Predictive Maritime Intelligence company, Windward, released its monthly executive summary for March 2022, indicating that this month has been chaotic with the intensification of deceptive shipping practices following Russian sanctions.

The maritime ecosystem has experienced a great deal of uncertainty and sudden changes following Russia’s decision to invade Ukraine a little more than a month ago.

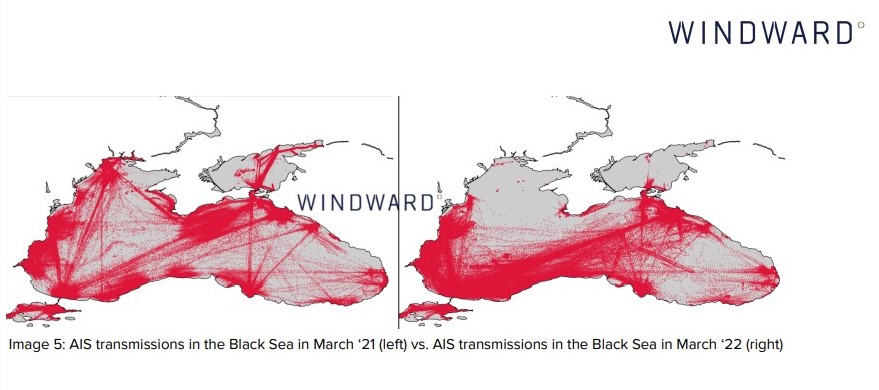

Sanctions, whether government-led or self-imposed by companies looking to protect their reputations, have already significantly impacted the world during a chaotic March, as evidenced by the shift in traffic in the nearby Black Sea and Baltic Sea.

[smlsubform prepend=”GET THE SAFETY4SEA IN YOUR INBOX!” showname=false emailtxt=”” emailholder=”Enter your email address” showsubmit=true submittxt=”Submit” jsthanks=false thankyou=”Thank you for subscribing to our mailing list”]

Regulation & Deceptive Shipping Practices

Private corporations went beyond the letter of the law in March, with banks and trading companies increasingly engaged in “self-sanctioning” against Russian entities in the shipping and commodities sector.

Insurers that offered coverage for trading in disputed areas are halting coverage of the Black Sea and the Sea of Azov, due to fear of secondary sanctions.

The British decision to ban ships with a Russian connection from its ports, seemingly set to be followed by the European Union, has broadened the potential scope of sanctions.

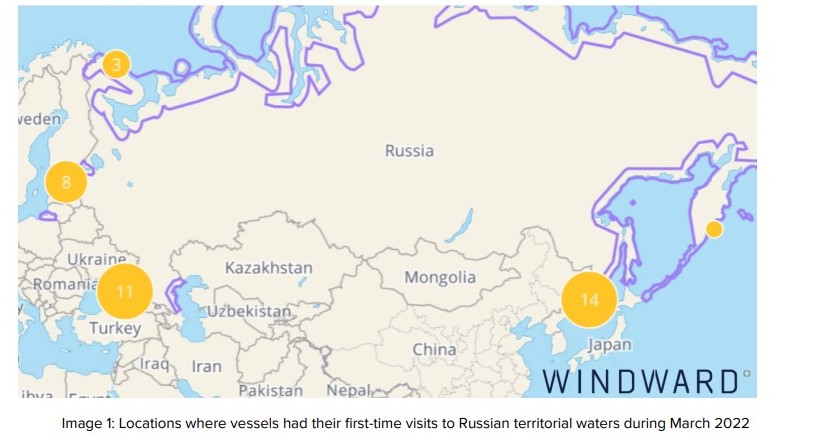

Since the beginning of the Russian military invasion of Ukraine in early March, Windward data shows that 33 vessels visited Russian territorial waters for the first time in their history.

When looking at the ownership and management data of these 33 vessels, 40% of entities involved in the ownership and management of these vessels are European or North American, and 21% are Chinese, or from Hong Kong.

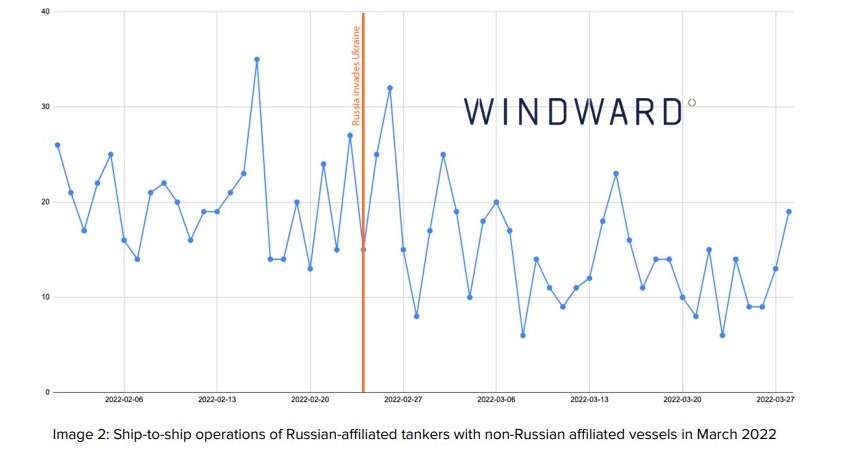

The number of ship-to-ship meetings that lasted at least three hours between Russian-affiliated clean product tankers and non-Russian-affiliated vessels remains at 73%, which is the average in the weeks prior to the Russian invasion of Ukraine, including occasional spikes above that.

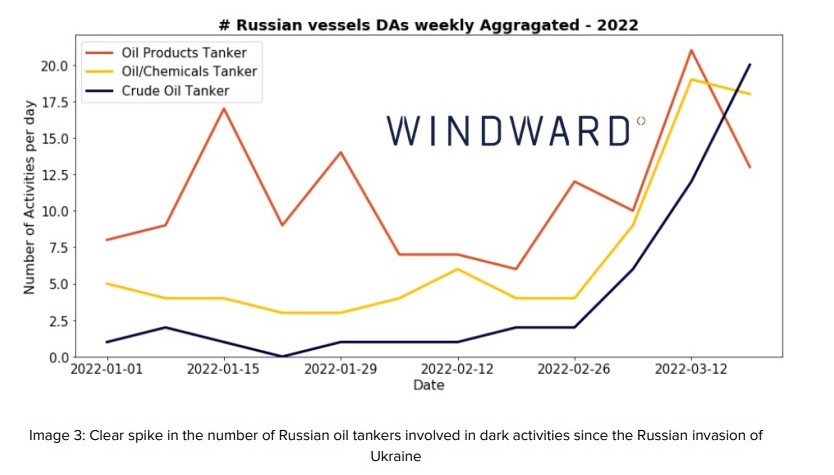

Windward data shows a significant increase in dark activity by Russian oil tankers since the beginning of the Russian invasion of Ukraine and the wave of financial and moral sanctions on the country.

Before the sanctions were put into place, the average number of dark activities by Russian oil tankers was five per week.

That number more than doubled to 12 dark activities per week on average since then, peaking at 17.3 between March 12-18, more than threefold the weekly average before the sanctions.

Before the invasion and subsequent sanctions, Russian crude oil tankers were barely involved in dark activities, with a weekly average of 1.1 such activities per week. Between March 19-25, that number skyrocketed to 20!

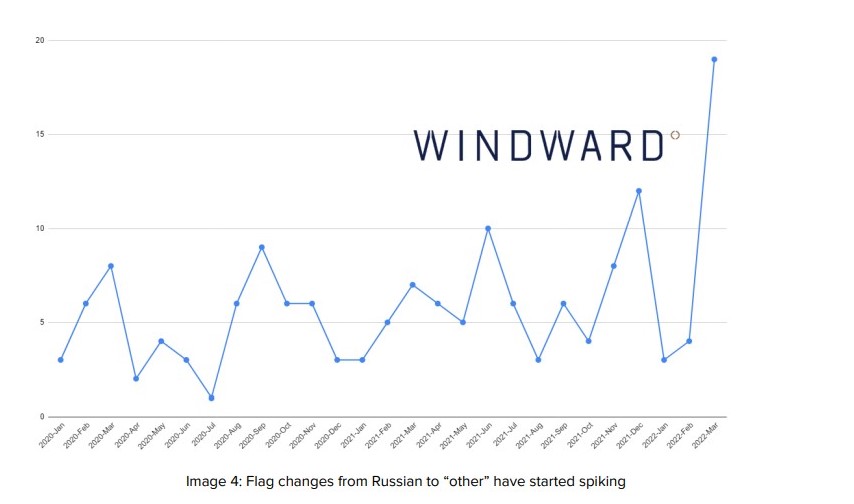

According to Windward’s proprietary behavioral data, March 2022 marks a rush of vessels and even fleets moving away from affiliation with the Russian regime by changing the flags under which they trade from the Russian flag to those of other countries.

In the context of the current situation between Russia and Ukraine, such a trend is likely to point to one of two scenarios – honest business people trying to continue trading as usual without the potential hurdles that a Russian flag could create for them; or bad actors that intentionally hide their Russian identity and/or business connections to deceive authorities and counterparts.

Some of these vessels are owned or operated by companies registered in Russia.

Based on Windward’s data on flag changes dating back to January 2020, the average number of vessels that changed their flag from Russian to non-Russian was 5.8.

