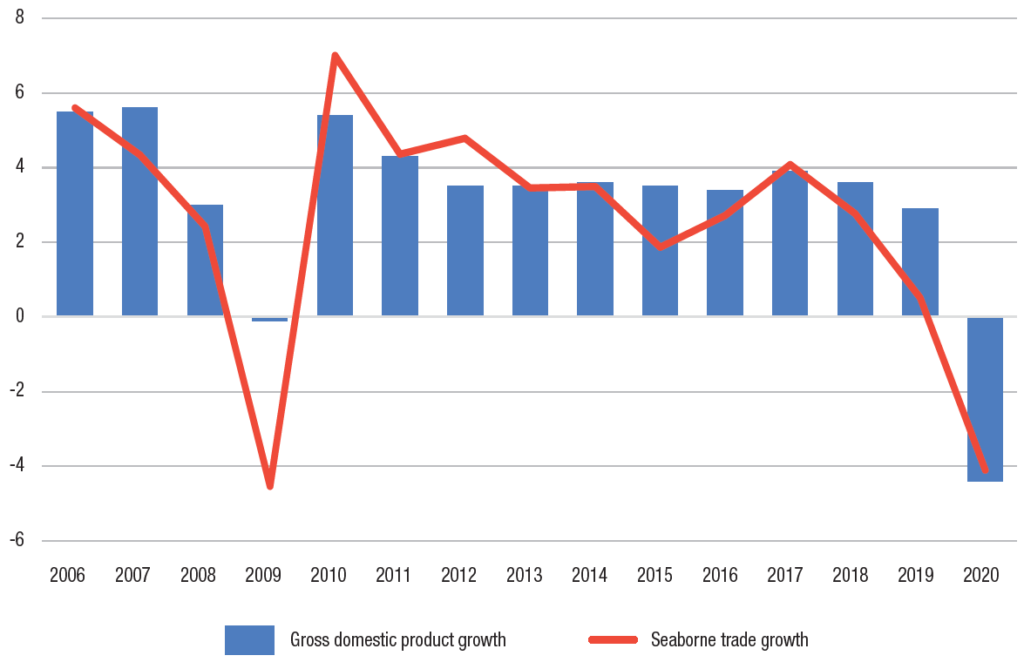

Global maritime trade will plunge by 4.1% in 2020 due to the unprecedented COVID-19 disruption, according to UNCTAD Review of Maritime Transport 2020, released on 12 November. However the pandemic has laid the foundations for a transformed industry and UNCTAD expects a return to growth in 2021.

The report forecasts a grim outlook for maritime trade in the short-term, but UNCTAD expects maritime trade growth to return to a positive territory and expand by 4.8% in 2021, assuming world economic output recovers. However, it highlights the need for the maritime transport industry to brace for change and be well prepared for a transformed post-COVID-19 world.

The global shipping industry will be at the forefront of efforts towards a sustainable recovery, as a vital enabler of the smooth functioning of international supply chains. The industry must be a key stakeholder helping adapt ‘just-in-time efficiency’ logistics to ‘just-in-case’ preparedness,

…UNCTAD Secretary-General Mukhisa Kituyi said.

The pandemic has also exposed how unprepared the world seemed to be in the face of such a crisis, the report observes, underscoring the urgent need to invest in risk management and emergency response preparedness in transport and logistics.

UNCTAD’s director of technology and logistics, Shamika N. Sirimanne, said the pandemic should not push to the back burner action to combat climate change in shipping.

The momentum of current efforts to address carbon emissions from shipping and the ongoing energy transition away from fossil fuels should be maintained,

…she said.

Furthermore, the pandemic unveiled the need for digitalization and eliminating paperwork in shipping, including in ports, reinforcing the need for standards and interoperability in electronic documentation, UNCTAD says.

Many trade facilitation measures taken during the pandemic require further investments in digitalization and automation. Accepting digital copies instead of paper originals, pre-arrival processing, electronic payments and customs automation all help speed up international trade.

On the flip side, the pandemic has also highlighted that digitalization comes with increased cyber security risks.

Responses to the pandemic

At the peak of the crisis, the container shipping industry adopted more discipline, cutting capacity and reducing costs to maintain profitability instead of market share, the report notes.

As a result, freight rates remained at stable levels despite the depressed demand. From the perspective of shippers, these strategies meant severe space limitations to transport goods and delays in delivery dates.

To cope with pandemic-related disruptions, players in the maritime sector adjusted their operations, finances, sanitary and safety protocols as well as working practices and procedures.

In addition, several governments, through their border agencies, port authorities and customs administrations, made reforms to keep trade flowing while keeping people safe.

Border agents, port workers and customs officials play an essential role in keeping trade moving, helping us to navigate through the crisis. It will be important to assess the best practices that emerge from their experiences to strengthen trade facilitation in the years to come,

…Dr. Kituyi said.

Trends in maritime transport 2019

COVID-19 hit world trade after an already weak 2019, driven by China-US tensions, uncertainties around Brexit, complaints made by several countries against Indian tariffs, the Japan-Korea trade dispute and general moves towards protectionism. The report estimates that tariffs cut the volume of maritime trade by 0.5% in 2019.

More notable facts and figures on global maritime trade in 2019:

- Iron ore trade fell for the first time in 20 years, by 1.5%, due to disruptions such as the Vale dam collapse in Brazil and Cyclone Veronica in Australia.

- Brazil overtook the US as the world’s largest seaborne grain exporter.

- As of March 2020, an estimated 20% of global trade in manufacturing intermediate products originated in China, up from 4% in 2002.

- The deployment of larger container ships often increases total transport costs across the logistics chain. The capacity of the largest container vessel went up by 10.9%, but it’s mainly the carriers that benefit from the economies of scale offered by larger vessels, while ports and inland transport providers don’t necessarily benefit.

- Ports are showing more interest in strengthening connections with the hinterland to get closer to shippers and ‘anchor’ cargo volumes – in line with the push for port-centric solutions over recent years.

- China, Greece and Japan remain the top three ship-owning countries in terms of cargo-carrying capacity, representing 40.3% of the world’s tonnage and 30% of the value of the global fleet.

- Liberia, the Marshall Islands and Panama remain the three leading flags of registration, in terms of carrying capacity and of value of the fleet registered. As of 1 January 2020, they represented 42% of the carrying capacity and 33.6% of the value of the fleet.

- The flags of Iran, Taiwan (province of China) and Thailand registered the highest increases in terms of deadweight tonnage. The number of ships flying the flag of Iran quadrupled – this was due to the pressure of sanctions, which led several registries to de-flag vessels associated with trade involving the country.

Explore more details in the full report: