A new report by Lloyd’s Register examines methanol as a marine fuel regarding safety, availability, bunkering infrastructure, techno-economic and other aspects.

The Fuel for thought report is the first report in Lloyd’s alternative fuels series. As the report notes, the biggest questions for the further development of methanol as a fuel relate to pricing, availability and carbon accounting. It explores the current state of methanol as a clean fuel and its role in achieving a sustainable future in the following way:

#1 Safety and toxicity issues

According to the report, methanol is toxic and extreme care is required with handling. It can be absorbed into the body by inhalation, ingestion, skin contact, or eye contact.

Furthermore, adverse health effects of methanol contamination or exposure are not always immediately evident and can be fatal. The fuel will also react violently with strong oxidants, raising the risks of fires and explosions in the case of a leak.

#2 Bunkering

Methanol is a liquid at ambient temperature and pressure so it does not need to be pressurised, compressed or stored cryogenically. However, methanol is corrosive and storage tanks need to be constructed from a compatible material or appropriately coated, the report notes.

As per the IMO’s requirements for ships using methanol, the bunker tank ullage space should also be inerted with a gas such as nitrogen gas to reduce explosion risks and vessels may need inerting systems installed. Fuel systems need to be considered in a retrofit or newbuild design given lubricity issues.

As the report highlights, due to the experiences already recorded of transporting methanol as a cargo, and of using it as a fuel for the last decade, safe bunkering guidance has been written and will lead to probable international safety requirements.

#3 Techno-economic aspects

- Newbuilding value proposition: Industry indications point to a two-stroke methanol dual fuel engine having a 10% premium on now established dual fuel LNG engines, while four-stroke engines will be comparable.

- Methanol ready: There is a certainty that regulations to reduce greenhouse gas emissions from shipping will be agreed at a regional and international level, but great uncertainty over how these regulations can be met.

- Retrofit value proposition: While newbuilding orders may be built to designs where retrofitting is easier and more cost efficient by considering eventual methanol fuel use, most younger tonnage in service has not been built with a retrofit installation in mind.

#4 Methanol production and price

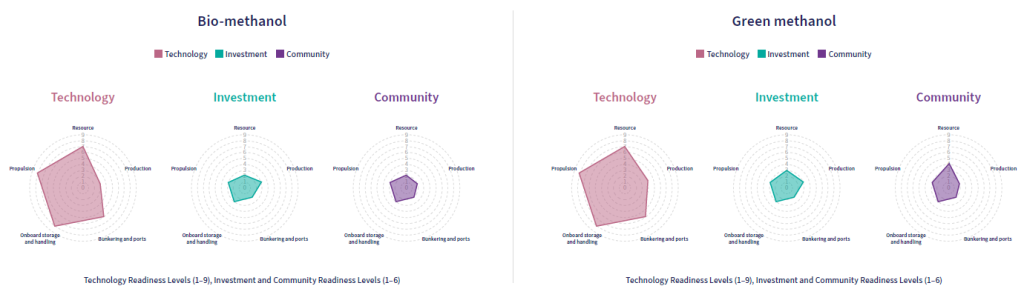

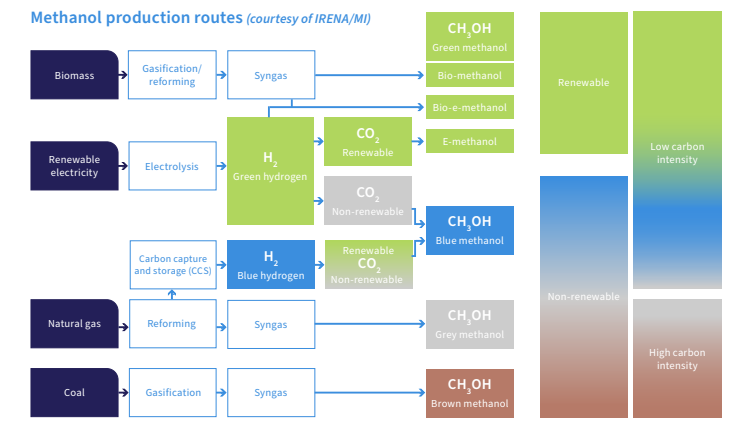

Successful deployment of methanol as a marine fuel relies on renewable production, from electrolysis and/or bioresources, the report supplies. Biomethanol is produced by using biomass feedstocks. With low production volumes the cost of production can only be estimated. E-methanol is obtained by combining captured CO2 with hydrogen from renewable electricity.

Grey methanol prices vary regionally (Asia, USA and Europe) with spot market average prices and forward contracts (see table). Prices range from $327 to $366 per ton on the spot markets for February 2023. These prices are trading prices, and it is expected that green and blue methanol prices will be scarcer and more expensive, Lloyd’s predicts.

Additionally, according to the report, bunkering infrastructure costs will create added expenses when cleaning methanol bunkers in ports and terminals. Estimates have pointed to green methanol being supplied initially at around $1,000 per ton.