SIGTTO published its 2021 Annual Report, providing a roundup of key gas shipping and terminal developments in 2021, highlighting many aspects of the industry.

Gas shipping and terminal developments 2021

The global LNG market bounced back robustly in 2021, after a slowdown and only marginal growth in 2020 due to the outbreak of the Covid-19 pandemic. Seaborne movements of LNG reached 372.3 million tonnes (mt) in 2021, a 4.5 per cent increase on the 2020 level of 356.1 mt. According to statistics compiled by GIIGNL, LNG sold in the spot and short-term markets decreased by 6.2 mt in 2021, dropping 4 per cent, to 136.3 mt and accounting for 36.6 per cent of the LNG market in 2021.

[smlsubform prepend=”GET THE SAFETY4SEA IN YOUR INBOX!” showname=false emailtxt=”” emailholder=”Enter your email address” showsubmit=true submittxt=”Submit” jsthanks=false thankyou=”Thank you for subscribing to our mailing list”]

Australia, with shipments of 78.5 mt, topped the LNG exporters list for the second year running in 2021. Qatar, with loadings of 77.0 mt, remained a close second. The US was once again in third place, but its 67.0 mt of exports was 49.8 per cent ahead of its 2020 shipments. With still more new liquefaction trains coming onstream in the US Gulf in late 2021/early 2022, the US is expected to emerge as the world’s leading LNG exporter in 2022.

Liquefaction plant and feedgas problems in Peru, Nigeria, Trinidad, Angola and Norway meant double-digit drops in export shipments from these countries in 2021 but Egypt, with its two export terminals once again fully operational, recorded a 390 per cent jump in exports compared to 2020, to 6.6 mt.

Of the world’s 44 LNG import countries in 2021, China recorded the biggest annual increase in volume. It purchased 79.3 mt, 10.4 mt more than the 2020 total. The performance pushed China to the top of the LNG importers league table, dislodging Japan from a position it had held for five decades. Japan’s LNG imports, at 74.4 mt, were more or less static last year while Korea, the third largest purchaser of LNG, welcomed the discharge of 46.9 mt at its terminals, a 15 per cent year-on-year jump.

Another notable performance amongst LNG importers in 2021 was that of Brazil. The country suffered its worst drought in a century last year, curtailing the generation of hydropower, the primary source of Brazil’s electricity, to slow to a trickle. LNG imports were stepped up to cover for the lost hydropower and the country’s purchases, of 7.0 mt, were 193 per cent up on the 2020 figure.

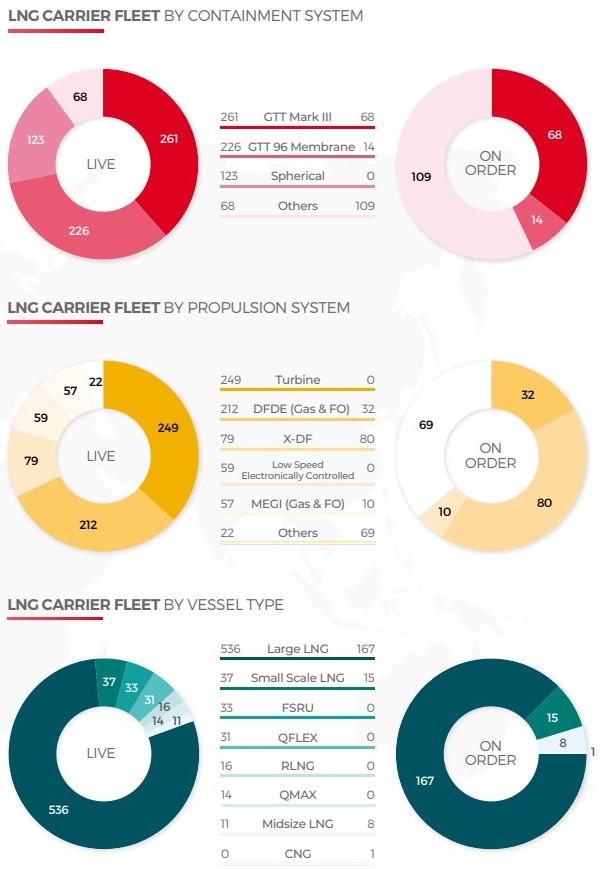

GIIGNL reports that a total of 68 LNGCs were delivered in 2021, up from 47 in 2020. The global fleet of LNGCs stood at 700 vessels at the end of 2021, including 48 FSRUs and 64 vessels of less than 50,000 m3. The sub-50,000 m3 fleet comprised 31 LNG bunker vessels and 33 LNGCs. A record 111 LNGCs were ordered in 2021, including 86 large carriers, pushing the total LNGC orderbook as of 31 December 2020 to 196 ships. The newbuilds represented 28 per cent of the existing LNGC fleet in capacity terms.

In addition to the 31 LNGBVs in service at the end of 2021, another 22 such vessels were on order, ten of which are due for delivery in 2022. Figures compiled by DNV show that 240 dual-fuel ships that are not LNG carriers but will be powered with LNG were ordered in 2021. That number exceeded the total of LNG-fuelled vessels contracted in the previous four years combined and is likely to require some 3 million tonnes per annum (mta) of LNG as bunker fuel.

According to the DNV statistics there were 251 LNG-fuelled vessels in service at the end of 2021 and 403 more on order.The level of LNG-fuelled ship contracting continued briskly during the first half of 2022 and it is estimated that the demand for LNG as bunker fuel will hit 9-10 mta by the end of 2025.

In its review of the global seaborne LPG trade in 2021 Barry Rogliano Salles (BRS) points out that the US consolidated its position as the top LPG exporter with shipments of slightly over 50 mt, 11.5 per cent ahead of the 2020 level. The US thus accounted for 41 per cent of the 122 mt of LPG transported by sea worldwide in 2021. Middle East LPG exports, at 34.7 mt, were marginally down year-on-year.

East Asia remained the world’s major LPG importer last year, with 54.8 mt discharged at the region’s terminals. China accounted for 44 per cent of this volume, its imports of 23.9 mt being 14.5 per cent up on the 2020 total. Propane accounted for two-thirds of China’s purchases, for use as a feedstock at the country’s growing number of propane dehydrogenation plants.

India remained the world’s second largest LPG importer in 2020, its purchases of 18.6 mt being 7.4 per cent up on the 2020 level. LPG shipments to Europe, at 22 mt, and to South East Asia, at 11.6 mt, were comparable to the 2020 volumes.

Some 15.2 mt of petrochemical gases was moved by sea in 2021, with ethane representing a comparably new and important cargo. The US exported 6 mt of ethane in 2021, 64 per cent of which was delivered to India and China, primarily in very large ethane carriers (VLECs).

The very large gas carrier (VLGC) fleet numbered 321 vessels at the end of 2021, compared to 303 12 months earlier. Some 52 VLGCs were ordered in 2021, bringing to 70 the total number of such ships on order, equivalent to 22 per cent of the existing fleet in cargo-carrying capacity terms. All the VLGCs ordered in 2021 were specified as dual-fuel ships, with the ability to burn LPG.

BW Epic Kosan reported that, exclusive of Chinese-flag ships, there were 342 fully pressurised LPGCs of over 3,000 m3 in service at the end of 2021, with 18 such vessels on order. Navigator, another operator active in the smaller ship sectors, stated that there were 117 fully refrigerated medium gas carriers (MGCs) of

25-40,000 m3 in service, 15 of which were ethylene-capable, while another 28 MGCs were on order at end-2021. Also, there were 118 handysize gas carriers of 15-25,000 m3 in service, 35 of which were ethylene-capable, at the turn of the year.