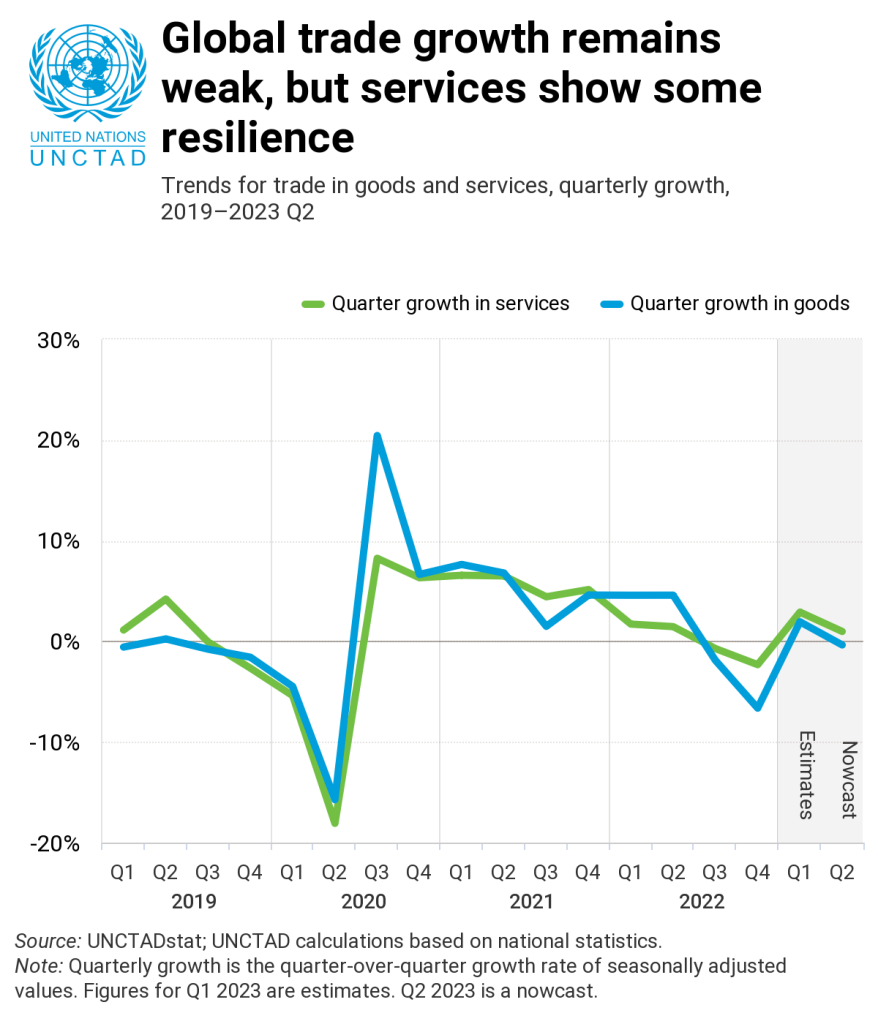

During the first quarter of 2023, trade growth was positive for both goods and services, according to UNCTAD’s latest Global Trade Update. After the downturn in the second half of 2022, world merchandise trade rebounded in both volume and value.

Following two consecutive quarters of decline, global trade in goods and services rebounded between January and March 2023. But prospects for the rest of the year are bleak. Over the first three months of 2023, trade in goods went up by 1.9% from the last quarter of 2022, adding about $100 billion. Global services trade also increased by about $50 billion, up by about 2.8% compared to the previous quarter.

The current projection for Q2 2023 indicates a slowdown in global trade growth. Global economic forecasts have recently been revised downwards, and factors such as persistent inflation and, financial vulnerabilities, along with the ongoing war in Ukraine and geopolitical tensions, pose challenges to global trade. Overall, the outlook for global trade in the second half of 2023 is pessimistic, as negative factors dominate the positive.

- Increasing demand for services

Global commercial services are expected to continue growing in the second half of 2023, primarily driven by a rise in demand for information and communication technology (ICT) services and by the rebound in travel and tourism sectors.

- Trade supporting the green transition

The patterns of international trade are anticipated to become more closely tied to the transition towards a greener global economy. Trade and industrial policies reflecting climate commitments would necessarily affect trade flows, especially in goods and services related energy efficient products and renewable energy production.

- Shipping costs remain low

Global shipping capacity remains strong. The Shanghai containerized freight rate index has returned to pre-pandemic levels, and is expected to remain low throughout 2023.

Negative factors:

- Geopolitical factors

The war in Ukraine and geopolitical tensions remain the biggest factors impacting international trade thorough 2023.

- Weakening global economy

Global economic forecasts are being revised downwards and economic growth in many countries is expected to remain below historical trends.

- Potential rise in trade restrictive measures

Persistent inward-looking policies in large economies could result in an increase in trade restrictive measures, which would hold back international trade growth.

- Slowing industrial output

Both China and the United States Purchasing Managers Index declined in May 2023, suggesting a decline in industrial production for the next quarters. China exports for May 2023 were also below expectations, signaling weak global demand for goods.

- Inflation, commodity prices and interest rates

Many economies are expected to maintain relatively high interest rates as a result of ongoing inflationary pressures. Despite a downward trajectory, commodity prices, particularly in the energy, food, and metals sectors, are projected to remain above pre-pandemic averages.

- Concerns of debt sustainability

The current record levels of global debt, coupled with high interest rates, will continue to negatively affect the macroeconomic conditions of many countries. Economies with underlying vulnerabilities could see further increases in borrowing costs.