The Q2 2024 Dry Bulk Shipping Market Overview & Outlook from BIMCO has been released which features an analysis of the dry bulk shipping market regarding supply and demand.

Supply/demand balance

BIMCO’s chief shipping analyst, Niels Rasmussen highlights that they expect the supply/demand balance to strengthen in 2024 and weaken in 2025. Supply is estimated to grow by 2-3% in 2024 and 1.5- 2.5% in 2025, while demand is projected to grow by 2.5-3.5% in 2024 and stagnate in 2025.

Overall, conditions in the dry bulk market should stay strong in 2024 but could begin to weaken in 2025.

Since September 2023, the Baltic Dry Index has firmed on stronger capesize demand. Strong cargo volumes including higher iron ore shipments from Brazil and a build-up of iron ore inventories in China have all contributed to higher capesize freight rates. In the smaller segments, rerouting away from the Red Sea

and Panama Canal has helped boost demand. Second hand prices have also surged, as prices for 5-year-old ships approached those of newbuilds.

Freight rates are expected to stay strong in the near term but could cool starting in the second half of 2024. As transits through the Red Sea and Panama Canal rebound, sailing distances are expected to shorten. In 2025, freight rates may weaken as supply grows faster than demand.

Capesize ships should fare the best, as the fleet is expected to grow more slowly. Their demand growth has been driven by increasing volumes rather than by longer sailing distances due to rerouting away from the Red Sea and Panama Canal. Panamax and supramax ships may see their earnings pressured by high ship deliveries and low demand growth. Both upside and downside demand risks remain. A longer than assumed crisis in the Red Sea and continued Panama Canal transit restrictions will likely strengthen the market. On the other hand, a deterioration in conditions in China’s property or financial sectors would harm demand.

Demand

We forecast dry bulk demand to grow by 2.5-3.5% in 2024 and stabilise at between -0.5% and 0.5% in 2025.

…Niels Rasmussen said.

Cargo volumes are expected to grow by 0.5- 1.5% in both 2024 and in 2025. That is a positive upward revision of 0.5 percentage points for 2024 since our previous report, due to a strong first quarter of 2024.

Average sailing distances are expected to lengthen 1.5-2.5% in 2024 but could shorten 0.5-1.5% in 2025. This is a positive revision for demand in 2024, as ships increasingly sail around the Cape of Good Hope instead of through the Suez Canal. Stronger cargo from the Atlantic basin paired with lower coal volumes should also contribute to longer distances.

Supply

We estimate that dry bulk supply will only grow by 2-3% in 2024 and 1.5-2.5% in 2025.

…Niels Rasmussen said.

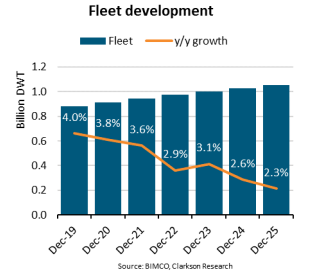

The dry bulk fleet is expected to grow by 2.6% in 2024 and 2.3% in 2025, the slowest it has grown since 2016.

Ship deliveries are forecast to reach 32.0 and 32.4 million DWT in 2024 and 2025 respectively. This is a slight upward revision since their last update, primarily among the smaller segments. Supramax is the segment with the highest fleet growth, at 4.4% in 2024 and 4.5% in 2025.

Credit: BIMCO