The outlook for global container port demand is modest growth and a number of uncertainties, but capacity expansion plans are also muted. This means that most world regions will face an increase in average terminal utilisation, according to the Global Container Terminal Operators Annual Review and Forecast 2019, by Drewry.

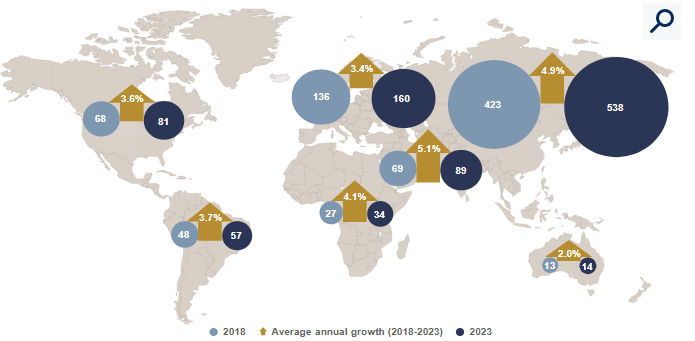

Drewry’s container port demand expectations for the next five years is for a global growth of 4.4% per annum on average, increasing world container port throughput from 784 million teu in 2018 to 973 million teu by 2023, a rise of almost 190 million teu.

The latest five-year forecast is a far cry from the heady days of the 2000s when forecasts were around 9% growth per annum until the global financial crisis of 2007-08 brought this to a shuddering halt

Drewry said.

In addition, various locations are expected to outperform markedly the global average, most notably Middle East/South Asia and Southeast Asia/Far East.

Moreover, worldwide container port capacity is forecast to increase at a CAGR of around 2%, according to confirmed additions only. This is well under the projected demand growth and reflects the continued easing off from greenfield projects by investors over the last few years.

Therefore, average utilisation at the global level could grow from 70% in 2018 to 79% by 2023. However, it will remain at a comfortable level for both operators and customer alike.

At the regional level, about all regions are projected to see their average utilisation levels increase. The most notable upward swings are expected in Greater China and Southeast Asia. Referring to China, Neil Davidson, author of the report and Drewry’s senior analyst for ports and terminals, explained:

The previous very rapid pace of capacity expansion is on hold, with the focus instead being on consolidation of port and terminal ownership into large groups. This, plus the uncertainty about China’s international trade growth in the face of tariff wars and protectionism, suggests that the government is taking a cautious approach

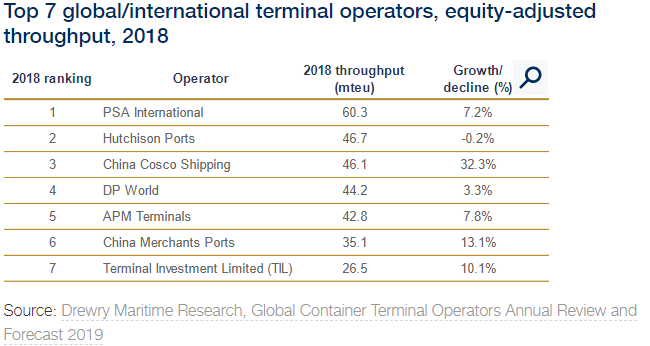

In addition, regarding the performance of the individual global/international terminal operators, the top seven players are:

A premier league of seven big operators has emerged, after which the next largest player is a third of the size. Between them they accounted for nearly 40% of global throughput in 2018. Within this elite group, Cosco has moved sharply up the table in this year’s analysis

Mr. Davidson concluded.