According to Gibson, the shipping industry is preparing for significant changes in tanker trade, as the entire Mediterranean Sea is set to become an emissions control area (ECA) starting May 1, 2025.

This new regulation will enforce a reduction in the maximum allowable sulphur content of fuel from 0.5% to 0.1%, unless vessels are equipped with exhaust gas cleaning systems (scrubbers) that can effectively lower emissions. Gibson notes that historical trends show refineries and bunker suppliers have successfully adapted to similar ECA regulations in regions like the United States and Northern Europe, but the new ECA will have implications for bunker prices and commodity flows in the Mediterranean.

Gibson reports that current bunker demand in the Mediterranean is about 21.5 million tonnes, with over 50% being very low sulphur fuel oil (VLSFO). However, according to Gibson, demand for VLSFO is expected to drop significantly as vessels will likely switch to compliant 0.1% marine gas oil (MGO) or ultra-low sulphur fuel oil (ULSFO) while transiting the ECA.

Projections from Gibson indicate that VLSFO demand could plummet to approximately 6 million tonnes per year. Additionally, Gibson highlights that high sulphur fuel oil (HSFO) demand may remain stable due to ships equipped with scrubbers; however, the effectiveness of some scrubber systems in meeting the new standards could necessitate a transition to alternative fuel grades.

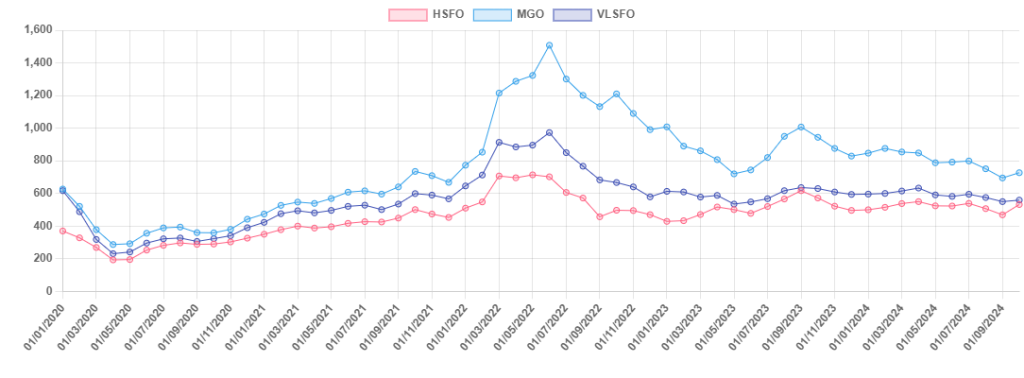

As a result, Gibson explains that ships operating in the Mediterranean will incur higher costs unless utilizing scrubbers. For instance, year-to-date prices for 0.1% MGO in Gibraltar averaged $798 per tonne, a 35% increase compared to $590 per tonne for VLSFO, according to Gibson.

This price disparity is likely to lead to higher freight rates, particularly affecting tankers. Gibson also reports that the ECA will alter the flow of refined products, as a drop in VLSFO demand could facilitate export opportunities, particularly towards East of Suez, while the Mediterranean faces an increasing structural deficit in gasoil, prompting imports from the U.S. and Middle East.

Overall, these changes, as noted by Gibson, suggest a gradual transition from dirty to clean tankers in regional operations, although larger dirty tankers may benefit from exporting surplus fuel oil to Asia.

Additionally, Gibson points out that the upcoming FuelEU legislation will mandate a 2% reduction in greenhouse gas intensity starting January 1, 2025, further influencing the shift toward greener fuel alternatives.