The Baltic Exchange, in collaboration with Xinhua News Agency, announced the release of the 2024 Xinhua-Baltic International Shipping Centre Development Index (ISCDI) Report.

For the 11th consecutive year, Singapore has been recognised as the world’s leading shipping centre, achieving a score of 96.23 out of 100. The enduring success of the island nation is attributed to Singapore’s strategic location, robust international outlook, and a well-established ecosystem of professional maritime services.

Key findings of the 2024 ISCDI Report:

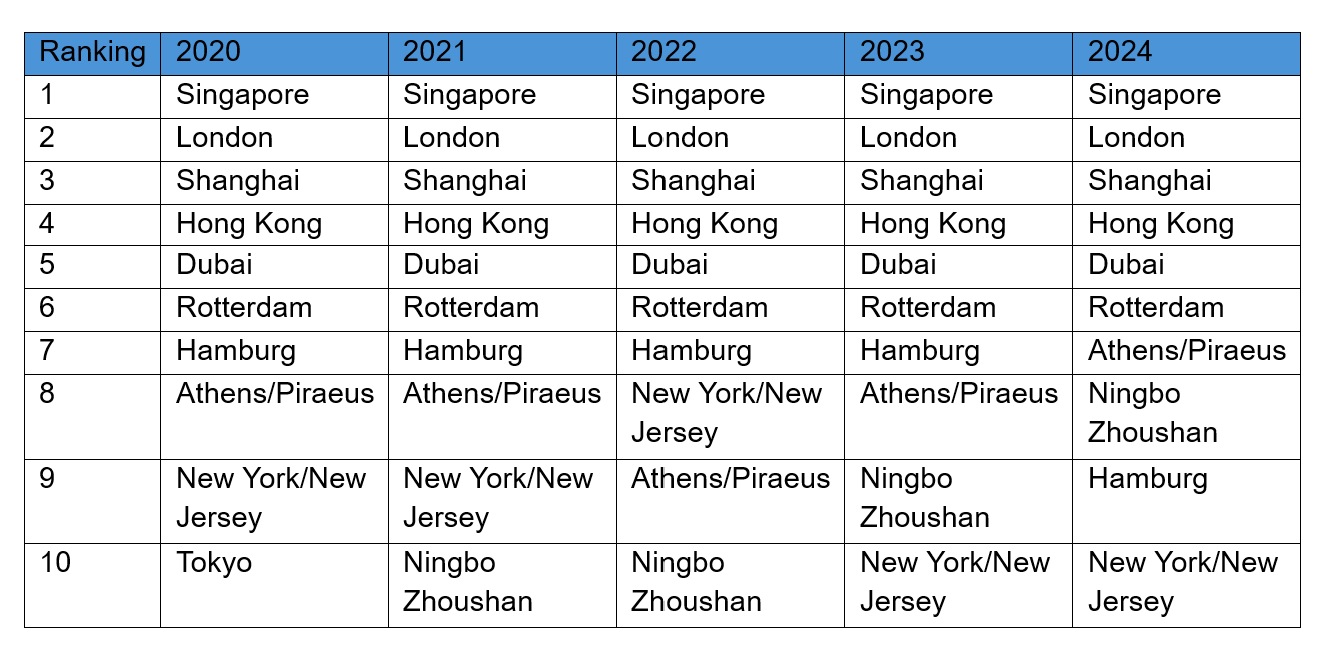

- Top Performers: Singapore, London, and Shanghai continue to lead the rankings, underscoring their global leadership in shipping.

- Stability in Rankings: The top 10 shipping centres have shown little change from the previous year, reflecting the stability and sustained performance of these hubs and the wider maritime industry.

- New Entrant: Tianjin was the only new feature to this year’s list, taking 19th position, marking yet another Asian port in the global rankings.

