The final investment decision (FID) for the Arctic LNG 2 project has been approved by Total, Novatek and other project stakeholders. As Total states, the project is set to have a production capacity of 19.8 million tons per year (Mt/y).

Specifically, the project is expected to exports its first LNG cargo by 2023, the second and third train to start up by 2024 and 2026. Recently, Igor Shuvalov, Chairman of VEB.RF, informed that one vessel could cost as much as $330 million.

[smlsubform prepend=”GET THE SAFETY4SEA IN YOUR INBOX!” showname=false emailtxt=”” emailholder=”Enter your email address” showsubmit=true submittxt=”Submit” jsthanks=false thankyou=”Thank you for subscribing to our mailing list”]

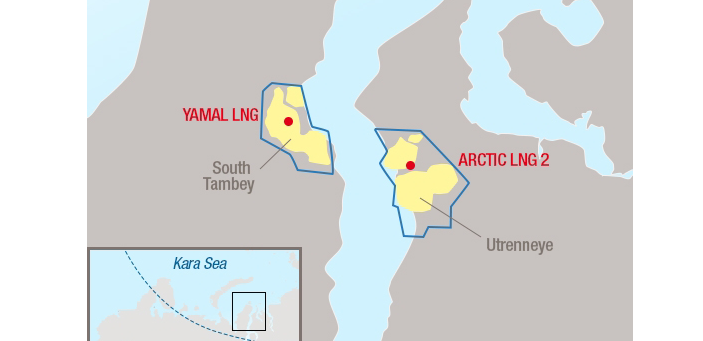

The Arctic LNG 2 project has low upstream costs with the development of the giant resources from the Utrenneye onshore gas and condensate field.

The installation of three concrete gravity-based structures in the Gulf of Ob on each of which will be located a 6.6 Mt/y liquefaction train will contribute to significant capex reduction compared to Yamal LNG, which recently reached the 20 million tonnes of LNG production.

Also, the close proximity to Yamal LNG will allow Arctic LNG 2 to leverage synergies with existing infrastructure and logistics facilities.

Concerning the project, Total holds a direct 10%, Novatek a 60%, CNOOC 10%, CNPC 10% and a Mitsui-Jogmec consortium, Japan Arctic LNG 10%. Yet, Total informs that they hold an additional indirect 11.6%, via its 19.4% stake in Novatek, thus an aggregated economic interest of 21.6 percent in the project.

Novatek and Sovcomflot will collaborate with VEB in the project, whose cost will exceed 300 bn rubles.