The newly-launched BP Energy Outlook for 2018 examines the ‘most likely’ path for global energy markets until 2035, developing alternative cases to explore key uncertainties. Global demand for energy is set to continue to grow over the next two decades as prosperity increases and the world’s population rises. However, the mix of fuels used will change, driven by technological advances and environmental concerns, and demand will grow more slowly than in the past as energy is used more efficiently. Carbon emissions will continue to rise, but also slower than in the past.

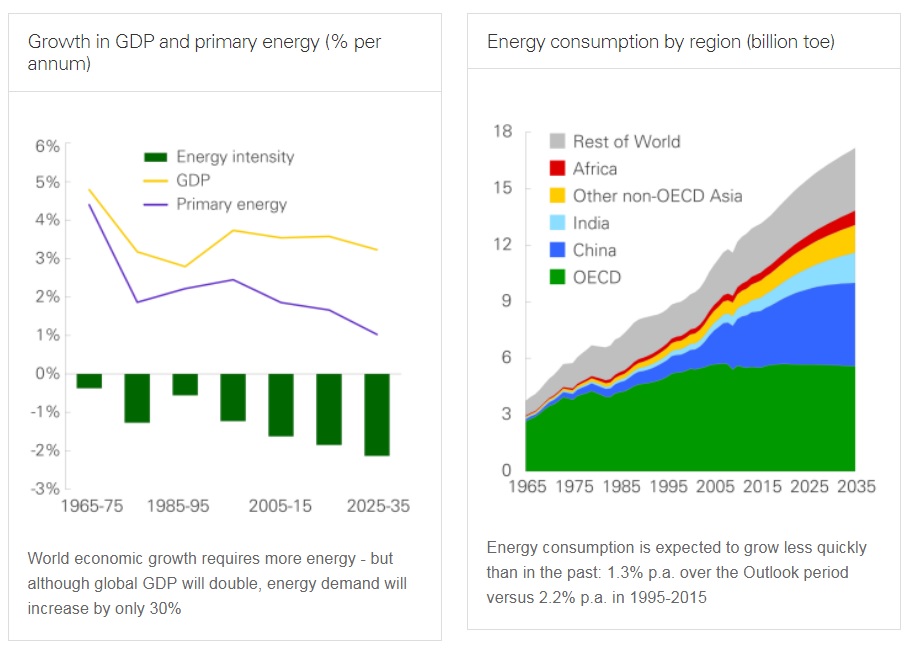

Namely, in the base case, the world’s economy almost doubles in size over the Outlook period, driven by fast-growing emerging economies, resulting in an increase in global energy demand, although the extent of this growth is substantially offset by rapid gains in energy efficiency. Energy demand increases by only around 30% – around a third as much as the expected growth in the global economy.

[smlsubform prepend=”GET THE SAFETY4SEA IN YOUR INBOX!” showname=false emailtxt=”” emailholder=”Enter your email address” showsubmit=true submittxt=”Submit” jsthanks=false thankyou=”Thank you for subscribing to our mailing list”]

The fuel mix continues to adjust: although oil, gas and coal remain the dominant source of energy, renewables, together with nuclear and hydro energy, provide half of the additional energy required out to 2035. Natural gas is expected to grow faster than oil or coal, helped by the rapid growth of liquefied natural gas increasing the accessibility of gas across the globe. The most likely path also sees carbon emissions from energy continuing to increase, indicating the need for further policy action.

Commenting on the launch, Spencer Dale, group chief economist, BP, said:

The main story in this year’s Energy Outlook is about the energy transition that is taking place and is likely to continue to take place over the next 20 years. On the demand side, there’s a shift in the pattern of demand, away from the US and Europe to fast-growing Asian markets. On the supply side, the story is one of a continuing shift in the fuel mix towards lower carbon fuels.

Key points

1.Energy growth slows

- The growing world economy will require more energy, but consumption is expected to grow less quickly than in the past – at 1.3% per year over 2015-2035 compared with 2.2% per year in 1995-2015.

