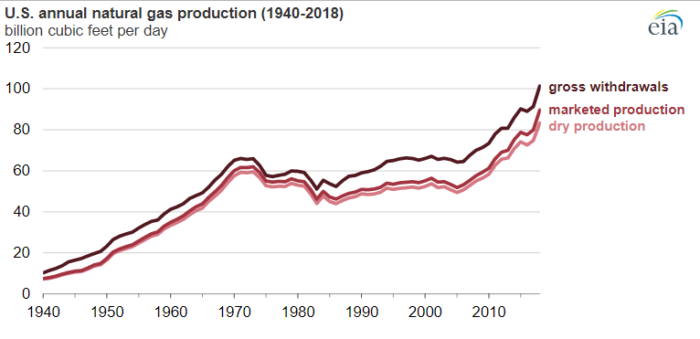

According to EIA US natural gas production experienced an increase by 10.0 billion cubic feet per day in 2018, noting an 11% rise in comparison to 2017. The development reported was the largest annual increase in production on record, establishing a record high for a second year in a row.

Specifically, US natural gas production measured as marketed production and dry natural gas production also reached record highs at 89.6 Bcf/d and 83.4 Bcf/d, respectively.

The natural gas gross withdrawals rose every month, except June 2018. Ultimately, the withdrawals reached a record monthly high of 107.8 Bcf/d in December 2018.

Marketed natural gas production and dry natural gas production also achieved monthly record highs of 95.0 Bcf/d and 88.6 Bcf/d, respectively, in December 2018.

In addition, marketed production reflects gross withdrawals less natural gas used for repressuring wells, quantities vented or flared, and nonhydrocarbon gases removed in treating or processing operations. Dry natural gas is consumer-grade natural gas, or marketed production less extraction losses.

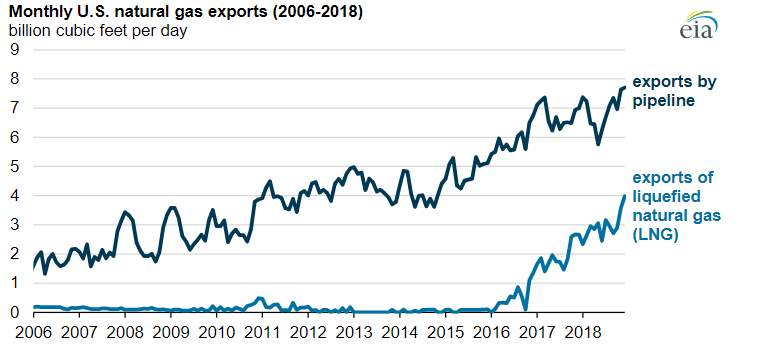

Equally to natural gas production increase, the volume of natural gas exports both through pipelines and as LNG increased as well for the fourth year in a row, reaching 9.9 Bcf/d.

Overall, natural gas exports increased by 14% in 2018, and LNG exports grew by 53% to 3.0 Bcf/d.

Both pipeline and LNG exports reached record monthly highs in December 2018 of 7.7 Bcf/d and 4.0 Bcf/d, respectively.

The United States continued to export more natural gas than it imported in 2018, after being a net exporter in 2017 for the first time in nearly 60 years.

Additionally, in September 2018 the US exported more natural gas by pipeline than it imported by pipeline for the first time in at least 20 years.

EIA foresees that natural gas exports by pipeline will surpass natural gas imports by pipeline in 2019 for the year.

The Appalachian region remained the largest natural gas-producing region in the United States. Furthermore, Appalachian natural gas from the Marcellus and Utica/Point Pleasant shales of Ohio, West Virginia, and Pennsylvania continued to grow, with gross withdrawals increasing from 24.2 Bcf/d in 2017 to 28.5 Bcf/d in 2018.

Yet, Ohio experienced the largest percentage increase in gross withdrawals of natural gas, up 34%, in 2018 to 6.5 Bcf/d.

Also, Texas faced the largest total volumetric gain in gross withdrawals in 2018, increasing to 24.1 Bcf/d, up from the state’s 2017 production of 21.9 Bcf/d.

Concluding, EIA supports that Texas’s increase in natural gas production is mainly because of the development in the Permian Basin and Haynesville Shale formation.