According to EIA, during 2018 the annual Henry Hub natural gas spot price increased to $3.16 per million British thermal units (MMBtu), up 15 cents from the 2017 average. The prices were risen gradually, with important increases on October and November, before experiencing a decrease in December.

Specifically, the growing US production and low temperatures during winter, resulted to a increasing demand on natural gas consumption on 2018.

Additionally, continued increases of U.S. natural gas exports by pipeline to Mexico and additional liquefied natural gas export capacity that came online during the year resulted in the United States exporting more natural gas than it imported for the second year in a row.

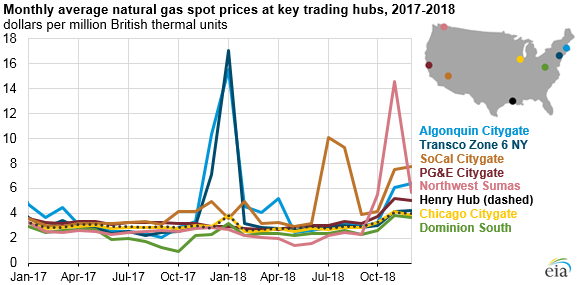

During January 2018, the natural gas spot prices spiked in the Northeast because of the extreme cold weather, which mostly affected the Eastern US.

- January

Moreover, the Algonquin Citygate, which server Boston-area consumers, and the Transco Zone 6 NY hub, which serves New York City, averaged $15.52/MMBtu and $17.67/MMBtu, respectively.

At Algonquin Citygate, the daily prices reached as high as $125/MMBtu and $175/MMBtu at Transco Zone 6 NY.

- November

Natural gas prices again increased since many were the areas that experienced colder weather conditions.

Several weeks of inventory withdrawals in mid-November placed upward pressure on prices, which reached $4.70/MMBtu at the Henry Hub, or $1.65/MMBtu higher than on the same date in 2017.

- December

Prices fell at Henry Hub throughout the month of December, and as of January 2, 2019, prices were $2.79/MMBtu.

What’s more, other regions in the Lower 48 states experienced natural gas price spikes in 2018. Daily average natural gas spot prices at the SoCal Citygate in Southern California experienced volatility throughout 2018 as ongoing pipeline capacity constraints limited natural gas supply in the region.

The spread in natural gas spot prices between the Henry Hub in Louisiana and the Appalachian region continued to narrow in 2018. Pipeline capacity buildout in the Appalachian region continued during 2018 to bring natural gas to demand centres outside the region, decreasing the price difference between the two regions.

EIA expects that U.S. natural gas production will have reached record levels in 2018.

Through the first ten months of 2018, dry natural gas production in the United States was 11% higher in 2018 compared with the same period in 2017. Growth has been driven by production increases in the Appalachian Basin in the Northeast, the Permian Basin in western Texas and New Mexico, and the Haynesville Shale in Texas and Louisiana.