The Q4 2023 Shipping Market Overview & Outlook from BIMCO has been released which features an analysis of the dry bulk shipping market regarding supply and demand.

BIMCO’s chief shipping analyst, Niels Rasmussen finds in his report that the supply/demand balance should remain stable in 2024 and tighten

slightly in 2025. As such, freight rates may remain around 2023 levels in 2024 and could improve in 2025.

Demand

In our base scenario, we expect cargo demand to grow by 2.5-3.5% in 2023, 0.5-1.5% in 2024 and 1-2% in 2025.

…Niels Rasmussen stated.

Average haul could increase by between 0.5% and 1.5% in 2023 and between 0% and 1% in both 2024 and 2025. From 2024 onwards, there may be a decrease in shipments of coal, which is a commodity with below average sailing distances. Furthermore, shipments of iron ore and grain from South America and

bauxite from Guinea could continue to increase, further boosting average haul.

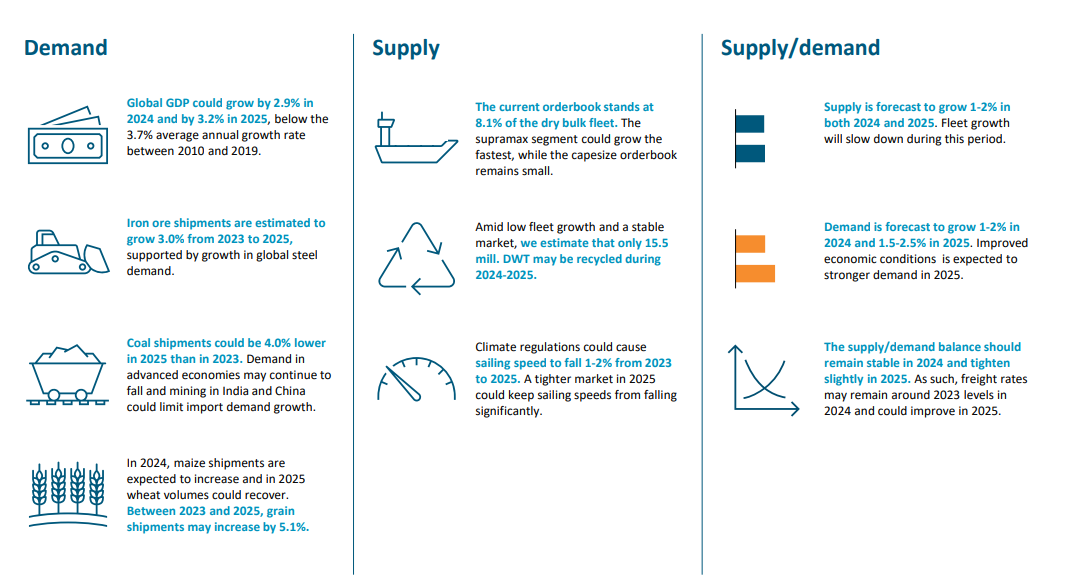

In October, the International Monetary Fund (IMF) forecast global GDP to grow by 2.9% in 2024 and by 3.2% in 2025, a minor downward revision of 0.1 percentage points for 2024. The fight against inflation in many advanced economies will continue to impact economic growth in 2024. However, the likelihood of global GDP growing by only 2% is estimated by the IMF at only 15%, an improvement over the previous estimation of 25%. The downside risks have eased, and the IMF’s projections are consistent with a scenario where inflation declines without a major downturn in economic activity.

Supply

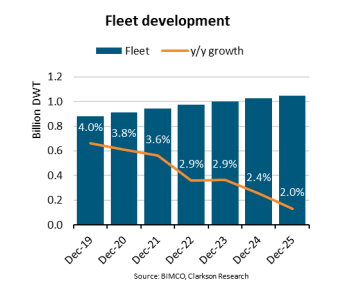

The dry bulk fleet is estimated to grow by 2.9% in 2023, 2.4% in 2024 and 2.0% in 2025. For 2023, supply is estimated to grow by 2-3%, affected by lower sailing speeds and lower congestion. In both 2024 and 2025, lower sailing speeds could cause supply to only grow by 1-2%.

The order book currently stands at 8.1% of the dry bulk fleet and deliveries are expected to reach 33.2 million deadweight tonnes (DWT) in 2024 and 27.2 million DWT in 2025. The supramax segment is projected to grow the fastest in 2024 and 2025, with estimated deliveries of 13.4 million DWT and 10.0 million

DWT respectively. Conversely, the capesize order book stands at only 5.1% of the fleet, with deliveries expected to reach 7.2 million DWT in both 2024 and 2025.

Supply/demand

Overall, we expect the supply/demand balance to tighten in 2023, remain stable in 2024 and tighten marginally in 2025. Supply is expected to grow by 2-3% in 2023 and by 1-2% in 2024 and 2025. Demand is projected to grow by 3.5- 4.5%, 1-2% and 1.5-2.5% in 2023, 2024 and 2025 respectively.

…Niels Rasmussen stated.

Throughout much of 2023, the Baltic Dry Index stayed low, particularly during the summer months. However, it has recovered significantly since September, led by higher spot rates for capesize ships. This year, overall, the capesize segment fared comparatively better than smaller segments, benefiting from strong

demand for iron ore, coal and bauxite.

Credit: BIMCO