The Q1 2024 Shipping Market Overview & Outlook from BIMCO has been released which features an analysis of the tanker shipping market regarding supply and demand.

According to Niels Rasmussen, BIMCO’s Chief Shipping Analyst, for crude tankers, they forecast that the supply/demand balance will tighten further during both 2024 and 2025. Low fleet growth, along with increasing sailing distances, create the foundation for the improvement despite a slowing of growth in oil demand.

The product tanker supply/demand balance is also expected to tighten in 2024 but weaken in 2025. Like the crude tanker market, longersailing distances support demand growth despite slowing oil demand.

However, an increase in contracting of new ships during 2023 will drive fleet growth in 2025 higher than our estimated demand growth.

..said Niels Rasmussen.

The crisis in the Red Sea is driving sailing distances up as ships avoid the Suez Canal and instead proceed via the Cape of Good Hope. In their forecast, they assume that this crisis will impact the market until the end of June 2024. Crude tanker fleet capacity growth will be mainly in the Aframax and Suezmax segments that are estimated to grow by 2.8% and 4.2% respectively from end 2023 to end 2025. VLCC capacity is expected to grow only 0.5% and benefit most from the tighter supply/demand balance.

Macro environment

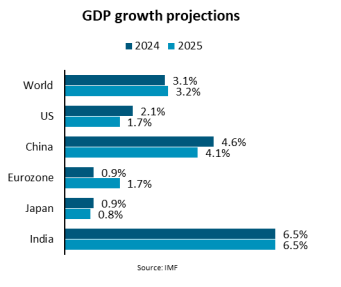

Global economic growth is estimated to have been 3.1% in 2023. The International Monetary Fund (IMF) projects that growth in 2024 and 2025 will end up at 3.1% and 3.2% respectively.

The IMF forecasts slower growth for both 2024 and 2025 in the US, China, Japan and India compared to 2023. On the other hand, the eurozone, Canada, Nigeria, Saudi Arabia, SouthAfrica and the UK are forecast to see growth accelerate in both 2024 and 2025. As inflation is falling faster than previously

expected and growth remains steady, the risk of a hard landing has reduced, and risk is no longer weighted to the downside.

Global oil demand continued to grow in 2023 and, according to the International Energy Agency (IEA), increased by 2.3 million barrels per day (mbpd) to hit 101.8 mbpd.

Demand

We estimate that crude tanker demand will increase by 6.5-7.5% in 2024 and 2-3% in 2025. Cargo growth is forecast to be 2-3% in 2024 and 1-2% in 2024. Increased sailing distances due to the Red Sea crisis are expected to lift demand in the first half of 2024, whereas the continued shift of crude supply towards the Americas and of crude demand towards Asia will add to average sailing distances in both 2024 and 2025.

..Niels Rasmussen stated.

Product tanker demand is forecast to increase 5-6% in 2024 and 1.5-2.5% in 2025. Cargo demand growth is estimated at 1-2% in 2024 and 0.5-1.5% in 2025. The Red Sea crisis is assumed to impact east/west trade lanes during the first half of the year and force a share of ships to proceed via the Cape of Good Hope instead of via the Suez Canal. Increased east/west volumes due to reduced refinery runs in Europe is in the meantime expected to add to sailing distances in both 2024 and 2025.

Whereas demand growth in 2023 was dominated by an increase in the demand for jet fuel and other transportation fuels, demand growth in 2024 is expected to be driven by the petrochemical industry. Demand in North America and Europe is seeing the impacts of electrification and fuel efficiency, with demand

in both areas appearing to have peaked. In fact, the IEA has estimated that demand in Europe has fallen in 2023 and will fall again in 2024.

Supply

We forecast that crude and product tanker supply will grow in line with fleet growth during both 2024 and 2025. Crude tanker supply is therefore estimated to grow by 0-1% in 2024 and 0.5-1.5% in 2025. Product tanker supply is predicted to grow 1.5-2.0% in 2024 and 4-5% in 2025.

..BIMCO’s Chief Shipping Analyst said.

The crude tanker fleet is expected to see deadweight capacity growth of 0.6% in 2024 and 1.1% in 2025. It will grow from 463.1m deadweight tonnes at the end of 2023 to 471.0m deadweight tonnes at the end of 2025.