China was one of the countries which showed a significant reduction to PSC inspections during 2020, due to COVID-19 pandemic outbreak.

During 2019 6,233 individual ships inspected during 10,943 PSC Inspections. The figures for 2020 were 770 individual ships and 1,113 inspections. The numbers show a reduction of 90% to inspections. The key figures and PSC KPIs for 2020 are shown on Table 1.

|

Inspections |

1,113 |

|||

|

Detentions |

56 |

Detention rate (DER) |

5.30% |

|

|

Deficiencies |

2,363 |

Deficiency Per Inspection (DPI) |

2.54 |

|

|

Inspections with at least one deficiency |

938 |

Inspections with def. Rate (DIR) |

84.27% |

|

|

Inspections with more than 5 def. |

103 |

Insp.with more than 5 def.Rate (FDR) |

9.24% |

|

|

Clean Inspections |

175 |

Clean Inspection Rate (CIR) |

15.72% |

Table 1: Key figures and PSC KPIs for 2020 in China

The Global average during 2020 for DER is 2.13% and for DPI is 1.52; considering these, the figures for China’s PSC inspection area are significantly higher. The reason may be that as the PSC authorities minimized the inspections, they targeted mostly the High Risk Ships reducing the number of standard risk and Low risk ships.

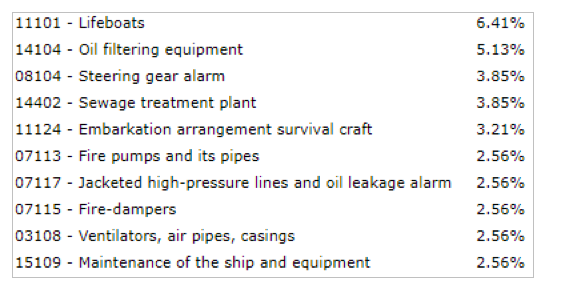

Table 2 shows the most common deficiency areas marked during 2020. The rest of deficiency categories had significant lower share during 2020.

Table 2: Most common deficiency areas in China during 2020

In respect of detentions the distribution of detentions per ship type was:

- Bulk Carriers: 24

- General Cargo: 18

- Tankers: 3

- Container: 7

- Other: 4

Table 3: The top 10 detainable deficiencies in China, during 2020

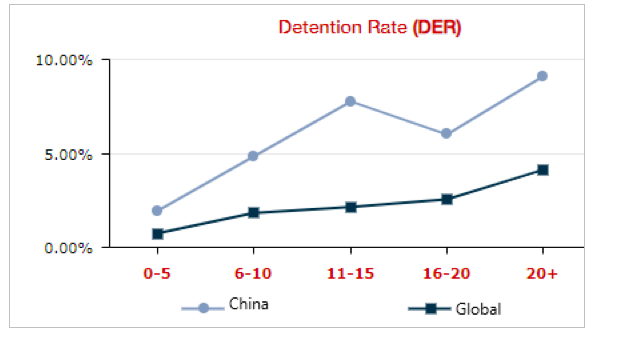

Lifeboat related deficiencies are the most common reason for detention. Additionally pollution related items (as Oil filtering equipment and sewage treatment) are also in top 5 positions. The distribution of detentions per age (Graph 1) shows that ships aged more than 10 years old have an increased number of detentions.

Overall, a good preparation is required as the MSA responsible for China’s PSC inspections conducts detailed inspections in respect of safety and security. The first months of 2021 showed a normality in ships operations, thus the PSC inspections are expected to follow an increasing curve in China in the forthcoming months.

• PREPARE for forthcoming PSC inspections

• ANALYSE PSC performance to identify strengths & weaknesses

• BENCHMARK fleets against competition and the industry