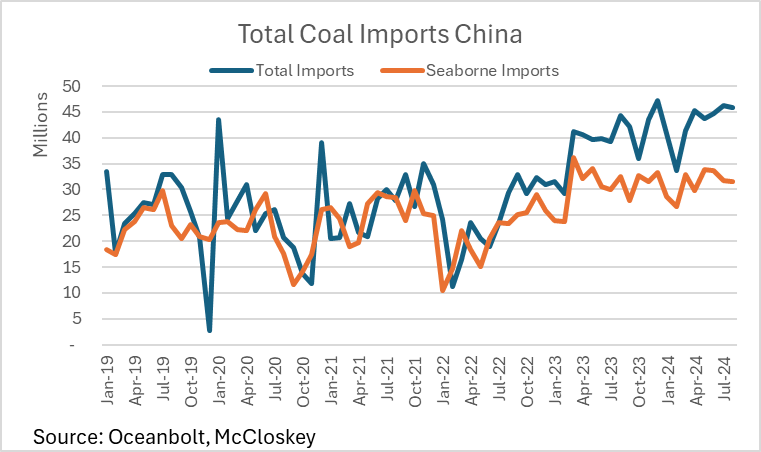

China has tried to find alternatives as coal imports transported by sea lose market share according to Veson Nautical data.

The share of Chinese coal imports being transported by sea have fallen sharply in the last two years, down from 93% of the total between 2015-2022 to 76% in 2023-2024 according to a new report by commodity market intelligence provider Oceanbolt, a Veson Nautical solution.

The report ‘How China’s New Silk Road is Impacting Maritime Coal Transport’, states that despite coal exports to the world’s second largest economy soaring 62% to 473.4 million tonnes in 2023, seaborne imports only increased by 45%.

The data represents a seismic shift in global trade flows as China looks to diversify supply away from traditional exporters and capitalize on geopolitical uncertainty by purchasing discounted coal from other sources.

Australia bearing the brunt

The report also states that Australia’s share of China’s coal imports fell sharply, from 26% in 2019 to just 11% in 2023 after the unofficial ban on Australian coal imports was lifted. Since all Australian coal exports to China are seaborne, this decline largely explains the recent drop in seaborne coal volumes.

“The country that has been impacted the most in this shift to higher land borne volumes is Australia,” Mikkel Nordberg, Senior Maritime Analyst at Veson Nautical says. “And while there has been a recovery in imports of Australian steam coal to China after trade resumed in 2023, the coking coal trade has been heavily impacted.

Nordberg adds that China imported just 2.8 million tonnes of Australian coking coal, a staggering 91% decline from pre-ban levels.

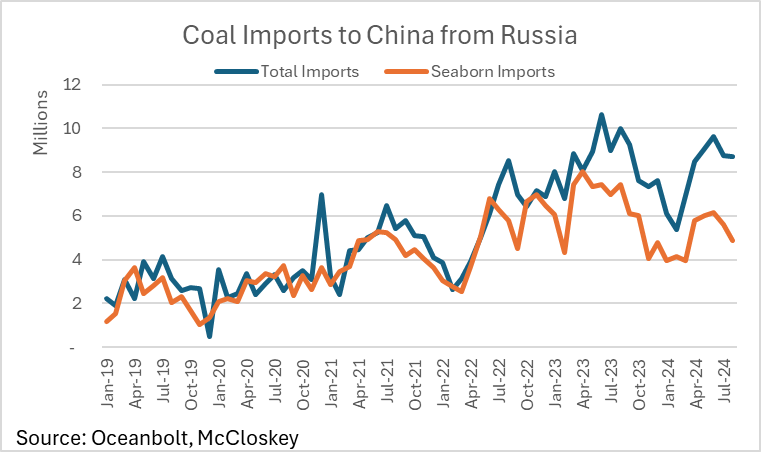

Cheap Russian coal sees imports rise

The report cites Russia as a growing supplier of coal to China. Russia’s share of Chinese coal imports grew from 11% in 2019 to 22% in 2023. This shift could be linked with the war in Ukraine and the subsequent sanctions imposed on Russia by Western nations.

These sanctions effectively halted Russian coal exports to the EU and other Western allies, forcing Russia to seek alternative markets.

“With reduced global demand and limited buyers, China has capitalized on the opportunity to purchase Russian coal at discounted prices,” Nordberg says. “As a result, the Russia-China coal trade surged, increasing by 20% in 2022 and a further 50% in 2023, reaching 102 million tonnes.”

Nordberg adds that between 2022 and 2023, Russian coal exports to China grew by 34 million tonnes, but only 18.7 million tonnes of this increase were transported by sea, suggesting that 15.3 million tonnes were shipped via land.

Mongolia emerging as major player

The report also cites Mongolia as a big winner as coal exports to China soar as infrastructure improves.

Around 90% of Mongolia’s coal production is destined for export to China due to limited domestic demand. According to the Mongolian Coal Association, the country has the potential to produce up to 100 million tonnes annually.

However, this capacity is constrained by border infrastructure and customs processes. In 2023, Mongolia took significant steps to enhance its coal export capabilities, including the inauguration of a new railway line connecting its coal mines to the Chinese border.

Consequently, Mongolia’s coal exports to China surged by 125% in 2023, reaching 70 million tonnes, and have grown another 27% so far in 2024. Approximately 75% of these exports are coking coal, making Mongolia China’s largest supplier of this resource.

“In 2023, Mongolia accounted for 53% of China’s total coking coal imports,” Nordberg says. “As a landlocked country, all of Mongolia’s coal exports are transported overland, which means that it is effectively replacing the seaborne coking coal volumes previously sourced from Australia.”

Growing land borne trade hurts seaborne trade growth

The report concludes that the increase in land borne coal volumes could have significant repercussions in the bulk carrier sector. Assuming that the land borne volumes should otherwise be sourced from Australia, the report argues that the total ton-mile demand lost out on 1% growth last year.

“This development has unquestionably hurt the Capesize and the Panamax class vessels, which are the largest carriers of Chinese coal imports,” Nordberg concludes. “It has been particularly evident in Panamax freight rates which underperformed the Supramaxes in Q3, and the usual seasonal rebound we tend to see in Q4 has not materialised.”