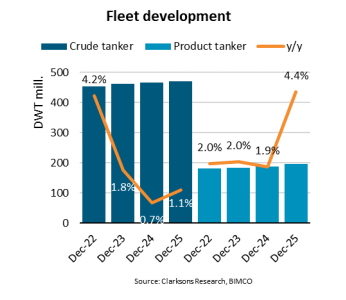

We estimate that the crude tanker and product tanker fleet will end 2023 up 1.8% and 2.0% respectively on last year.

..said Niels Rasmussen.

Crude tanker growth will also remain muted in the coming few years as the order book to fleet ratio remains very low at 4.3%. Contracting of product tankers has in the meantime increased significantly during 2023 and the order book to fleet ratio has increased from 6.0% at the beginning of 2023 to 10.6%. As many owners have secured delivery of newbuildings in 2025, fleet growth is set to increase.

As explained, they therefore estimate that the crude tanker fleet will grow only 0.7% and 1.1% in 2024 and 2025 respectively whereas the product tanker

fleet is forecast to grow 1.9% and 4.5% in 2024 and 2025 respectively.

So far this year, crude tankers have sailed about 2% faster than last year, which will have increased supply by between 1% and 1.5%compared to 2022. Product tankers’ average speed has on average been the same in 2022 nd 2023.

Crude tankers have in the meantime seen 4.8% higher congestion year-to-date than last year, whereas congestion for product tankers has been 7.7% lower.

All in all, crude tanker supply has grown slower than fleet growth in 2023 whereas product tanker supply has grown faster.

Supply/demand

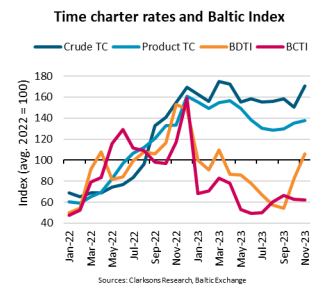

Though the spot markets for both crude and product tankers have suffered reductions during 2023, and crude tankers especially have seen significant volatility, both markets have remained attractive. Time charter rates have remained near the highs of 2022 and second-hand ship prices have continued to increase.