Plastic pollution is amongst the most alerting challenges the world faces today threatening lives and the human health. A new study discusses how risks related to plastic pollution play out across insurance lines and asset classes in which insurers invest.

Plastic debris are a great risk for the marine ocean, the creatures living in the marine environment, the people, and the insurance industry as well. Plastics made from fossil fuels account for 20% of total oil consumption and their manufacture, recycling and incineration is energy intensive, resulting in high carbon emissions.

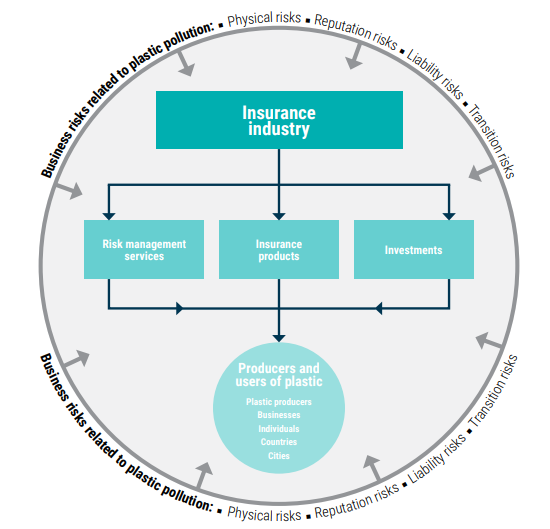

According to the report, plastic pollution’s challenges heavily impact the insurance and investment portfolios in the form of physical, transition, liability and reputational risks.

At the same time, plastic pollution presents significant opportunities for insurers to position themselves on the frontline in tackling this global issue and helping to secure a more sustainable future.

Insurers should have an active role in addressing the risks related to plastic pollution and contribute to global efforts to reduce it.

Steps to be taken to tackle plastic debris:

#1 Lead by example

- Introduce policies to reduce plastic use and waste internally

- Include plastic pollution in ESG or sustainability approaches

#2 Understand, prevent and reduce plastic pollution risks

- Support knowledge and build awareness among the public, government and industry

- Include plastic pollution risks in risk assessment models for insurance and investment activities

- Develop relevant risk reduction measures

- Reduce the plastic footprint of reinstating damaged property investment activities

#3 Insure risks associated with plastic pollution

- Design innovative insurance products to cover the risks associated with plastic pollution

#4 Support alternatives to plastic

- Support innovations for plastic alternatives through insurance products and investments

#5 Support wider efforts to reduce plastic pollution

- Actively engage with key stakeholders as risk managers, insurers and investors

- Disclose plastic pollution risks and opportunities in relevant disclosure and reporting frameworks

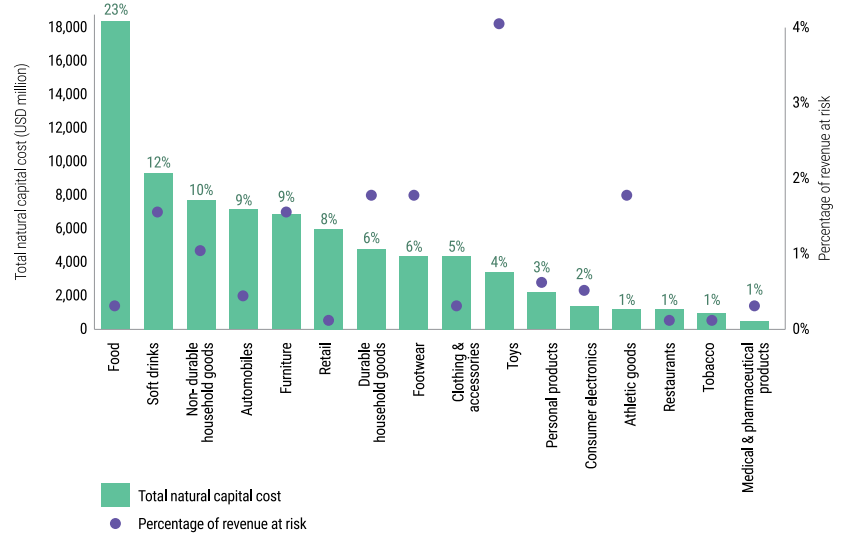

In the meantime, the report addressed the categories of risks associated with plastic pollution. In essence:

Physical risks

Microplastics in seafood, bottled water and other commonly used products could harm the human health. Also, by producing, recycling and incinerating plastic carbon emissions are produced harming more the environment.

The pollution is also affecting the ecosystems and biodiversity, whereas it poses a great risk to the health and quality of life of people, especially in coastal environments, exposed to plastic pollution.

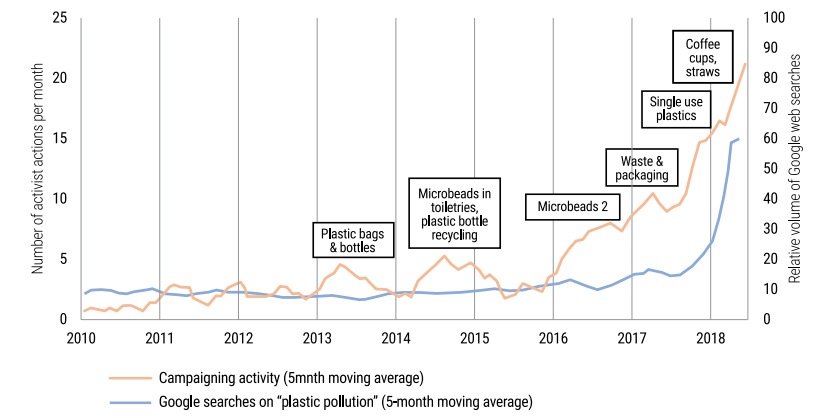

Reputational risks

Reputational risks of transacting have to do with a businesses perceived as high plastic polluters or who are investors in high plastic polluters

As presented in the graph above, plastic pollution has become the talk of the town the last years; This is a challenge for businesses because the more awareness people have, the more will be the risk of staff dissatisfaction.

Liability risks

The study proposes the exposure to liability claims for plastic pollution as public awareness and regulation change, and highlights the employer’s liability to understand the risk to human health to workers when they are frequently in contact with plasticisers and other additives used in plastic production that pose a serious threat to human health.

The employers should also be aware of the risk of litigation for liability claims related to bodily damage caused by chemicals present in plastics.

To deal with plastic debris, the study proposes:

- Regulatory or tax changes around plastic production, distribution, use, consumption and disposal.

- Changes in customer demand as a result of greater public awareness of plastic pollution.

- New technological developments around reusable, bio-based and biodegradable materials, as well as innovative designs in reusable items, that may substitute plastics

Principle 1:

Establish a company strategy to identify, assess, manage and monitor ESG issues in business operations. Integrate ESG issues into risk management, underwriting and capital adequacy decision-making processes, including research, models, analytics, tools and metrics. Respond to clients quickly, fairly, sensitively and transparently at all times and make sure claims processes are clearly explained and understood.

Principle 2:

Always inform clients and suppliers about the benefits of managing ESG, requirements on ESG issues.

Principle 3:

a) Governments, regulators and other policymakers.

Dialogue with governments and regulators to develop integrated risk management approaches and risk transfer solutions

b) other key stakeholders

enable the dialogue with intergovernmental and non-governmental organisations, business and industry associations and media to promote the public awareness of ESG issues and good risk management.

Principle 4:

Assess, measure and monitor the company’s progress in managing ESG issues and proactively and regularly disclose this information publicly

To learn more on the risks of plastic pollution in connection with the insurance industry, click herebelow