The International Chamber of Shipping (ICS) presents a new report identifying hydrogen demand sectors, demand locations, and the demand-pull timeline.

The groundbreaking report, written by the Professor of Energy Economics at Biberach University of Applied Sciences, Germany, called “Turning hydrogen demand into reality: Which sectors come first?” focuses on the potential of clean hydrogen to function as an energy carrier and feedstock to decarbonise multiple sectors, especially hard-to-abate sectors.

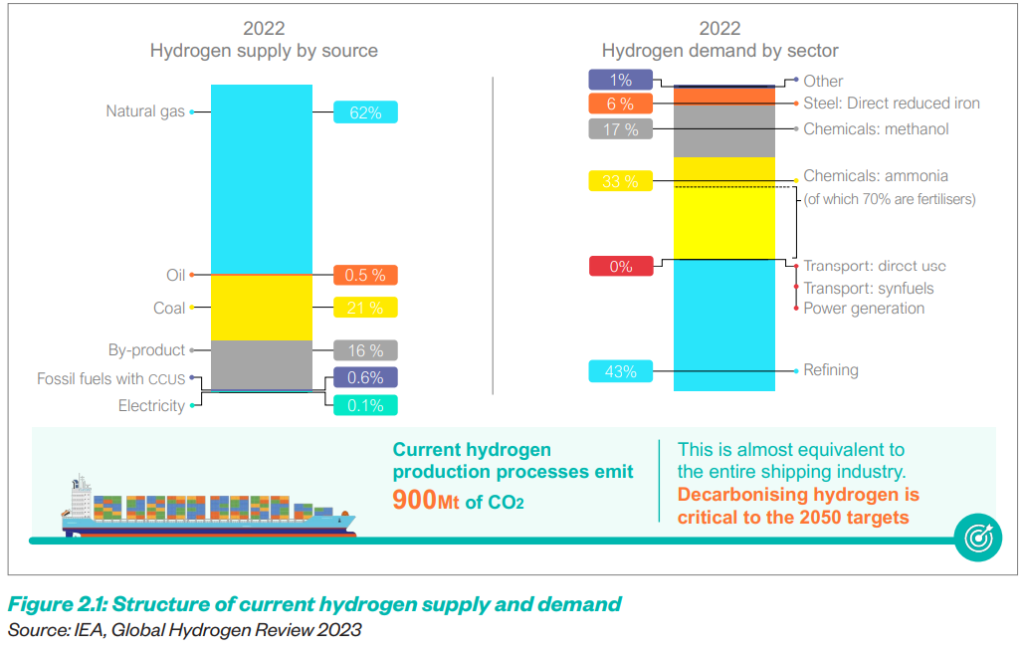

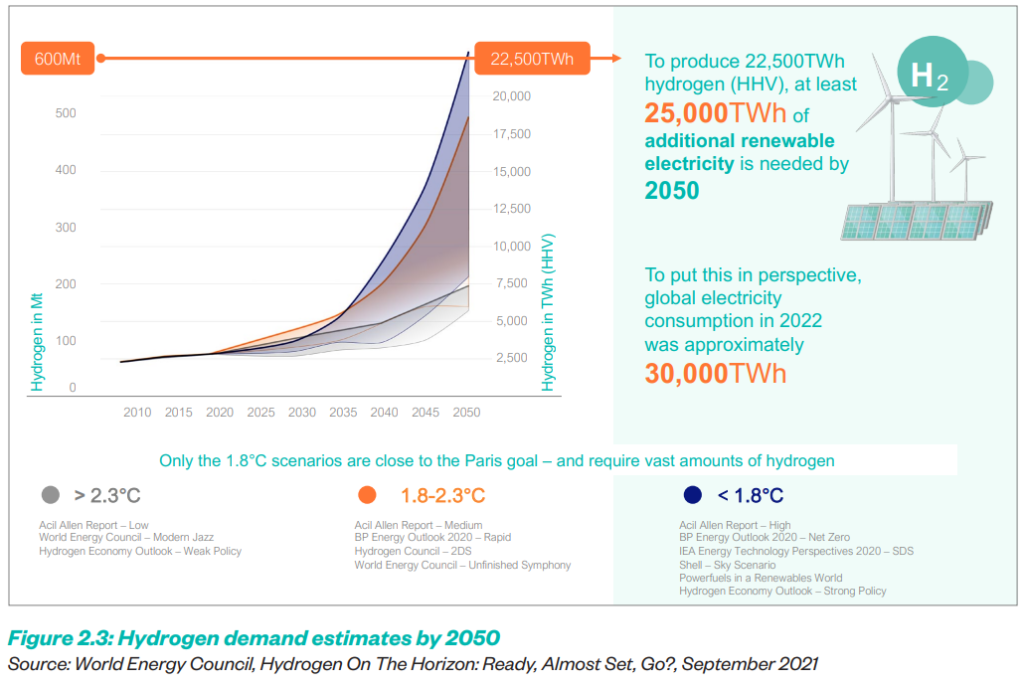

The report identifies that to meet future hydrogen demand, the scale of renewable electricity demand for green hydrogen production is unprecedented and leads to once-in-a-generation opportunities and challenges.

Key findings

- Hydrogen has an important but not dominant role in the transformation towards climate neutrality.

- Hydrogen demand depends strongly on climate ambitions and could benefit from offtake agreements with multiple sectors.

- Scenarios for future hydrogen demand show huge variability and uncertainty from now towards 2050.The rate and timeline of hydrogen uptake varies between sectors due to infrastructure, regulatory and sectoral ecosystem challenges and is likely to take place in stages.

- To unlock investment, governments should also focus their attention on supporting demand side derisking over supply side subsidy.

- Industrial demand, and not transport, will vastly dominate hydrogen demand in the coming decades, acting as a baseload for hydrogen demand.

- The scale of electricity demand for green hydrogen production is unprecedented and leads to oncein-a-generation opportunities and challenges.The need for hydrogen transport by ship requires the energy–maritime value chain to shift towards a low-carbon infrastructure that is fit for purpose.

- Maritime trade infrastructure is essential for scaling up hydrogen demand and reducing costs.

- Demand-pull for hydrogen is further enabled by trade.

- The role of maritime shipping is primarily as an enabler of a hydrogen economy and is key for global

energy security

