BIMCO released its dry bulk shipping market overview & outlook for January 2025, highlighting that the return to the Red Sea would weaken the market.

Supply/Demand

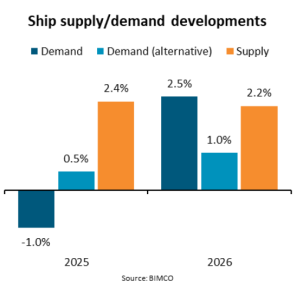

Supply is forecast to grow 2.4% in 2025 and 2.2% in 2026. Sailing speeds may decrease as market conditions worsen. If ships gradually return to the Red Sea in 2025, demand is estimated to fall 1% in 2025 and grow 2.5% in 2026. Cargo demand growth is expected to slow in 2025.

The supply/demand balance is expected to weaken in 2025 and remain at that level in 2026. The market is expected to weaken even if ships do not return to the Red Sea. The ceasefire in Gaza could lead to a return of ships to the Red Sea. However, significant uncertainty remains over the permanence of this agreement.

Demand

China’s GDP growth is forecast to slow to 4.6% in 2025 and 4.5% in 2026, according to the IMF. Weak domestic consumption and a property crisis continue to pose a challenge. Iron ore shipments are forecast to grow 0.5% from 2024 to 2026. Chinese steel production could remain weak, even if exports continue to grow.

Coal shipments are estimated to fall by 3.5% between 2024 and 2026. Chinese and Indian import demand are being challenged by growing domestic mining. Between 2024 and 2026, grain shipments are expected to increase by 3.5%, strengthening in 2026 driven by maize.

Supply

The fleet is expected to grow 5.4% between end-2024 and end-2026. Deliveries of smaller ships have been revised up since our previous forecast. The dry bulk orderbook is equivalent to 10.6% of the current fleet, with 13% of contracted capacity capable of using alternative fuels upon delivery.

16.8m DWT are expected to be recycled between 2024 and 2026. An expected weakening of market conditions will likely encourage the recycling of older ships. Sailing speeds could slow by 1.0% between 2024 and 2026. Amid weaker market conditions, ships may slow down to save on fuel costs.