In March 2022, that number spiked to the highest in that entire period to 18 changes, more than three times the average.

Five of these eighteen vessels are affiliated with Russian companies through their ownership and/or management structure.

The most common flag of choice is the Marshall Islands flag, to which 11 of these vessels are changing their registration. Saint Kitts and Nevis is the second most popular, with three vessels switching to it.

Trade flows

Maritime trade and operations in the vicinity of the conflict are noticeably shifting in terms of traffic. This is clear when comparing automatic identification system (AIS) transmissions in the Black Sea from March 2021 to March 2022:

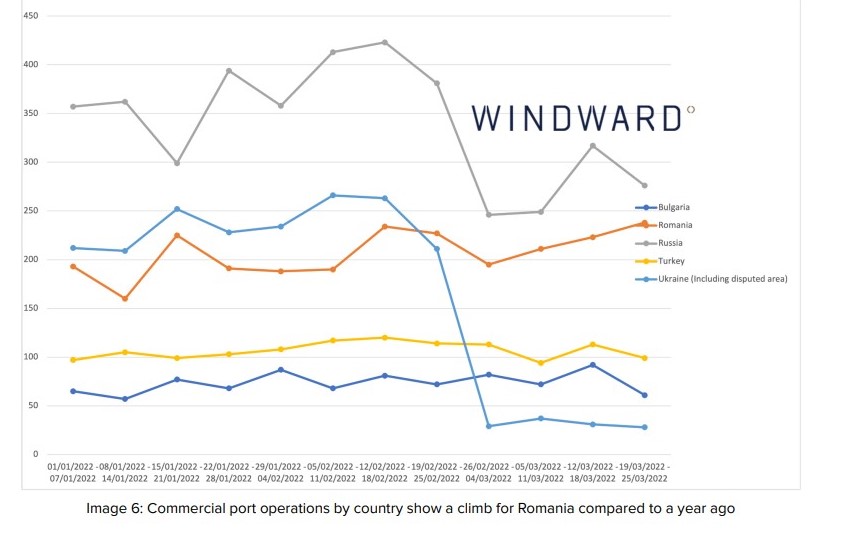

According to Windward’s AI-driven behavioral data, overall commercial port operations in the Black Sea are at 79% of their annual average – including the decreased operations during the Russian invasion.

Windward is seeing a climb in commercial port operations in Romania – 115% from the annual average thus far – compared to a drop for most other countries in the region.

Container vessels

Container shipping has noticeably slowed and many forwarders are seeking to avoid sending rail freights via routes that enter Russian territory.

The world’s largest shipping companies – CMA, MSC, Maersk, Hapag Lloyd, One, and others – have halted all activity with Russia.

Using data obtained from Windward’s Ocean Freight Visibility solution and the World Bank, Windward estimates that MSC, CMA, and Maersk would have been responsible for moving approximately 101,000 containers in and out of Russia in March.

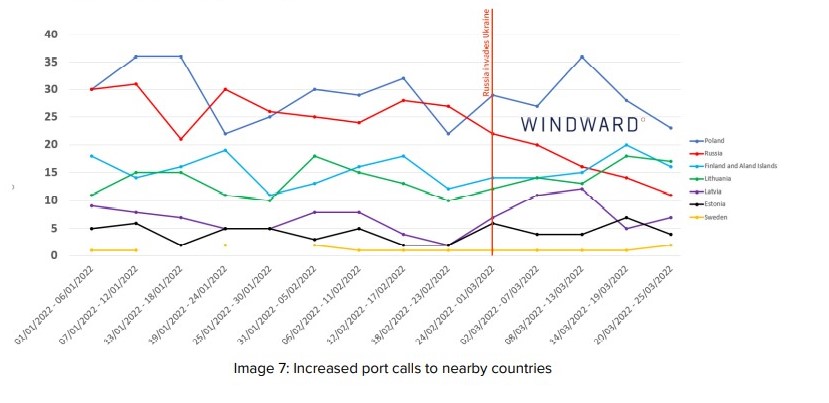

In the Baltic Sea – which is encircled by Russia, Poland, Sweden, Finland, Estonia, Lithuania, and Latvia – Windward data indicates that before February 24, 2022, Poland and Russia were the leading destinations for port calls by container vessels in the area, with weekly averages of 29 and 27 port calls, respectively. Finland was a distant third with about half (15).

Since February 24, container vessel port calls to Russia dropped by 38.3% to an average of 16.6. This has left Lithuania, Latvia, and Estonia to pick up the slack – each is handling more port calls to close the gap.

Oil trade

Some oil majors, such as Shell, have decided to completely shun Russian oil, with U.S. and UK buyers expected to be under increased scrutiny due to the upcoming ban on these imports.

