During the 2020 GREEN4SEA Athens Forum, Mr. Panayiotis Mitrou, Global Gas Segment Manager, Lloyd’s Register Marine & Offshore, shared his views on LNG as a fuel, towards 2050 compliance and beyond.

LNG as a fuel comes to life: more than 400 ships right now are being ordered or in service, a number of vessels are ready and a comprehensive bunkering supply chain is already in place or will be in place at the time of new deliveries.

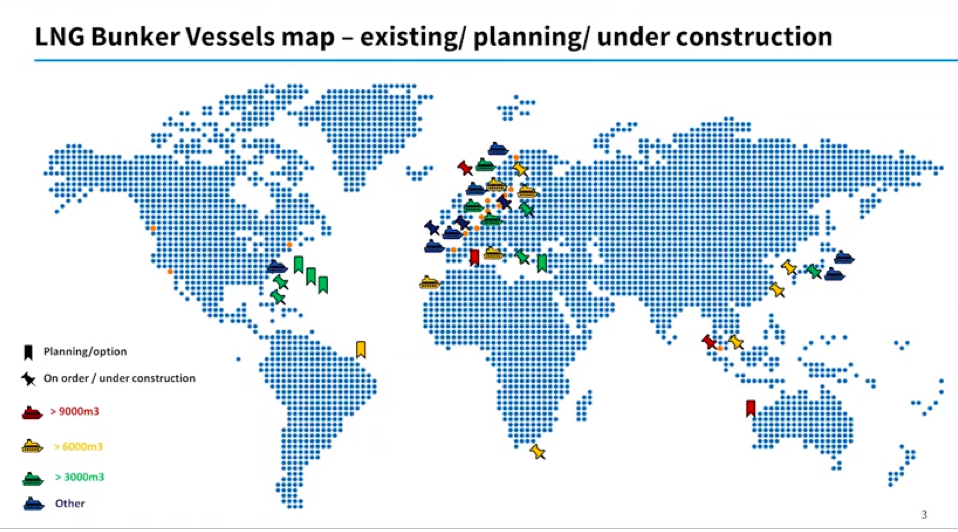

Referring to the global map below which shows the bunkering locations around the world, you can see cubic capacities which can cater with large LNG fuelled ships, container ships, VLCCs, Aframax tankers around the world.

Someone can also witness here the effect of the European Union, where the ECA zone, in conjunction with the funding mechanisms of the EU made a difference in Northern Europe. But, we also have Singapore, Durban, China, Japan, the US now progressing their LNG bunkering supply chain as well.

This implies that today or in a few years’ time all the major trade routes will be covered.

The LNG Bunkering Outlook

-

The oversupply question, despite the projected LNG market Growth, liquefaction capacity of an additional 35% within the next 6 years is expected to create a ‘long’ market.

-

LNG Bunkering cannot tackle but can benefit from potential oversupply of LNG

-

LNG will need to remain competitive to pipeline Gas, this means competitive pricing both at source and the supply chain

-

LNG market and its supply chain are expected to mature and expand with more spot trading opportunities and a wider storage network

-

LNG Bunkering is expected to grow by 50-60% CAGR until mid 2020s to a several billion $ industry.

Except for decarbonization and 2050 discussions, today we need to focus on the the current regulatory status; on one hand, this involves the IMO’s shorter measures that industry needs to tackle within the next decade, and on the other hand, there is the EU MRV Emissions Trade Scheme (ETS), the amendment of the MRV directive. According to the draft text of the EU MRV ETS, companies may need to reduce their annual CO2 emissions per transport work, by at least 40% by 2030, compared to the average performance per category of ships of the same size and type in the first reporting period as referred to in Article 8 of the MRV Directive.

So, it refers to 40% reduction in GHG emissions by 2030 on the basis of the first operating period of the MRV. It also refers explicitly to methane slip. So, methane slip will be translated to an equivalent to carbon dioxide and will get into this and eventually this will all end up to a fund where carbon allowance money from shipping will be used to, support the transition.

What’s important here is that by 2030, we need to comply with targets that are on the verge of what we can deliver today.

What can make the difference for the time being and the only available mature solution right now, as things stand, seems to be LNG.

There are reasons why someone would perhaps go down the LNG option for the next decade; but, what will happen until 2050?

This will now refer to indications and areas that are not that mature yet. There is a lot of uncertainty about the technology that will be around by that time, but i will make reference to four options that we consider today for an LNG fuelled ship of tomorrow.

The four options are

-

Biomethane

-

Synthetic methane

-

Carbon capture systems

-

Shifting to zero carbon fuels like hydrogen or ammonia

Starting at the end

It’s unfair to compare LNG with zero carbon fuels because they are not as mature, but the main problems or characteristics we see today with ammonia are

-

compatibility, IGC relevant requirements, the corrosivity of ammonia

-

the nitrogen oxides produced, which can be tackled with SCR

-

Cubic capacity, 40% more than LNG

-

Toxicity, more risk analysis required

With hydrogen

-

Liquefaction, -253 deg. C, incompatible with all existing assets as a liquid, grids, storage

-

Cubic capacity, 250% more than LNG, a large containership would need 50,000 m3 of LH2 Tanks

-

Flammability

Synthetic Methane

-

It is produced from H2 and Co2

-

H2 is produced from H2O

-

The production of H2 and CO2 requires renewable electricity

-

There are different technologies for:

-

Electolysis

-

CO2 sequestration

-

Methanation

We have two technologies right now on carbon capture. One, capture from point sources is quite mature, direct air capture is not yet mature, but we expect this to mature quite swiftly.

