The U.S. Energy Information Administration’s (EIA) U.S. Crude Oil and Natural Gas Proved Reserves, Year-End 2018 report, informs that U.S. oil and natural gas proved reserves had another record-breaking year.

Specifically, in 2018, U.S. crude oil and lease condensate production increased 583 million barrels (17%) from 2017’s production level, and imports of crude oil decreased 73 million barrels (-3%) from 2017’s import level. U.S. natural gas production increased 12% (3.7 Tcf) in 2018, and natural gas imports decreased 5% (144 Bcf) from the 2017 level.

[smlsubform prepend=”GET THE SAFETY4SEA IN YOUR INBOX!” showname=false emailtxt=”” emailholder=”Enter your email address” showsubmit=true submittxt=”Submit” jsthanks=false thankyou=”Thank you for subscribing to our mailing list”]

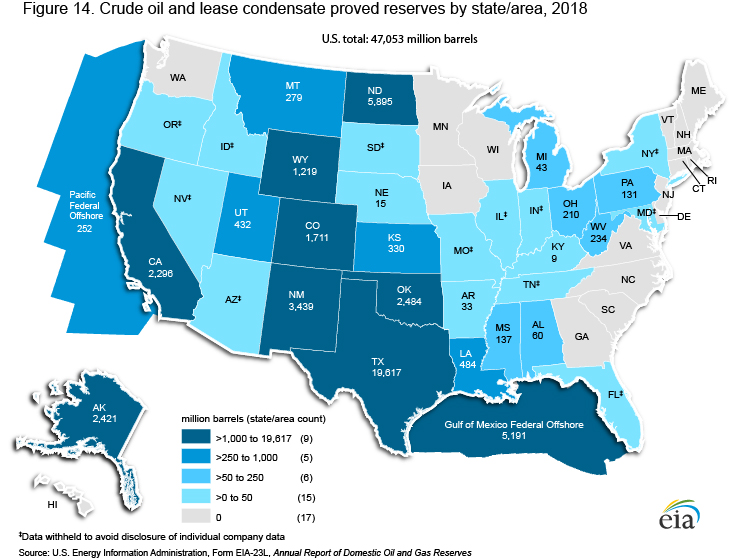

U.S. proved reserves of crude oil and lease condensate rose to 47.1 billion barrels in 2018, a 12% increase compared with the previous record set at year-end 2017 of 42 billion barrels.

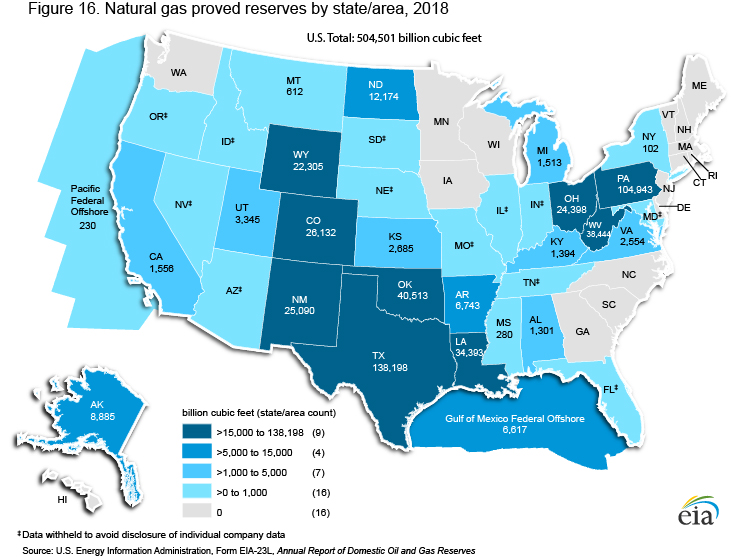

In fact, U.S. proved reserves of natural gas rose to 504.5 trillion cubic feet (Tcf), a 9% increase compared with the record level set in 2017 of 464.4 Tcf; it is said that the growth in oil and natural gas proved reserves was driven by an increase in 2018 oil and natural gas prices.

What is more, higher fuel prices can often increase the proved reserves estimates because a larger portion of the oil or natural gas resource base can be economically producible. Namely, in 2018, the annual average spot price for West Texas Intermediate (WTI) crude oil rose from $51.03 per barrel (b) in 2017 to $65.66/b in 2018, a 29% increase.

The annual average natural gas spot price at the Henry Hub national benchmark in Louisiana rose from $2.99 per million British thermal units (MMBtu) in 2017 to $3.35 per MMBtu in 2018, a 12% increase. U.S. crude oil and lease condensate production increased 17% in 2018 compared with 2017.

In 2018, U.S operators produced an average of 10.96 million barrels per day (b/d), 1.6 million b/d more than in 2017. U.S. marketed natural gas production increased 12% in 2018 compared with 2017. Operators produced 89.9 billion cubic feet (Bcf) of marketed natural gas per day in 2018, 10 Bcf/d more than in 2017.

