According to Xeneta, the ongoing impact of conflict in the Red Sea, spiraling freight rates and congestion across global ocean container supply chains resulted in record high carbon emissions in Q3 2024.

As explained, the Xeneta and Marine Benchmark Carbon Emissions Index (CEI), which measures carbon emissions across Xeneta’s top 13 ocean container shipping trades, hit 107.9 points in Q3 – the highest on record and up 12.2% compared to a year ago before the Red Sea crisis. The CEI is based on Q1 2018, meaning any reading above 100 indicates carbon emissions per tonne of cargo carried are above levels from that period.

Q3 2024 is only the second time the 100 point mark has been breached, with the first time being Q1 2024 in the immediate aftermath of escalation in the Red Sea.

In Q3, six of the 13 trades were below the 100 point benchmark – indicating a lowering of emissions per tonne of cargo carried compared to Q1 2018 – while seven scored above 100.

Trades split between those impacted by Red Sea and those that are not

The effect of the Red Sea crisis on the CEI is most clearly seen in a year-on-year comparison, with the four trades most impacted by diversions around the Cape of Hope seeing emissions increase by more than 30% in Q3 2024 compared to Q3 2023 (the two fronthauls and two backhauls connecting the Far East with North Europe and Mediterranean).

The biggest year-on-year increase is found on the Far East to Mediterranean trade, up 60.1%, while the backhaul is up 46.3%. Furthermore, Xeneta points out that the trade from North Europe to South America East Coast has also seen a year-on-year CEI increase of more than 30% in Q3, despite not transiting the Red Sea and Suez Canal.

Conversely, five trades have seen lower emissions compared to Q3 last year – and unsurprisingly these are trades not impacted by longer sailing distances around Africa. The backhaul from the US East Coast to the Mediterranean has seen by far the biggest year-on-year drop in Q3, down 26.5%.

Comparison with Q2

Comparing Q3 with Q2 provides insight into the evolving impact of the Red Sea conflict on the CEI during 2024.

Emissions on the fronthaul from the Far East to Mediterranean (the trade with the biggest year-on-year increase) actually fell in Q3, down by 3.5% from Q2 to 140.6 points (the backhaul increased a further 10% in Q3 to 164.3 points).

The biggest quarter-on-quarter increases in Q3 are found on backhaul trades unimpacted by the Red Sea diversion. Most notably, Xeneta claims emissions have increased 40.3% from the US West Coast to Far East and 19.7% from the US East Coast to North Europe.

Reducing emissions falls down priority list

The deterioration on the Transatlantic backhaul is partly due to a 1250 TEU decrease in the average capacity of ships deployed on this trade, with smaller ships being less efficient when it comes to carbon emissions.

Another reason for higher emissions on backhaul trades is an increase in speed as carriers rush to get their ships back for their next scheduled sailing. Several trades have seen average sailing speed reach multi-year highs. For example, from North Europe to the Far East the average sailing speed rose to 16.2 knots in Q3, the highest it has been since Q3 2022 (this was also the last time average sailing speed from the US West Coast to the Far East was higher than in Q3 2024), Xeneta finds.

This is an example of how reducing carbon emissions falls down the priority list at times of increasing congestion, tightening capacity and spiralling freight rates. When shippers are scrambling to secure capacity and carriers are financially incentivized to provide it, carbon reduction is not front of mind for either party.

Falling filling factors is also leading to higher emissions per tonne of cargo carried. This is largely due to a deteriorating trade balance, with exports from Europe and US back to the Far East growing at a much slower rate than volumes on the fronthaul leg.

As noted by Xeneta, in the first eight months of the year, Far East to Europe volumes rose 7.7% compared to an increase of just 0.3% the other way. And though exports from North America to the Far East have performed better, up 7.0%, this is still considerably lower than the 17.7% increase on the fronthaul.

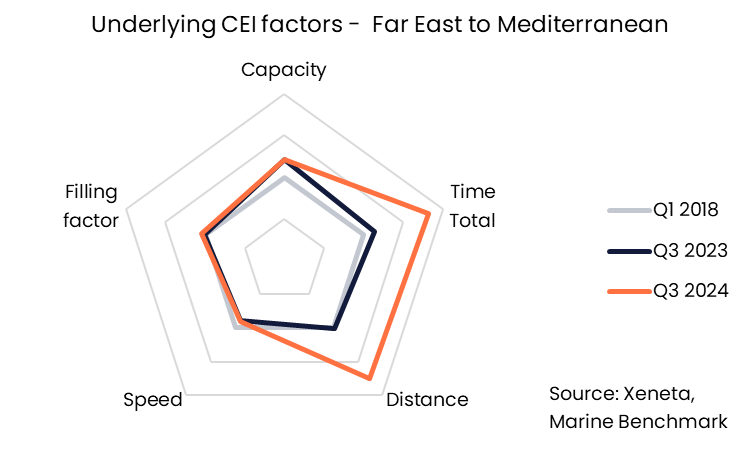

Far East to Mediterranean

According to Xeneta, the fronthaul and backhaul trades between the Far East and Mediterranean stick out as the worst performing trades in 2024 and serve as good example of why the Red Sea crisis impacts carbon emissions. The CEI on these trades is driven up by the factors directly linked to the Red Sea conflict – namely longer sailing distances and transit time due to ships heading around the Cape of Good Hope rather than through the Suez Canal.

A year-on-year comparison showing increased sailing distance and transit time on the trade from the Far East to Mediterranean is illustrated in the chart below.

The chart also shows that average sailing speed is slightly lower in Q3 2024 compared to Q3 in 2023 and 2018. The average size of ships deployed on this trade has also increased alongside improved filling factor. All of this helps to reduce carbon emissions – but it is nowhere near enough to make up for the diversion around Africa, Xeneta highlights.

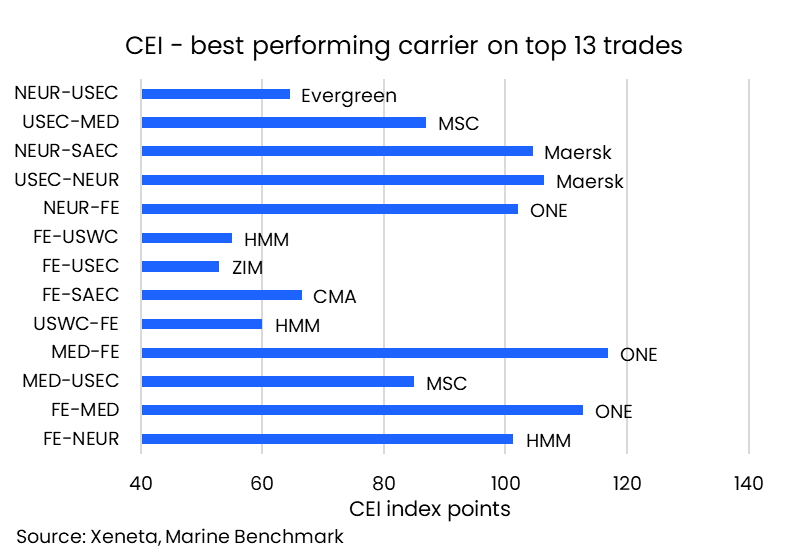

Carrier Level

Looking across the top 13 trades, ONE and HMM take top spot as best performing carrier on three trades. Only COSCO, Hapag-Lloyd and Yang Ming failed to take top spot on any of the top 13 trades, Xeneta concludes.