According to Vortexa’s analysis, LNG freight prices are under pressure as rapid fleet growth outpaces demand, and ballast speeds of the fleet are falling at the start of the winter season, highlighting the oversupply.

As explained, this dynamic is a reversal of recent historical trends where freight demand typically peaks during this period as Europe and Asia ramp up stockpiling for winter. LNG freight prices have been trending lower this year as strong fleet growth outpaced liquefaction capacity additions. 52 newbuild carriers joined the fleet year to date, nearly double the number of deliveries in the same period last year. In contrast, new liquefaction capacity has been limited, with only 5.8 mtpa of additions in 2024.

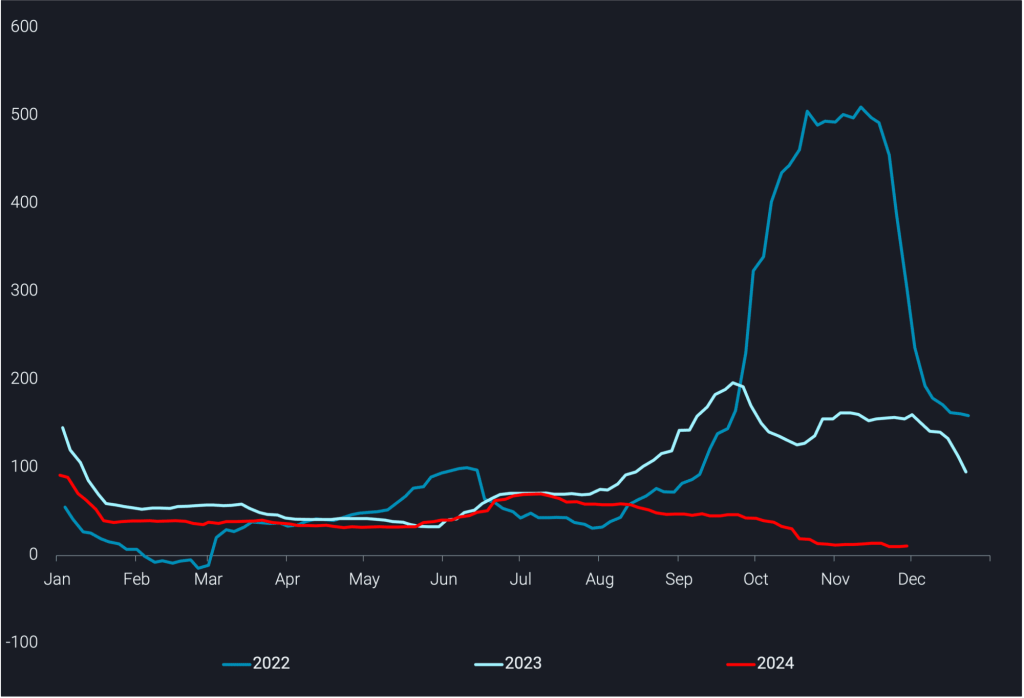

The excess vessel availability is highlighted by a decline in average speeds of the fleet at the start of the winter season, when speeds typically ramp up to meet peak freight demand as LNG stockpiling begins for European and Asian markets.

This year weekly average ballast speeds of the fleet fell by 1% from mid-September to November, in contrast to a 5% increase during the same period in the last two years.

