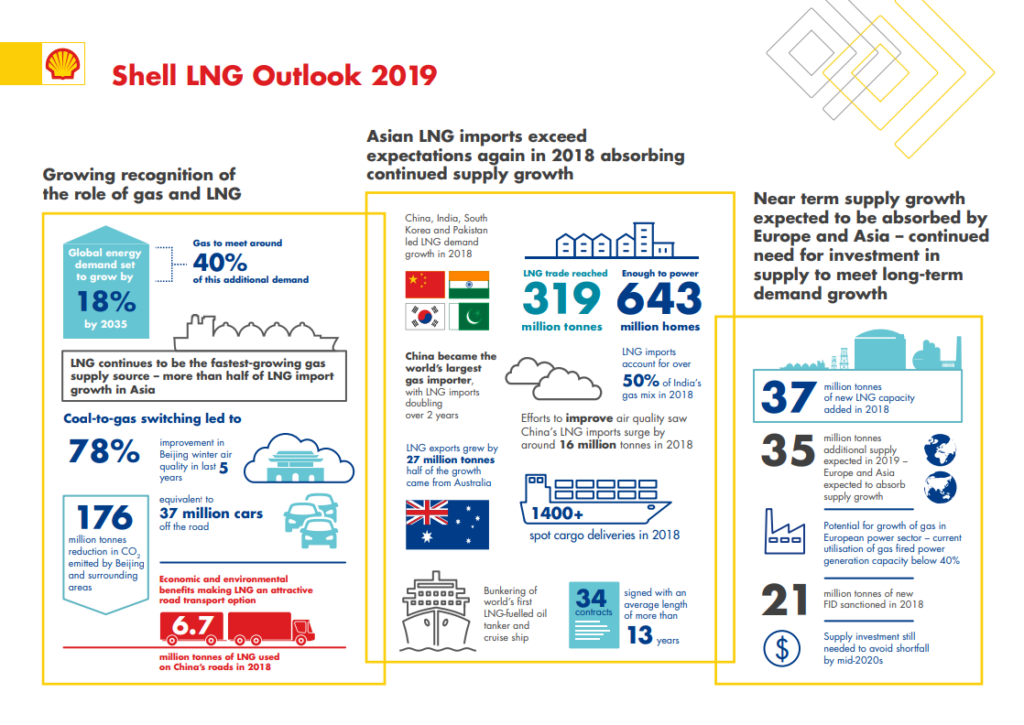

Increased demand for cleaner-burning fuel in Asia led to rapid growth in LNG use in 2018, with global demand growing by 27 million tonnes to 319 million tonnes, according to Shell’s 2019 LNG Outlook. Shell expects demand to reach about 384 million tonnes in 2020.

LNG supply

Specifically, global LNG supply is expected to rise by 35 million tonnes in 2019, with Europe and Asia absorbing all this additional supply. A rebound in new long-term LNG contracting in 2018 could also revive investment in liquefaction projects. Based on today’s demand projections, Shell still expects supplies to tighten in mid-2020s.

[smlsubform prepend=”GET THE SAFETY4SEA IN YOUR INBOX!” showname=false emailtxt=”” emailholder=”Enter your email address” showsubmit=true submittxt=”Submit” jsthanks=false thankyou=”Thank you for subscribing to our mailing list”]

Moreover, current efforts to enhance urban air quality saw China’s imports of LNG rise by 16 million tonnes in 2018, up by 40% from 2017. In fact, the switch from coal to has had led to an improvement of 78% in Beijing winter air quality in the last 5 years.

On the supply side, Australian LNG exports kept up with those of long-time leading supplier Qatar towards the end of 2018 and are expected to rise by 10 million tonnes in 2019. Both countries are well-positioned to supply rapidly developing economies across Asia with gas they need to improve air quality by displacing coal-fired power and heating.

Maarten Wetselaar, Integrated Gas and New Energies Director at Shell, stated:

The continued surge in Chinese LNG imports has helped improve air quality in some of its biggest cities over the last few years. China’s success in making the air cleaner for millions of people shows the critical role that natural gas can play in providing more and cleaner energy to the world

In addition, an increasing number of countries have chosen natural gas to meet their growing energy needs. Namely:

- In Bangladesh, natural gas meets more than half of total energy demand, while the domestic gas production has been declining. Furthermore, LNG meets existing and new gas demand;

- Panama is replacing oil-fired power generation and complements renewable power generation. What is more, the strategic location of Panama Canal offers opportunities for LNG bunkering;

- Finally, Gibraltar is replacing oil-fired power generation and sees more innovative small-scale LNG solutions, while it also increases the diversity of supply.

These facts made LNG trade increase from 100 million tonnes in 2000 to 319 million tonnes in 2018.

Long-term contracts bring more investment

New LNG projects mainly require long-term sales agreements to secure financing. From 2014 through 2017, LNG buyers had increasingly been looking to sign shorter, smaller and more flexible contracts. Shell had warned in its 2018 LNG Outlook that this mismatch between suppliers and buyer needs would have to be mitigated to allow developers to proceed with new projects.

Now Shell notes that:

Encouragingly for the long-term health of the global LNG market, the average length of contracts signed more than doubled from around 6 years in 2017 to about 13 years in 2018. Meanwhile, the total contracted volume more than doubled to almost 600 million tonnes in 2018

See more information in the following PDF