EIA published that the implementation of new regulations on marine fuel will affect crude oil and petroleum product markets the following decade. The Administration focuses mainly on the long-term implications of the market changes that will involve changes to ships, marine fuels, refining, and some infrastructure in the next six to eight years.

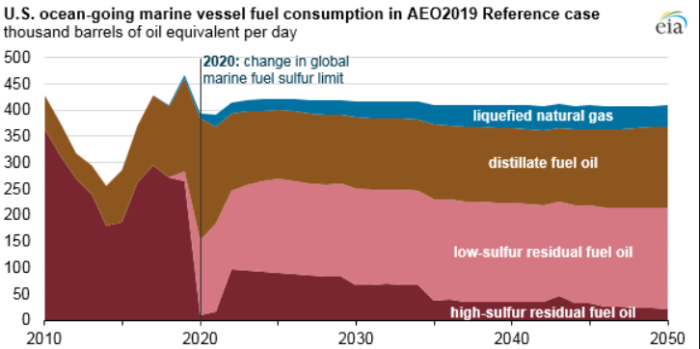

Mainly, IMO’s new regulations limit the sulphur content by 0.5%. The limit will alter the way the US consume bunker fuel, which according to AEO2019, accounted for about 411,000 barrels per day in 2018. This volume equals the 3% of total transportation energy use and 1% of total U.S. petroleum and liquid fuel use.

The change will affect marine vessels that account for the global economy reaching more than 80% of global trade by volume and more than 70% by value.

In addition, marine vessels also consume about 4 million b/d of petroleum, 4% of total global oil consumption.

EIA states that there are three options for the maritime industry to meet the sulphur content regulations.

- Installing scrubbers to remove pollutants from ships’ exhaust so ships can continue consuming high-sulfur residual fuel oil;

- Switching to lower-sulphur residual fuel oil or blending with distillate fuel oil to achieve lower-sulfur fuel mixes;

- Switching from petroleum-based fuels to other fuels such as liquefied natural gas (Because this option involves retrofitting costs, it is likely to be constrained to new builds).

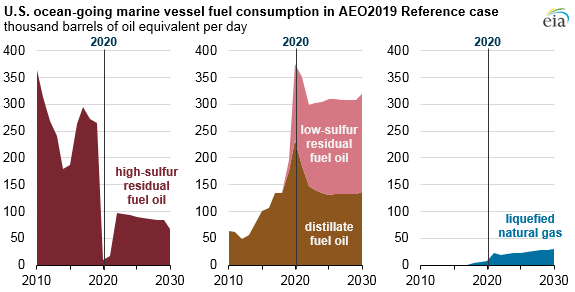

Moreover, EIA projects that the share of high-sulphur residual fuel oil consumed by U.S. ocean-going marine vessels will experience a decrease in the near term, from 58% in 2019 to 3% in 2020 because few ships currently have scrubbers installed or will have them installed by 2020.

Additionally, it is expected that the residual fuel share is to recover partially to 24% in 2022.

EIA projects that:

- It will be a common option to switch to lower-sulphur residual fuel oil or higher distillate blends;

- The share of low-sulphur residual fuel oil consumed in the U.S. bunker fuel market will increase from close to zero in 2018 to 38% in 2020;

- The need to use distillate in lower-sulphur bunker fuels will increase distillate’s share of U.S. bunkering demand from 36% in 2019 to 57% in 2020. After 2020, these fuels continue to account for relatively large shares of the fuels used in marine vessels.

- The use of LNG in marine bunkering concerning the US will be limited in the five years following, representing the limited infrastructure available to accommodate LNG.As infrastructure adapts, LNG’s share of U.S. bunkering grows to 7% in 2030 and to 10% in 2050.

Concluding, the majority of US refining capacity, mainly on the Gulf Coast has downstream units that upgrade residual oils into more valuable and lower-sulfur products. These units process heavier and higher-sulphur crude oils that yield large quantities of residual oils.

U.S. refinery usage will rise to 96% in 2020 and remain between 90% and 92% after 2026 through 2050 in the AEO2019 Reference case as these refineries aim to convert heavy, high-sulfur crude oil and residual fuel oil into lower-sulfur fuels.