Windward Risk in its quarterly reports, refers to the all risk at sea, offering an overview of any emerging behavioral trends in developing hubs prone to illicit activity.

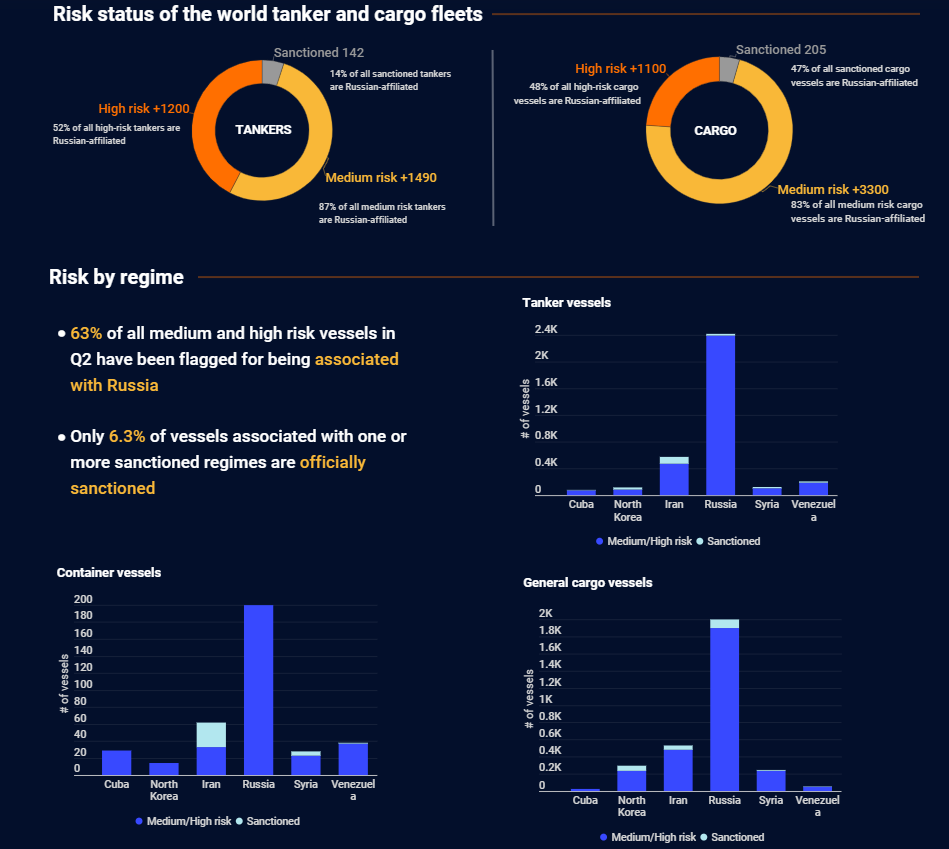

- 63% of all medium and high risk vessels in Q2 have been flagged for being associated with Russia

- Only 6.3% of vessels associated with one or more sanctioned regimes are officially sanctioned

Furthermore, deceptive shipping practices (DSPs) are tactics used by bad actors to evade detection, sanctions, and regulations while engaging in illegal operations, such as oil smuggling and illegal trading. Deceptive actors are quick to adapt their tactics and constantly seek loopholes in existing regulations and sanctions. Staying on top of these developing illicit behaviors and tracking emerging hubs is crucial for growing your business, while staying compliant.

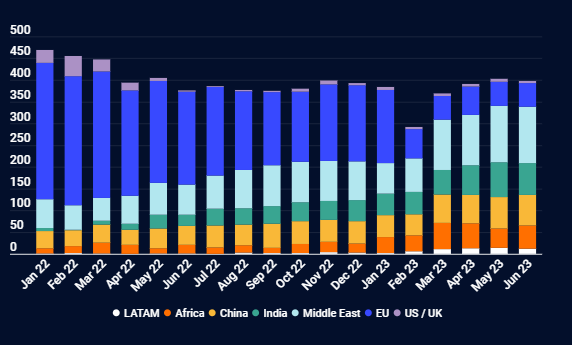

Russian oil exports – direct voyages

When looking at the data since June 2022, it’s clear that the volume of Russian oil being directly exported from Russia stayed the same throughout the war and the developing sanctions. While the volume stayed the same, the destinations have changed quite drastically:

- USA/EU/UK: In H1 of 2022, the average number of direct Russian oil exports was 143. These numbers dropped greatly in H1 2023 with an average of 41 direct voyages – a 71% decrease.

- LATAM: This last quarter represented an all-time high of direct export voyages of Russian oil. In Q1 of 2023, the average number of voyages was 6, and in Q2 increased to 13 – a 116% increase.

- Middle East: Q2 of 2023 showed a 50% increase in direct exports of Russian oil to the Middle East, with a quarterly average of 125 voyages.