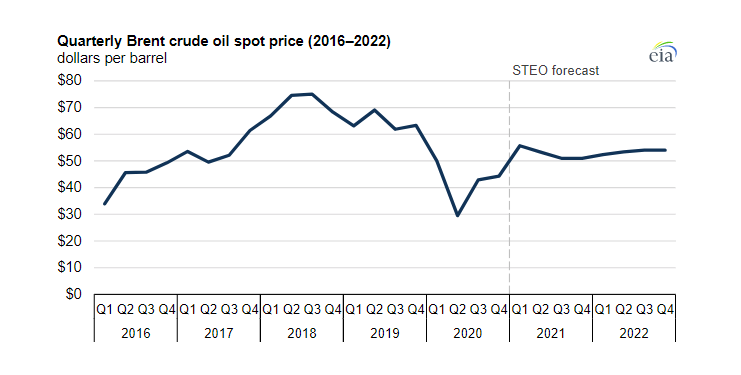

In its January Short-Term Energy Outlook (STEO), US EIA expects the price of Brent crude oil to increase from its December 2020 average of $50 per barrel to an average of $56/b in the first quarter of 2021. The Brent price is then expected to average between $51/b and $54/b on a quarterly basis through 2022.

This comes as EIA expects global demand for petroleum liquids to be greater than global supply in 2021, especially during the first quarter, leading to inventory draws.

Specifically, EIA expects that growth in crude oil production from members of the OPEC and partner countries (OPEC+) will be limited because of a multilateral agreement to limit production.

Saudi Arabia announced that it would voluntarily cut production by an additional 1.0 million b/d during February and March.

Even with this cut, EIA expects OPEC to produce more oil than it did last year, forecasting that crude oil production from OPEC will average 27.2 million b/d in 2021, up from an estimated 25.6 million b/d in 2020.

Meanwhile, EIA forecasts that US crude oil production in the Lower 48 states—excluding the Gulf of Mexico—will decline in the first quarter of 2021 before increasing through the end of 2022.

In 2021, EIA expects crude oil production in this region will average 8.9 million b/d and total US crude oil production will average 11.1 million b/d, which is less than 2020 production.

In addition, EIA expects that responses to the recent rise in COVID-19 cases will continue to limit global oil demand in the first half of 2021.

Based on global macroeconomic forecasts from Oxford Economics, however, EIA forecasts that global gross domestic product will grow by 5.4% in 2021 and by 4.3% in 2022, leading to energy consumption growth. EIA forecasts that global consumption of liquid fuels will average 97.8 million barrels per day (b/d) in 2021 and 101.1 million b/d in 2022, only slightly less than the 2019 average of 101.2 million b/d.

Concluding, EIA expects global inventory draws will contribute to forecast rising crude oil prices in the first quarter of 2021.

Despite rising forecast crude oil prices in early 2021, EIA expects upward price pressure will be limited through the forecast period because of high global oil inventory, surplus crude oil production capacity, and stock draws decreasing after the first quarter of 2021. EIA forecasts Brent crude oil prices will average $53/b in both 2021 and 2022.