According to the American Petroleum Institute (API), US petroleum markets established new records for oil production and refinery performance in August. However, US petroleum exports decreased.

Namely, based on API’s monthly report for August:

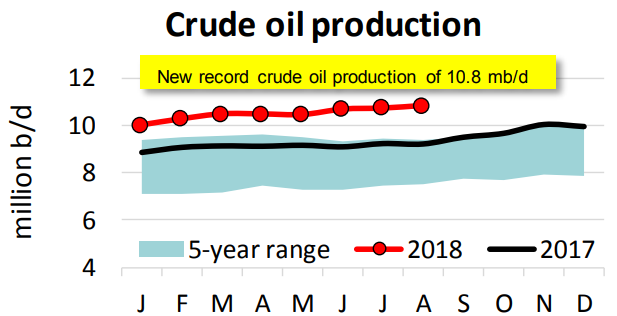

- Crude oil production was 10.8 million barrels per day (mb/d);

- Refining throughput was 18.0 mb/d record for the month of August.

Regarding US liquid fuels production remained up by more than 2.0 mb/d year-over-year (y/y) in August, and the US continued to supply virtually all global oil demand growth and compensate for production losses in some OPEC nations.

[smlsubform prepend=”GET THE SAFETY4SEA IN YOUR INBOX!” showname=false emailtxt=”” emailholder=”Enter your email address” showsubmit=true submittxt=”Submit” jsthanks=false thankyou=”Thank you for subscribing to our mailing list”]

In August, US petroleum demand, increased by 250 thousand barrels per day (kb/d) from July to 20.8 mb/d. This was the strongest demand for any month since August 2007 and indicated solid economic growth, industrial activity, and consumer confidence.

Nevertheless, the report showed that US petroleum exports decreased for a second consecutive month. Namely, crude oil exports: were 1.6 mb/d in August, down 400 kb/d from July and 560 kb/d from June. As for, refined product exports, these were 4.9 mb/d in August, down 160 kb/d from July and 730 kb/d from June.

Additionally, US petroleum exports decreased by 1.3 mb/d between June and August at the same time as US petroleum imports increased by more than 0.3 mb/d. As a result, the US petroleum trade balance decreased by 56% within two months.

While the increased imports reflected strong U.S. demand and refining activity, the drop-off in exports likely was due to a shift in buying patterns among U.S. trading partners.

Highlights

Specifically, the highlights for August were the following:

- U.S. petroleum demand accelerated to 20.8 mb/d;

- Gasoline demand notches its third highest August on record since 1945;

- Strong trucking and marine shipping activities drive highest August distillate demand since 2007;

- Strongest jet fuel demand year-to-date since 2001;

- Residual fuel oil demand most volatile on record since 1936;

- Refinery and petrochemical feedstock demand grew by more than 0.5 mb/d since August 2017.

See more in the PDF herebelow