The extreme drought has forced the Canal to implement further measures, reducing booking slot numbers to 25, starting November 3rd, and, unfortunately, it only goes south from then on.

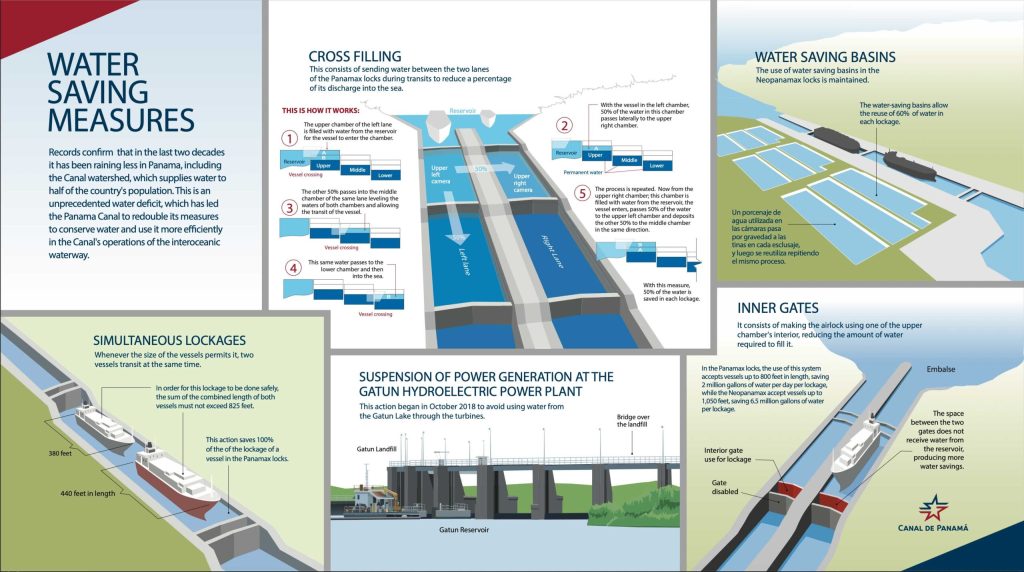

The Panama Canal has implemented water saving measures during this prolonged dry season. This month, due to unprecedented levels of Gatun Lake and projected 38% less rainfall for the rest of the year, the Canal has decided to further reduce daily transit capacity, after facing the driest October since 1950.

| Dates | Number of reservation slots |

| November 3rd to 7th | 25 |

| November 8 to 30 | 24 |

| December 1 to 31 | 22 |

| January 1 to January 31, 2024 | 20 |

| As of February 1, 2024 | 18 |

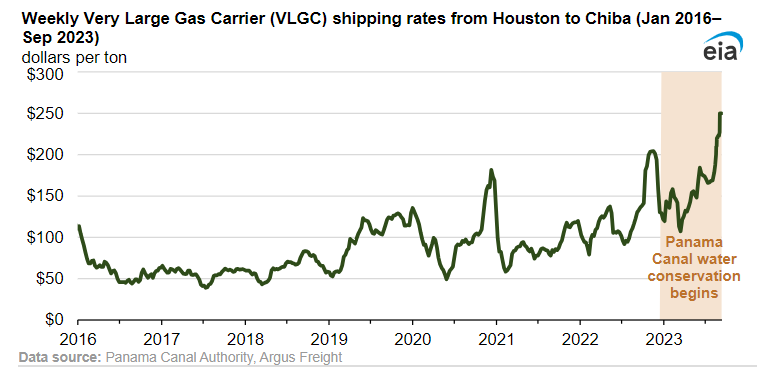

How the Canal impacts VLGC shipping rates

According to EIA (Energy Information Administration) VLGC rates have reached record highs because of the delays at the Panama Canal. Rates for VLGCs, which carry primarily propane (and, to a lesser extent, butane), on the Houston-Chiba (Japan) route reached $250 per ton for the week ending September 29, the highest since rates were first published in 2016.

The Houston-Chiba route usually passes through the Panama Canal because it takes nearly half the time compared with going across the Atlantic and through the Suez Canal.

Delays at the Panama Canal have pushed shipping rates higher elsewhere by decreasing the globally available number of vessels as more wait to cross the Panama Canal, EIA notes. More recently, however, the higher freight rates caused VLGC charterers to stay out of the market in October, which made more VLGCs available on the market and caused rates to fall to $176 per ton for the week ending October 13.

Capitalizing on the situation

Seeing potential in the Canal’s situation, Mexico’s government is reviving a railway between the Gulf of Mexico and the Pacific Ocean to divert traffic away from the Panama Canal.

The construction of the Tehuantepec isthmus corridor aims to capitalize on Panama Canal’s low water levels. Mexico has spent around 50bn pesos on the project, including upgrading the railway, buying land for industrial parks, and acquiring machinery and new rolling stock. However, it could take considerable time for the work to be completed.

Industry remains positive

Despite all difficulties, companies seem to hold their faith on the Canal, with new investments underway. For instance, Seaspan and AES have signed a memorandum of understanding (MoU) aimed at providing LNG bunkering services to shipping vessels transiting the Panama Canal, as well as exploring options to provide this and similar services in regional markets within the area of influence of AES’s Costa Norte LNG terminal in Colón, Panama.

Moreover, Crowley is moving forward with plans to offer LNG bunkering services on the Pacific side of the Panama Canal. Crowley is prepared to offer bunkering and associated port solutions, with a projected start date of 2024.