According to the IEA’s latest market forecast, strong demand growth from China, greater industrial demand, and rising supplies from the US, will transform global natural gas markets over the next five years.

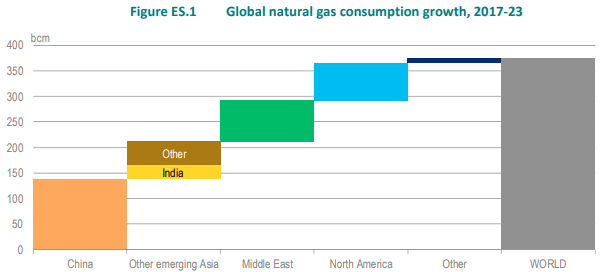

Namely, global gas demand will increase at an average rate of 1.6% a year, reaching over 4,100 billion cubic meters (bcm) in 2023, up from 3,740 bcm in 2017.

Chinese gas demand is expected to grow by 60% between 2017-2023, supported by policies aiming to reduce air pollution by switching from coal to gas. China will accounts for 37% of the growth in global demand in the next five years and will become the largest natural gas importer by 2019, overtaking Japan.

[smlsubform prepend=”GET THE SAFETY4SEA IN YOUR INBOX!” showname=false emailtxt=”” emailholder=”Enter your email address” showsubmit=true submittxt=”Submit” jsthanks=false thankyou=”Thank you for subscribing to our mailing list”]

The industry will play a key role to the increase in global gas demand to 2023, surpassing power generation, which historically held this role. Overall, industry accounts for over 40% of growth in global gas demand to 2023, IEA noted, followed by 26% for power generation.

As for the supply side, the US are the leaders in gas production growth worldwide to 2023, due to the current US shale revolution. Most new US supplies will be geared to export markets as LNG or through pipelines. The development of destination-free and gas-indexed US LNG exports will provide additional flexibility to the water-borne traded market.

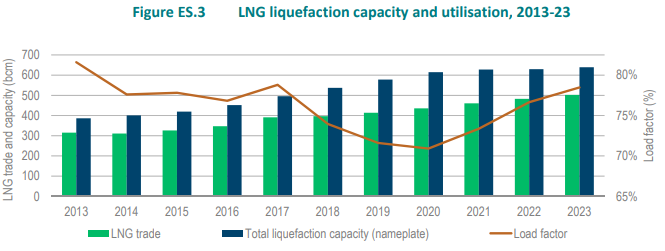

LNG will take a larger share in global gas trade, especially in Asia. LNG will probably rise from a third in 2017 to almost 40% in 2023. Asian markets will once again account for about half of global LNG imports by 2023. This LNG rise will have significant impacts on trade flows, prices and global gas security.

In addition, the LNG uptake will increase liquefaction capacity by 30% by 2023. This will be driven by an increase in output from the US, which accounts for nearly three-quarters of the growth in total global LNG exports in the period.

However, a lack of LNG projects after 2020 could tighten LNG markets. As such project have long-lead time, investment decisions will need to be taken in the next few years to ensure the availability of LNG after 2023.

You can see more information in following PDF