Many crude oil tankers have called in Russian ports (after March 1, 2022). The estimated quantity of crude oil that was delivered by these tankers is estimated at 55,800,000 barrels.

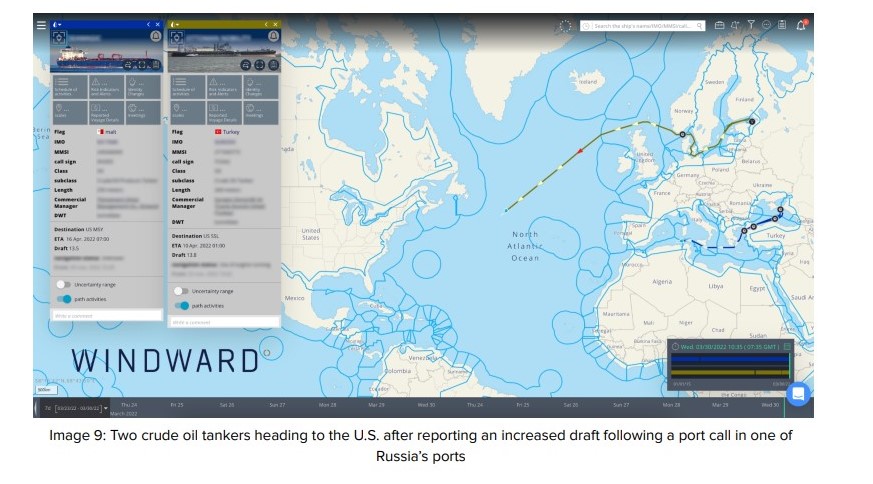

The cargos of crude oil tankers that have arrived in Russia starting March 1 have arrived to Asia and countries within Europe – and notably not to the U.S.

There are 34 other tankers that called port in Russia after March 1 and still have not arrived at their next respective destinations, including possibly the U.S.

In addition to the 34, there are 18 local tankers operating between Russian ports that are seeking their next destination.

The estimated capacity of the crude oil tankers that called port in Russia starting on March 1 and will then presumably call port outside of Russia is 25,250,000 barrels of crude oil.

Shenzhen shutdown

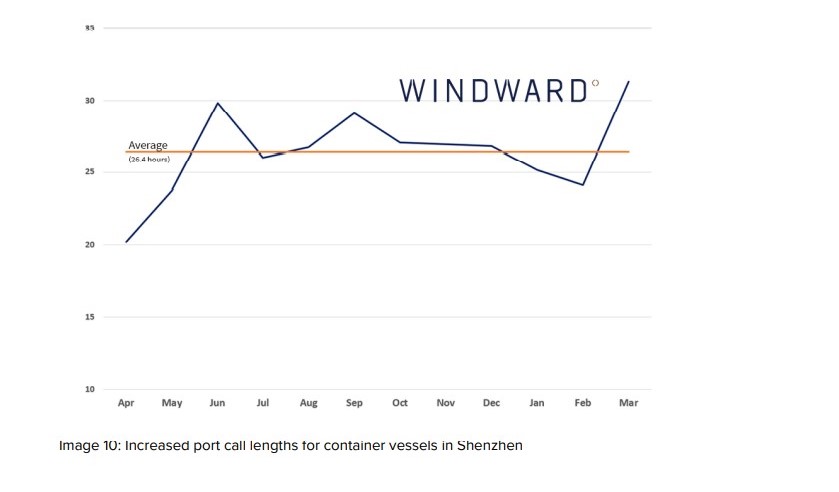

Following the recent Shenzhen COVID-19 lockdown, Windward data shows that the average length of a port call for container vessels in Shenzhen spiked from 26.4 hours in the past 12 months, to an average of 36.5 hours since the lockdown came into effect, peaking at 54 hours on March 19.

The total number of port calls made to Shenzhen during the lockdown week experienced a drop to an average of 67% of the previous 12-month average.

This brought the monthly average in March down to 78% of the yearly average, the lowest since the last lockdown in Shenzhen back in June 2021.

Despite official announcements stating that Shanghai port will remain functional, it is likely that carriers will choose to skip Shanghai to avoid congestion.

Windward data shows that carriers have been choosing Ningbo port instead in 26% of cases for container vessels in the past year.

Due to its relative proximity to Shanghai, it is equally probable that even container vessels that did not intend to call Ningbo port will choose it over Shanghai to avoid the expected congestion. If that is the case, Ningbo will of course become heavily congested.

Looking ahead

The conflict and COVID-19 outbreaks have created an extremely fluid situation requiring the predictive analytics of Maritime AI.

Players in the maritime ecosystem must remain proactive about identifying restricted vessels and containers by obtaining full visibility, in order to act ethically, while avoiding potential penalties and reputational harm.