For global hydrogen demand to keep the net-zero by 2050 scenario within reach, demand for hydrogen-based fuel sources would need to scale five times from current levels to reach approximately 500 million tonnes from 2030 to 2050. One of the main takeaways in this report is the high variability in potential demand. Industry will dominate the hydrogen demand. Shipping, however, can play a key role as an enabler of the hydrogen economy.

… said Guy Platten, Secretary General of the International Chamber of Shipping

Furthermore, Guy Platten added that one thing is certain: readiness at ports and infrastructure development to remove barriers for maritime uptake will be crucial. This will allow for both the maritime and other sectors to move forward, adding energy security and enhancing diversification. This is a once-in-a-generation opportunity to transform the whole energy-maritime value chain.

To remind, the Secretary General said during an exclusive interview with SAFETY4SEA during the 2024 Posidonia exhibition “From my perspective, I think the industry will resemble what it is today by 2030, but many changes will occur beneath the surface. We will start to see an uptake of near-zero or zero-carbon fuels by that time.”

The report highlights three economies as the main markets to initially drive hydrogen demand:

- South Korea,

- Japan,

- and the EU.

Europe has a target of 20 million tonnes of hydrogen per year by 2030, with half of that volume to come from imported sources. To meet this expected demand of the EU, the fleet will need to increase by up to 300 vessels for the EU2030 target.

According to the International Energy Agency (IEA), hydrogen use is expected to remain static and within current industrial use cases into 2030. However, to go beyond the current hydrogen demand by existing sectors, infrastructure, enabling regulation, and power access barriers need to be addressed for new sectors to begin uptake of hydrogen, the report finds.

The maritime industry will play a key role by connecting the hydrogen surplus regions with the high consumption areas. However, this necessitates port infrastructure for loading/unloading and pipeline transport from the port to the consumers. Coordinated action would help most to deliver this.

… said Stefan Ulreich, Professor of Energy Economics at Biberach University of Applied Sciences, adding that to just meet a global increase of 30 million tonnes of hydrogen traded worldwide, we could need up to 411 new hydrogen vessels (for long distances) or up to 500 vessels if transported as ammonia.