In fact, Rystad Energy, the energy research and business intelligence company providing data, tools, analytics and consultancy services to the energy industry, reports that energy projects that need oil prices above $60 per barrel in order to break even risk being uncommercial going forward.

Whatsoever, it is said that massive investments in exploration and sanctioning are still needed to meet growing global demand.

[smlsubform prepend=”GET THE SAFETY4SEA IN YOUR INBOX!” showname=false emailtxt=”” emailholder=”Enter your email address” showsubmit=true submittxt=”Submit” jsthanks=false thankyou=”Thank you for subscribing to our mailing list”]

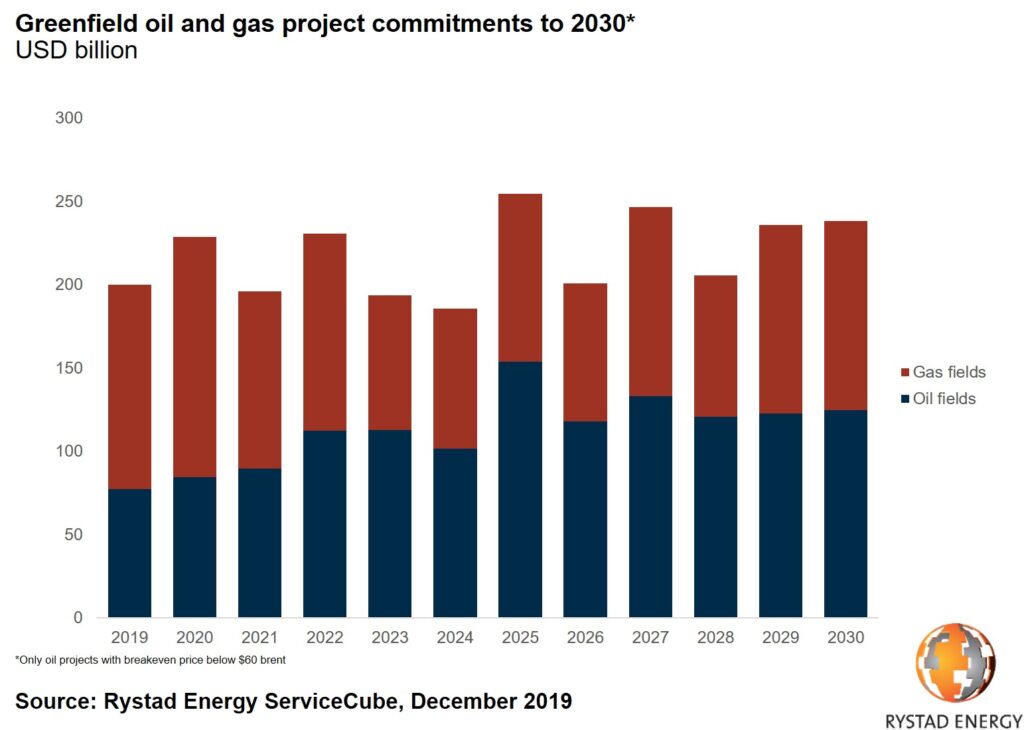

Rystad Energy forecasts that the global inventory of already discovered oil fields with a breakeven oil price of below $60 Brent is enough to meet demand growth and offset declines from maturing fields until 2027.

Thus, any additional volumes from not-yet-discovered fields will be needed in order to meet total liquids demand. Rystad advises that with the aims to discover such resources, global exploration efforts must continue, even under a scenario where oil demand peaks in the late 2020s.

What is more, operators will need to empty their portfolio of unsanctioned commercial discoveries over the coming years. Head of oilfield services research at Rystad Energy, Audun Martinsen highlights that

This means that although we need to discover additional resources, only fields with breakeven prices below $60 Brent are likely to be commercial through 2030 and likely towards 2040.

Moreover, Rystad Energy predicts as much as $225 billion worth of projects to be sanctioned for 2020, driven primarily by gas projects, and with $50 billion coming from onshore liquefied natural gas (LNG) facilities. Offshore project sanctioning will most likely surpass $100 billion in 2020.

Audun Martinsen adds that

with Brent oil prices at $60 per barrel, E&P operators are able to sanction oil and gas projects worth about $200 billion per year, driving a lot of interesting contract awards and elevating optimism among oilfield service providers.

While most offshore projects sanctioned this year have breakeven prices below $40 per barrel, it is estimated that there is a breakeven risk for the period 2020 through 2023.