- Energy demand grows more slowly because energy intensity (the energy used for each unit of gross domestic product – GDP) is expected to fall more rapidly. Global GDP doubles over the period whereas energy demand increases by only 30%.

- Virtually all the growth in world demand comes from fast-growing emerging economies, with China and India accounting for over half of the increase.

- The gradual decarbonization of the fuel mix is set to continue, with renewables, together with nuclear and hydroelectric power expected to account for half of the growth in energy supplies. Even so, oil, gas and coal remain the dominant sources of energy, accounting for more than 75% of energy supplies in 2035 (down from 85% in 2015).

- Nearly two-thirds of the increase in global energy consumption is used for power generation and the share of energy used for power generation rises from 42% to 47%.

- The share of energy used for power generation rises from 42% in 2015 to 47% by 2035.

2. Carbon emissions keep rising – but more slowly

- Carbon emissions are projected to grow at less than a third of the rate seen in the past 20 years – at 0.6% per year compared to 2.1% per year. This would be the slowest rate of emissions growth since our records began in 1965.

- However, it would still mean that emissions grow 13% by 2035, whereas they would need to fall to have a good chance of achieving the goals set out in Paris Agreement.

- The slowdown in carbon emissions growth reflects the accelerating decline in energy intensity and the pace of change in the fuel mix, with coal consumption slowing sharply – particularly in China – and gas and renewables, nuclear and hydroelectric power together supplying almost 80% of the increase in energy.

3. Oil demand grows – but slows

- Oil use continues to grow at 0.7% per year, although its pace of growth is expected to slow.

- The transport sector consumes most of the world’s liquid fuel, with its share of global demand remaining just under 60%.

- Increases in the supply of liquids are driven by holders of large-scale, low-cost resources, especially in the Middle East, US and Russia.

4. Gas grows faster than oil or coal

- Natural gas is expected to grow faster than oil or coal, with consumption increasing by 1.6% per year between 2015 and 2035.

- Shale production grows at 5.2% per year and accounts for around 60% of the increase in gas supplies, driven by US where shale output more than doubles. Towards the end of the period, China emerges as the second largest shale supplier.

- While both China and Europe become more dependent on imported gas over the period, an increased diversity of supplies associated with a rapid expansion of LNG helps to support gas consumption.

5. Coal demand slows dramatically

- Growth in global coal demand is expected to slow sharply, running at 0.2% per year compared to 2.7% per year over the past 20 years.

- Much of this slowdown is driven by China as its economy adjusts to a more sustainable pattern of growth. Even so, China remains world’s largest market for coal, accounting for nearly half of global coal consumption in 2035.

- India is the largest growth market, with its share of world coal demand doubling from around 10% in 2015 to 20% in 2035.

6. Nuclear and hydro generation grow steadily

- Nuclear and hydro power generation are expected to grow steadily over the Outlook, by 2.3% per year and 1.8% per year respectively, broadly maintaining their combined share within the power sector.

- China accounts for nearly three-quarters of the increase in nuclear generation, roughly equivalent to introducing a new reactor every three months for the next 20 years.

7. Renewables continue to grow rapidly

- Renewables in power are set to be the fastest growing source of energy – at 7.6% per year to 2035, more than quadrupling over the Outlook period. Renewables account for 40% of the growth in power generation, causing their share of global power to increase from 7% in 2015 to nearly 20% by 2035.

- EU continues to lead penetration of renewables, with the share of renewables in its power sector doubling to reach almost 40% by 2035. However, China is the largest overall source of growth over the next 20 years, adding more renewable power than the EU and US combined.

- The strong growth in renewable energy is underpinned by the view that both solar and wind power will become significantly more competitive over the Outlook period.

Exploring key uncertainties

Although the base case in the Outlook presents the single ‘most likely’ path for energy over the next 20 years, there are many risks and uncertainties that could affect the trends, such as a faster revolution in mobility, including more electric cars; risks to gas demand; and alternative pathways to a lower carbon world.

Explore more information in the PDF herebelow