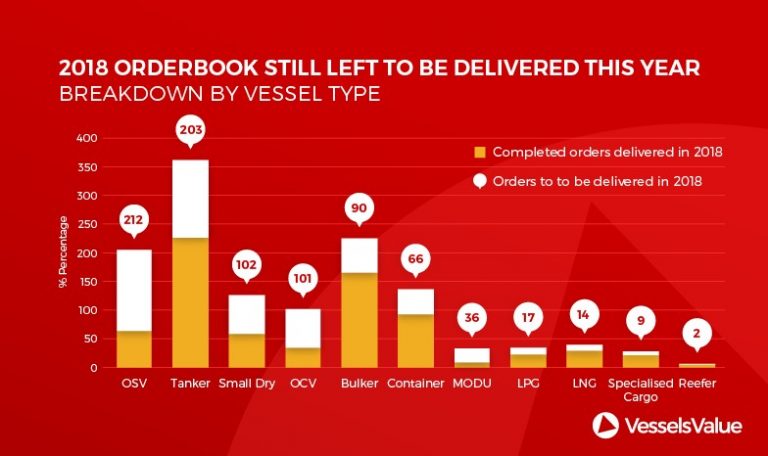

A total of 1,966 vessels have deliveries dates scheduled for 2018, but only 1,100 have hit the water so far this year, meaning 44% of the ’18 orderbook is outstanding, according to VesselsValue. Ship deliveries typically slow down towards the end of the year, as a vessel is considered a whole year younger if shipowners wait a few weeks, allowing the delivery to slip into the new year. Many sectors can expect a higher proportion of the orderbook to hit the water in future years.

Out of the three top shipbuilding countries, China still has 50% of their 2018 orders to deliver within the last two months of the year. Compared to Japan and South Korea, where 25% and 28% of their respective orderbooks is currently outstanding, Chinese yards could potentially slip 446 vessels into next year’s delivery schedule.

Ship types with the highest number of outstanding 2018 scheduled deliveries include all offshore vessels types (MODUs at 75% 2018 vessels still to be delivered, OSV 69%, OCV 67%) and the Small Dry sector at 54%.

South Korean Yards

- Shipyards are looking healthy this year – they have already delivered 160 vessels out of a total 221 scheduled for delivery this year.

- Concentration of deliveries are in the Tanker and LNG types, with 37 tankers still left to be delivered out of 128, and 8 LNG vessels out of a total 35 orders.

- However Korean yards have only managed to fill one offshore order, still intending to launch 3 MODUs, 1 OCV and 1 OSV by the end of 2018.

Orders at Chinese Yards

- Even though Chinese yards dominate the offshore newbuilding orderbook, securing 291 orders for delivery in 2018, not all is as it seems. 76%, or 221 vessels and rigs, are still to be delivered by the end of the year.

- As the market fell, vessel owners were delaying and cancelling orders in a bid to conserve cashflow and prevent further dips in utilisation.

- This worked to some extent, but the market has been left with a significant overhang of vessels waiting to be delivered. There has been a huge amount of speculation on the condition of the c.400 vessels – varying from rusting hulls, to good quality vessels. One would hope that none of these vessels are going to be delivered, but it is possible that an influx of new tonnage hampers recovery as charter rates look to be recovering.

Singapore & Malaysian Owners

- By far the largest 2018 orderbook comes from Nam Cheong, the Malaysian shipowner with delivery of 7 OSVs so far out of a possible 34 scheduled for this year.

- Next year will not provide the shipowner / yard with more respite, with another 15 vessels planned for 2019.

US Offshore Owners

- In the years prior to the oil price crash, OSVs would typically make up 30-50% of American deliveries.

- However, offshore support vessels reduced their proportion of the total US deliveries, with only 13 hitting the water in 2017 vs 63 in 2014.

- While the slow down of deliveries is being experienced around the world, the American company Edison Chouset is bucking the trend by taking delivery of 12 OSVs so far this year, with only 1 still in the schedule.

Norwegian Owners

- Norway has managed to get 57% of their scheduled orders delivered this year so far, totaling 47 vessels.

- This is at a similar level to 2017, where only 55 vessels hit the water during the full year.

- The vessel types with the largest overhang are in the container and OSV sectors.

German Owners

- 2018 represented a return to previous delivery levels for German shipowners, but only if all vessels are delivered.

- Currently there are 61 scheduled for 2018 vs 42 in 2017.

- The majority of the newbuild orders placed by German shipowners still waiting delivery (23 vessels) are in the container sector, with 14 out of 26 vessels scheduled for 2018 delivery sitting at the yards.

Greek Owners

- Globally Greece has taken delivery of 72% of all orders scheduled for delivery in 2018, however overall ordering levels have been steadily declining over the last 5 years.

- Greek owners remain highly aware of the state of the shipping markets and the progression of the shipping cycle. Decades of experience in the modern tanker and large bulk carrier markets have given owners an instinctual feel for timing fleet renewal.

- If all vessels scheduled for delivery in 2018 hit the water, Greece will increase their fleet by a total of 85 tankers, the highest tanker scheduled delivery level since 2010 when 98 vessels hit the water in a single year.

- On the other hand, Greek Dry Bulk deliveries have reduced to only 30 orders for 2018, the lowest level on record.