The latest Shipping Confidence Survey from BDO, shipping adviser and accountant, reports that the last quarter reached its highest level for 18 months, despite the feeling of uncertainty due to the upcoming 2020 sulphur cap.

Accordingly, for November 2019 respondents expressed a 6.4 out of 10.0 average confidence level, in comparison to August’s 5.8.

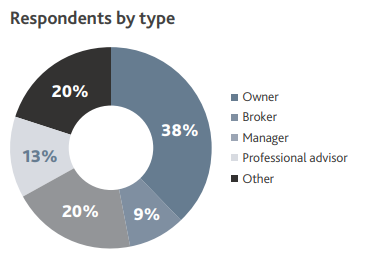

Concerning managers and owners’ confidence was up to 6.9, in comparison to levels recorded in the previous survey of 5.9 and 6.4 respectively.

The broking sector experienced a decrease from 5.1 to 3.9, which is the lowest rating in the category, since the survey was firstly launched in May 2008.

Specifically, concerning regions:

- Asia: decreased from 6.8 to 6.0

- Europe: increased from 5.7 to 6.2

- North America: increased from 4.3 to 6.8

Moreover, respondents’ major investments for the future remains stable by 5.5 out of 10.0.

Owner’s confidence decreased by 6.5 to 6.3, while that of brokers dropped from 4.4 to 2.9. Meanwhile the expectations of managers held steady at 6.1.

Expectations were down in Asia and in Europe, from 6.6 to 5.7 and from 5.4 to 5.1 respectively.

In the meantime, the number of respondents expecting finance costs to rise in the future increase to 37% from 25%.

Whereas 57% of managers (up from 20% last time) anticipated dearer finance over the next 12 months, just 32% of owners (albeit up from 27% last time) thought likewise.

In a stand-alone question, respondents were asked to estimate where the US Federal Reserve’s Federal Funds Rate would stand in 12 months’ time. 24% of respondents put the figure at 1.50%, while estimates of 1.75% and 1.25% were favoured by 17% and 16% of respondents respectively. 15% of respondents predicted that the rate would reach 2.00%, while 11% predicted a figure of 2.25%. Overall, 16% of respondents put the likely rate at no higher than 1.00%.

# Freight markets

Those waiting for increased tanker rates in the future increase from 43% to 46%

Dry bulk sector: overall expectations of rate increases were up from 39% to 50%, and in the case of brokers alone from 20% to 71%.

Container ship rates: rose by 10% to 29%

Net rate sentiment was positive in all three main tonnage categories.

Overall, despite Brexit, and President Trump’s impeachment inquiry, shipping’s confidence increased for 18 months in the quarter that is being reviewed. BDO’s study reveals an increased expectation over the next 12 months of dearer finance costs, highlighting that the cost of regulatory compliance begins being important, boosted by the implementation of the IMO sulphur cap.

The survey concludes that

There is a lot of uncertainty around IMO 2020 and world trade, but a more controlled demand-supply balance bodes well for the medium-term.