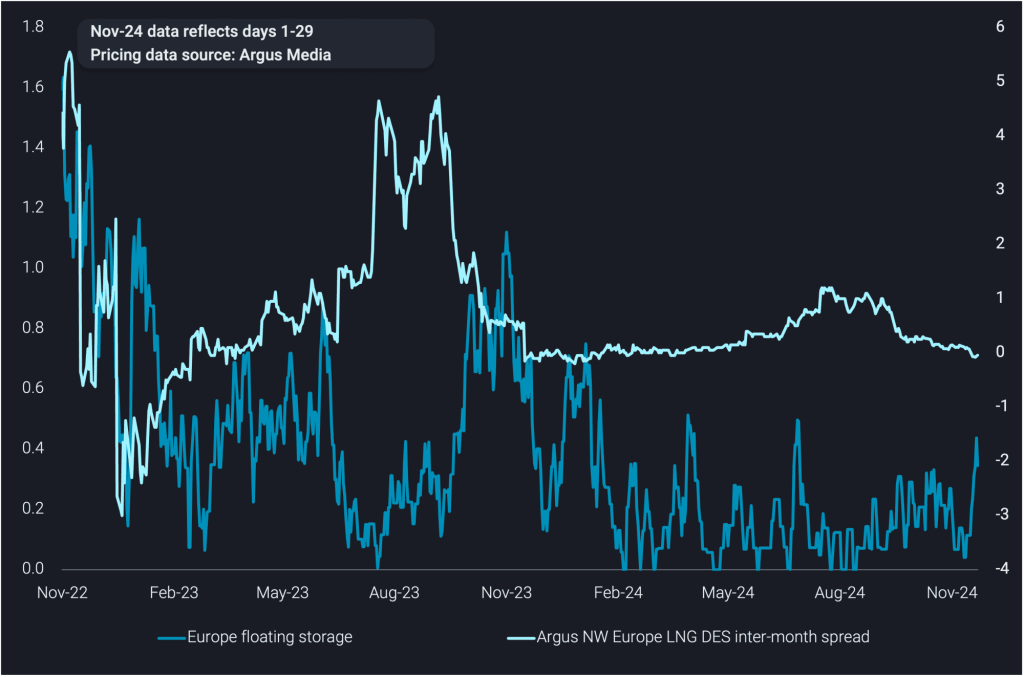

In addition, freight demand has also been limited with a shallow DES Europe contango market structure underpinning weak European floating storage incentive at the start of the winter season. Lower expected temperatures in Europe, extended maintenance periods at Norwegian gas fields and faster underground gas storage withdrawals have strengthened European spot prices in recent weeks, keeping the inter-basin arbitrage closed.

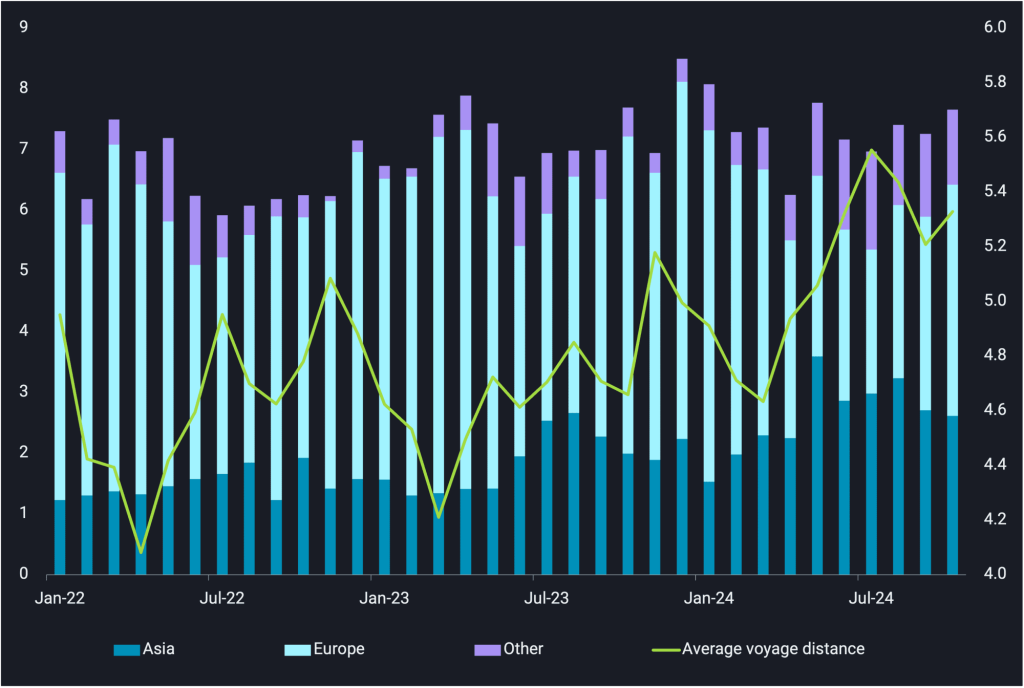

Looking ahead, LNG freight demand is projected to grow on the back of the ramp up of US projects coupled with a higher share of US exports heading to Asian markets than recent years. This will improve the tonne-mile demand of the fleet, particularly as US cargoes are forced on longer voyages to the Pacific Basin with carriers avoiding the Panama Canal and geopolitical conflict impacting transits through the Red Sea.

The LNG fleet will continue to rapidly expand in 2025, with additional 89 newbuilds expected to be delivered 2025. In the near term, this strong fleet growth will outpace the rise in shipping demand, creating continued pressure on freight prices.