The report highlights that the Port of Singapore’s vessel tonnage crossed an unprecedented three billion gross tonnage for the first time in its history, registering an impressive 9.4% year-on-year growth in 2023. This outstanding achievement becomes even more remarkable when viewed through the lens of global trade, which is expected to shrink by 5% to below US$31 trillion, according to the United Nations Conference on Trade and Development.

Singapore’s container throughput also reached dizzying heights, growing by an impressive 4.6% to a record-breaking 39.01 million teu, surpassing the previous

record of 37.57 million teu set in 2021. This remarkable feat was fuelled by the opening of new berths at the ambitious Tuas Port project, bringing the current

total to eight berths.

Singapore’s dedication to sustainability was further underscored by its remarkable progress in biofuel blends and liquefied natural gas (LNG) bunker sales. Bunker sales of biofuel blends more than tripled in 2023, soaring from 140,000 tonnes in 2022 to 520,000 tonnes, showcasing the unwavering commitment of the port and operators to reducing shipping’s environmental impact. Biofuel blends of up to B30 are now commercially available, while trials of up to B100 are ongoing. LNG bunker sales also experienced a significant jump, rising from 16,000 tonnes in 2022 to 110,000 tonnes in 2023.

Bunkering operations at the Port of Singapore had another record-breaking year, registering a staggering 51.82 million tonnes of bunker sales in 2023, surpassing the previous record of 50.64 million tonnes set in 2017. Of this, 1.2% was comprised of greener bunkering options with predictions of further growth in alternative fuel bunkering for 2024.

London once again secured second position with a score of 82.50, demonstrating its continued prominence as a maritime support services powerhouse. Shanghai, with a score of 81.84, retained third place, highlighting its significant role as a major port city in Asia. London and Shanghai have retained their positions of second and third place, respectively, within the Index for the past five years.

Hong Kong (79.07) and Dubai (75.64) rounded out the top five, emphasising the strength and importance of these key global shipping hubs. Rotterdam solidified its position as a European leader by maintaining its strong sixth place from 2023 into 2024.

Meanwhile both Athens/Piraeus and Ningbo Zhoushan have each climbed one place in the rankings this year, to seventh and eighth, respectively. As a result, Hamburg has dropped two spots to ninth but still maintains its decade-long position in the top 10.

As in 2023, New York/New Jersey rounded out the top 10 owing to a substantial increase in container volumes, as well as improvements in port infrastructure.

Other notable rankings include Houston at 11th (68.08), Tokyo at 12th (66.60), and Guangzhou at 13th (65.36). These cities continue to demonstrate robust maritime capabilities and significant contributions to global shipping.

The ISCDI Report evaluates a total of 43 maritime locations, considering various port metrics such as cargo throughput, crane count, container berth length, and port draught. It also assesses the presence of professional maritime support businesses, including shipbroking, ship management, ship financing, insurance, and legal services, alongside hull underwriting premiums. Additionally, the evaluation considers general business environment factors like customs tariffs, the level of electronic government services, and overall logistics performance.

According to this year’s ISCDI Report, the average score amongst the top 10 ports is 77.12 out of 100, and 69.98 for the top 20, with the average across the entire 43 rankings standing at 59.13.

Despite facing significant economic slowdowns, geopolitical tensions, and environmental challenges, the sector maintained stability and continued to facilitate the movement of essential goods around the world.

…Mark Jackson, Chief Executive of the Baltic Exchange, commented.

Pan Haiping, Chairman of China Economic Information Service, said: “This year’s ISCDI Report shows that the world’s trade and shipping network underwent some subtle changes in 2023. Even with all the challenges the global shipping industry faced throughout the year, including route challenges in the Panama Canal and the Red Sea, the maritime sector continues to exhibit strong vitality and excellent resilience, driven by global demand for goods.”

Decarbonisation has also become the consensus in the global shipping industry, while digital technologies such as AI, digital twins, IoT, and automation are constantly empowering the shipping industry and promoting the development of ports to become more efficient, smarter and more sustainable.

…Pan added.