BIMCO informed that the US sanctions on Iran are affecting the tanker shipping industry. The immediate effects may be less tangible but they add more uncertainty to the whole shipping industry that has plenty of uncertainty to deal with.

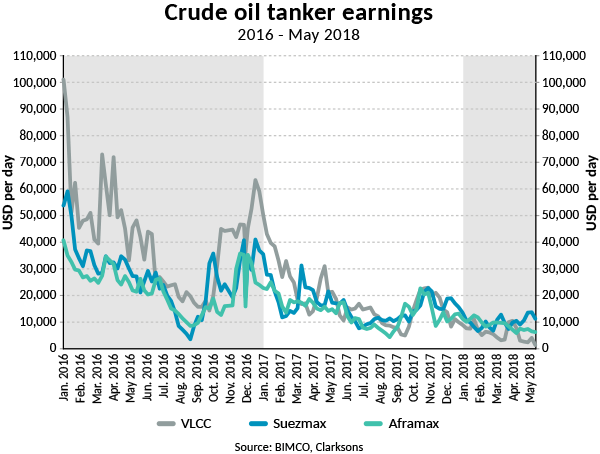

Freight rates for crude oil tankers and oil product tankers are making losses. However, the larger crude oil tankers were affected the most. Average earnings for VLCC, Suezmax and Aframax stood at USD 4,238; 18,073 and 17,930 per day respectively. In the product tanker sector average earnings were low, ranging from USD 10,561 per day for a LR2 via USD 6,500 per day for a LR1 to USD 9,121 per day for a MR.

[smlsubform prepend=”GET THE SAFETY4SEA IN YOUR INBOX!” showname=false emailtxt=”” emailholder=”Enter your email address” showsubmit=true submittxt=”Submit” jsthanks=false thankyou=”Thank you for subscribing to our mailing list”]

BIMCO said:

The tanker industry will enjoy a noteworthy higher level of demand when global oil stocks are drawn further down. Moreover, a better oil market balance may also cause a return to an oil price contango (contango is a situation where the future price of a commodity is higher than the spot price). An oil price contango is likely to indicate an increased demand for tankers for floating storage.

As Peter Sand noted, 2018 saw a narrow focus on VLCC orderings in the crude oil tanker sector. The developments in shipping in general and the oil tanker sector are focused on the larger ship sizes, but it remains important not to prepare too far in advance.

Moreover, more pipelines are built around the world, that are equally critical to the oil tankers. Amongst the newer pipelines are the Sino-Myanmar pipeline to Kunming, the second Sino-Russian pipeline to Daqing and the East-West Petroline from Arabian Gulf to Yanbu in the Red Sea.

Another trend to notice is how Europe is going to keep imports of oil products high. In recent years, Middle Eastern refineries are built for exports, and more are being expected in the next of years. However, it still remains to be seen if these refineries will be able to produce for domestic purposes.