Predictive Maritime Intelligence company Windward releases insights on how moral sanctions affect world fleet availability.

As the Russia-Ukraine conflict expands, shipping stakeholders are taking a stronger stand against Russian entities and vessels. The market is proactive and continues to drive restrictions on trade to and from Russia, pushing the political landscape to formalize the unofficial sanctions with regulations.

To quantify the impact of these moral sanctions on world fleet availability, it is necessary to understand the availability of this specific market share prior to the invasion.

[smlsubform prepend=”GET THE SAFETY4SEA IN YOUR INBOX!” showname=false emailtxt=”” emailholder=”Enter your email address” showsubmit=true submittxt=”Submit” jsthanks=false thankyou=”Thank you for subscribing to our mailing list”]

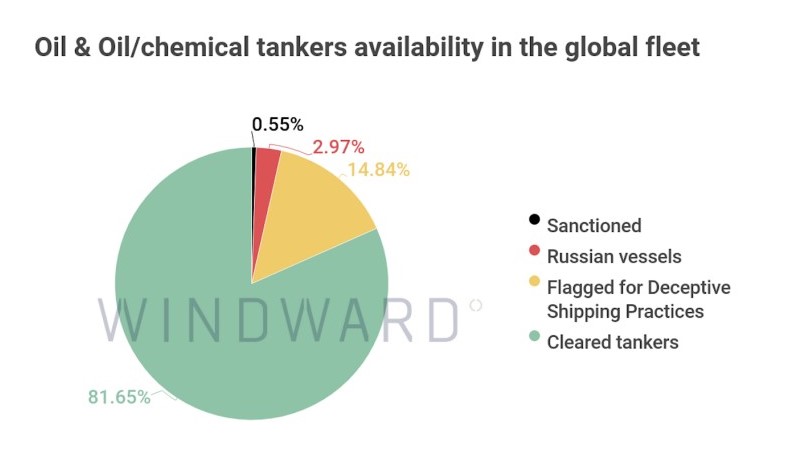

We can take a look at the most common vessel types – the transporters of clean petroleum products: oil and oil/chemical tankers. Currently, there are about +9,000 such registered vessels in the global fleet, including all flags and registration domiciles.

From this available market share, we must first remove sanctioned vessels and those owned or operated by sanctioned companies – a total of 50 vessels. With ESG considerations and moral restrictions coming into effect, about 300 Russian-affiliated tankers, without any previous sanctions compliance risk, are now considered off-limits for business and can be essentially removed from the oil and oil/chemical tankers’ availability.

Together with sanctioned vessels, this translates to a decrease of 4% in the market availability of oil tankers and oil/chemical tankers.

Additionally, shipping players that want to be proactive about deceptive shipping practices should also remove about 1,350 oil and oil/chemical tankers that are flagged for engaging in such practices, as well as those that were officially mentioned in reports published by the UN and OFAC.

After removing all sanction-designated vessels and entities, Russian-affiliated tankers, and those engaged in deceptive shipping practices from consideration, the original +9,000 refined products population decreases by 20%.

With a large portion of tankers becoming unavailable for business, we are expecting to see a great impact on oil and vessel prices in the next couple of weeks.