Remarkably, Texas saw the largest net increase in oil and natural gas proved reserves of all states in 2018, totaling 2.3 billion barrels of crude oil and lease condensate proved reserves and 22.9 Tcf of natural gas proved reserves. The largest share of the increase was produced in the Wolfcamp and Bone Spring shale plays in the Permian Basin.

Proved natural gas reserves increased in five of the top eight U.S. natural gas reserves states in 2018.

Texas had the largest net increase in proved natural gas reserves of any state, adding 22.9 Tcf of proved natural gas reserves. Pennsylvania had the second-largest net increase in 2018, adding 14.2 Tcf of proved natural gas reserves.

Extensions to natural gas proved reserves exceeded net downward revisions by operators in the Marcellus shale play. The third-largest net increase in proved natural gas reserves was in New Mexico, where operators added 4.2 Tcf of proved reserves to the Wolfcamp/Bone Spring shale play.

Three of the eight largest gas reserves states reported a net decrease in proved reserves in 2018; Louisiana, Colorado, and Ohio.

According to the EIA report, this decrease was a result of net downward revisions to natural gas proved reserves in 2018, despite each reporting an increase in proved reserves greater than 9 Tcf in the previous year (2017). It is added that strong supply growth has reduced the U.S. natural gas price in 2019, and operators have curtailed some of their anticipated field development plans because of this price reduction.

Natural gas highlights

- Proved reserves of natural gas increased 9%, from 464.3 trillion cubic feet (Tcf) at year-end 2017 to 504.5 Tcf at year-end 2018—another U.S. record for total natural gas proved reserves. The previous U.S. record was set in 2017.

- U.S. total natural gas production increased 12% from 2017 to 2018.

- Natural gas proved reserves from shale increased from 66% of total U.S. gas proved reserves in 2017 to 68% at year-end 2018.

- The annual average spot price for natural gas at the Louisiana Henry Hub increased by 12% from $2.99 per million British thermal units (MMBtu) in 2017 to $3.35 per MMBtu in 2018.

- Producers in Texas added 22.9 Tcf of natural gas proved reserves, the largest net increase of all states in 2018, as a result of increased prices and development of the Wolfcamp/Bone Spring shale play.

- The next largest net gains in natural gas proved reserves by volume in 2018 were in Pennsylvania (14.2 Tcf) and New Mexico (4.2 Tcf) as a result of development of the Marcellus shale play in the Appalachian Basin and the Wolfcamp/Bone Spring shale play in eastern New Mexico.

Proved reserves of combined crude oil and lease condensate increased in all of the top seven U.S. oil reserves states in 2018.

In 2018, Texas held the largest proved reserves of any state and saw the largest volumetric increase—a net increase of 2.3 billion barrels of crude oil and lease condensate proved reserves from 2017 to 2018. Most reserves additions were made in the Wolfcamp/Bone Spring shale play in West Texas (Texas Railroad Commission District 8).

New Mexico had the second-largest crude oil and lease condensate proved reserves increase—a net addition of 750 million barrels. Most reserves additions, as in Texas, were made in the Wolfcamp/Bone Spring shale play in eastern New Mexico. The third-largest net increase in proved reserves of crude oil and lease condensate was in the Bakken shale play in North Dakota, at 422 million barrels.

New Mexico and North Dakota saw the second- and third-largest net gains in crude oil and lease condensate proved reserves in 2018. New Mexico’s crude oil and lease condensate proved reserves increased by 750 million barrels and North Dakota’s increased by 422 million barrels that year.

Oil highlights

- Proved reserves of crude oil in the United States increased 12%, from 39.2 billion barrels at year-end 2017 to 43.8 billion barrels at year-end 2018, setting another U.S. record for crude oil proved reserves. The previous record was set in 2017 (39.2 billion barrels).

- Proved reserves of lease condensate in the United States increased 14%, from 2.8 billion barrels at year-end 2017 to 3.2 billion barrels at year-end 2018. Adding lease condensate to crude oil yields total liquids proved reserves of 47.1 billion barrels, a 12% increase over year-end 2017.

- U.S. crude oil and lease condensate production increased 17% from 2017 to 2018.

- The annual average spot price for a barrel of West Texas Intermediate (WTI) crude oil at Cushing, Oklahoma increased 29% in 2018, from $51.03 in 2017 to $65.66.

- Producers in Texas added 2.3 billion barrels of crude oil and lease condensate proved reserves, the largest net increase of all states in 2018. The increase was a result of increased prices and development in the Permian Basin of West Texas.

- The next largest net gains in crude oil and lease condensate proved reserves in 2018 were in New Mexico (750 million barrels) and in North Dakota (422 million barrels).

To explore more about the U.S. Energy Information Administration’s (EIA) U.S. Crude Oil and Natural Gas Proved Reserves, Year-End 2018 report, you can click on the PDF bellow.