Methanation is already in place, but it’s not competitive in terms of cost yet.

Bio-Methane

Research shows biomethane will be made available in adequate quantities for transportation requirements based on agricultural by-products.

Hybrid bio-e methane solution could derive from liquefaction of biomethane using renewable energy.

Carbon capture storage one more possible alternative. There are a number of systems currently under development, but they are not mature yet. We have to understand how we can get rid of this ashore or store carbon onboard.

The LNG Achilles heel is Methane Slip

We need to put the right technology in place to deal with methane slip as soon as possible. We need to asses this on real terms and not ‘noise’ terms. We need to be aware of where exactly this comes from and how do we apply measures, either operational or choose the right engine technology or improve the current engine technology to tackle this.

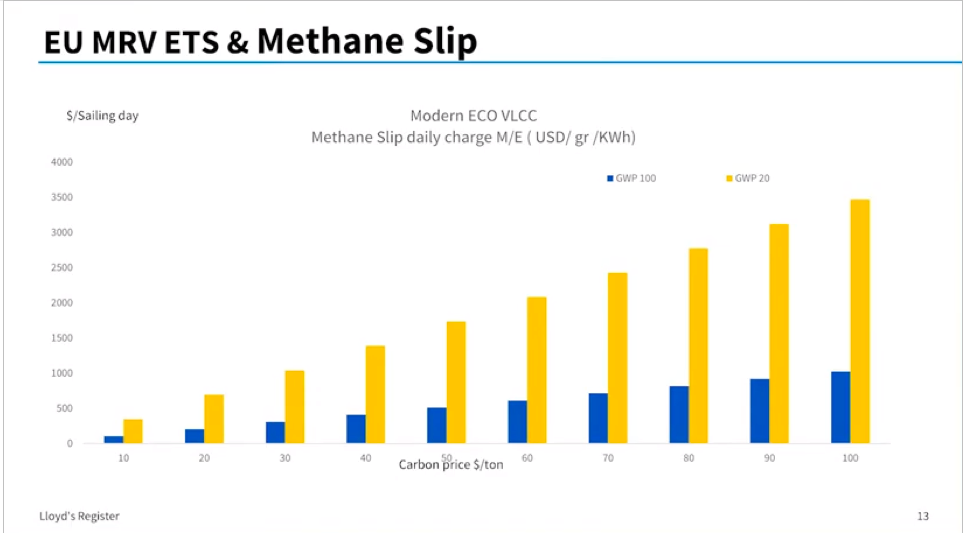

Based on potential regulatory action on methane slip, a sensitivity analysis diagram on potential impact of methane slip to shipping operations is presented hereunder

The graph shows a modern ECO VLCC Methane Slip daily charge M/E on US dollars per grammar per kilowatt. There are two bases, for methane slip and potential in GHG effect: The 100 global warming potential scale and the 20 years global warming potential scale.

Assuming that you have carbon pricing based on an ETS or some kind of other instrument, at 100 US dollars per ton of carbon, you could get 3,500 US dollars per grammar of methane slip. So, if you have two grammars, we are talking 7,000 per day, only on methane slip terms.

This is something we need to keep in mind for the years to come. We need to be quite conscious on what kind of technology we select today because we may be charged on it in the years to come.

What the future could look like, not on the basis of 100% carbon neutral reality. This is based on what is more pragmatic in market terms.

Flexibility is quite important, we are not going to see ammonia everywhere as we haven’t seen all kinds of blends all around the world. We will see geographical differences, in availability and pricing of different fuels, so you may have biofuels in other areas available, then you can have fossil fuels.

An important LNG attribute is that it can also deliver a blend of different origin components. So it could be fossil LNG, bio-LNG, synthetic LNG. All these could blend together in one fuel you could use, in accordance with carbon taxation, carbon emission requirements at any given moment and it’s quite important to be flexible on the operations front.

Eventually, we could shift to a different kind of fuel, as ammonia for example. However, we see a number of issues in turning a gas-fueled ship into an ammonia-fueled ship.

We can’t take it for granted that this will happen and we need to make sure what the options ahead will be.

Conclusions

-

It seems like the major barrier to LNG uptake is being tackled with favourable financials today.

-

While a number of uncertainties, deriving from decarbonization, are still on the table, a number of prospects seem to cater for future developments.

-

Methane slip in the short term, Biogas in the mid-term, carbon capture in the long-term, are areas where more research effort should be invested

-

Irrespective of whether you are pro LNG or not, consider an LNG favourable scenario in your projected New construction projects.

Above text is an edited version of Panagiotis Mitrou’s presentation during the 2020 GREEN4SEA Athens Forum.

View his video presentation herebelow

The views expressed in this article are solely those of the author and do not necessarily represent those of SAFETY4SEA and are for information sharing and discussion purposes only.

Panagiotis Mitrou is Global Gas Segment Manager at Lloyd’s Register. Lloyd’s Register started out in 1760 as a marine classification society. Today, LR is one of the world’s leading providers of professional services for engineering and technology – improving safety and increasing the performance of critical infrastructures for clients in over 75 countries worldwide.

Panagiotis Mitrou is Global Gas Segment Manager at Lloyd’s Register. Lloyd’s Register started out in 1760 as a marine classification society. Today, LR is one of the world’s leading providers of professional services for engineering and technology – improving safety and increasing the performance of critical infrastructures for clients in over 75 countries worldwide.