Harvey and Irma, two of the three powerful hurricanes which hit the Caribbean and southern United States in 2017 along with Maria, resulted in damage of approximately 63,000 boats in the US alone, at a cost of an estimated $655 million, according to the US Boat Owners Association, providing a clear reminder that traditional maritime risks should not be overlooked, Allianz noted.

In September 2017, Hurricane Irma caused major disruption to the fuel market in Florida, first by creating increased demand and then by disrupting the supply chain. As people fled the approaching hurricane, it generated a spike in demand for fuel, adding to logistical pressures already created by Hurricane Harvey, which struck Texas just over a week earlier.

Between 21-28 August 2017, when Harvey made landfall in Texas, retail gasoline prices in Florida and Miami increased 10 cents per gallon and 5 cents per gallon respectively, Allianz explained in its Shipping and Safety Review released earlier in July.

For months after the storms, salvage teams recovered large and small craft that either sunk or were run-aground on beaches, coral reefs and mangroves – 1,500 vessels were salvaged in Florida after Hurricane Irma alone and 459 boats were recovered in the US Virgin Islands. The series of storms have prompted debate within the marine insurance market about the insurability of pleasure craft in the region during hurricane season.

The yacht insurance market saw large losses from the 2017 hurricane season. While larger permanently manned vessels are able to sail away from storms, many smaller pleasure craft were not as well-informed or alert to the hurricane activity. Many remained in the area and were not adequately-secured,

…explains Volker Dierks, Head of Marine Hull Underwriting, AGCS Central & Eastern Europe.

Following the storms, the insurance market is reconsidering the adequacy of premiums for pleasure craft exposed to hurricanes, as well as how the risk can be covered in the future.

The 2017 hurricane season was a wake-up call and resulted in a large number of pleasure craft claims. Some insurers have quit the market due to losses and many are now considering under what circumstances they can continue to cover yachts in hurricaneexposed regions, especially during the actual hurricane season.

Hurricanes Harvey, Irma and Maria also damaged or destroyed thousands of pleasure craft in the Caribbean and US, raising questions over the insurability of vessels remaining in the region during the season.

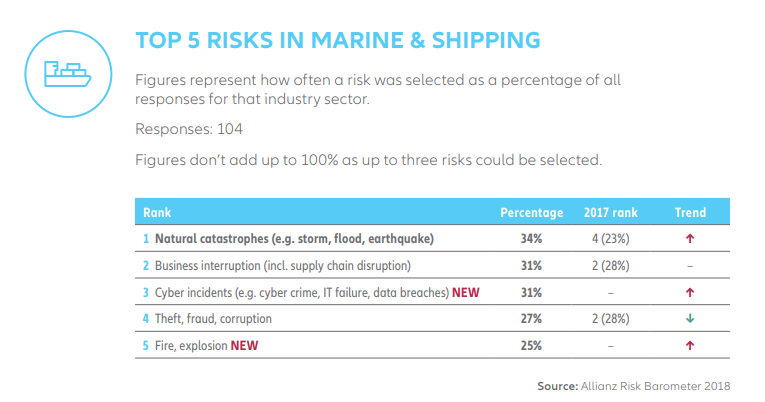

According to Allianz Risk Barometer released earlier in 2018, natural catastrophes rank no 1 of the top 10 risks for the marine industry, while they ranked 4th the previous year.