Overcapacity will remain a key challenge for the container shipping industry and more mergers are expected to take place. However, this should not be considered as a bad sign for the industry. McKinsey says that mergers can provide sizable operational synergies and commercial opportunities by combining two complementary businesses and provides tips for help industry players better manage the integration process.

In order the container line to take advantage of the mergers and succeed, it is important to approach them strategically and with an eye toward best practices. McKinsey suggest an approach for conduction a successful container M&A:

- Select the right target with a clear investment thesis

- Conduct due diligince

- Structure the right deal

- Fight for your fair value

- Think through your negotiation strategy

The following examples describe various merger structures:

- Standard acquisition. For example, Maersk will acquire Hamburg Süd for €3.7 billion on a cash and debt-free basis. Maersk will finance the acquisition through a syndicated loan facility.2

- Merger. Hapag-Lloyd merged equity shareholdings with UASC.3The previous shareholders of each line became common shareholders in the new Hapag-Lloyd.

- Joint ventures. The Japanese carriers are setting up a new joint venture by injecting their assets into it; NYK Line is contributing 38 percent, and K Line and MOL Liner are each contributing 31 percent).4

- Partial integrations. COSCO Shipping and Shanghai International Port Group made a preconditional voluntary general offer to Orient Overseas (International) Limited (OOIL) to acquire all of its issued shares. COSCO Shipping and OOCL (wholly owned by OOIL) will continue to operate under independent brands.

- Charter arrangements. Rather than acquiring China Shipping’s fleet and container assets, COSCO Shipping chartered them long term.5It also left China Shipping’s original listed company to develop into a leasing and finance company.

In order to ensure a successful integration, McKinsey further suggest to focus on few key points:

- Integrate the companies and form a shared new vision

- Act early to fully capture synergies by launching a clean team

- Pay attention to cultural differences, and use these insights to facilitate cultural integration and communication

- Go ‘big bang’ for the transaction while migrating services gradually

- Set up a value-added integration infrastructure and governance

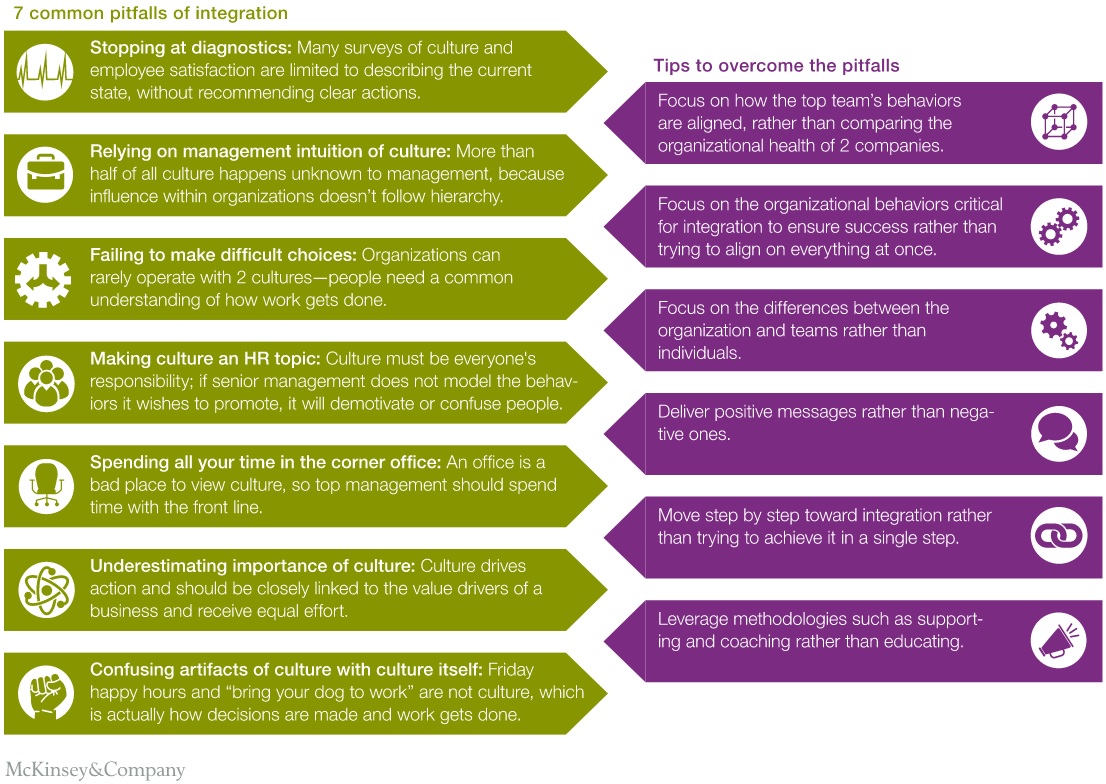

McKinsey has created the following infographic to illustrate how to retain talent & capture value from a merger and avoid the pitfalls of cultural integration: