US sanctions on Iran have forced South Korea to look for alternative sources of condensates, thereby impacting tonne-mile demand, shipping consultancy Drewry said. Meanwhile, as Asian petrochemical consumption is likely to slow down, intra-regional trade will weaken and will therefore lead to lower charter rates for small gas carriers.

The petchem sector in South Korea is faced with a ‘double-edged sword’. On the one hand, the US sanctions on Iran have forced South Korea to look for alternative sources of feedstock, and on the other, declining petchem prices and weaker economic forecasts for South Korea’s major petchem consumers, such as China and Japan, have reduced the demand for South Korean,

…explains Shefali Shokeen, Senior Research Analyst, Drewry Maritime Research.

As explained, China’s imports of South Korean petchem products decreased by 2.3% due to trade war with US. This led South Korea’s petchem exports to drop 1.4% to 2,761,000 tonnes in 2018 from 2,799,000 tonnes in 2017.

Furthermore, petchem exports are projected to decline again in 2019, due to forecasts of slower industrial production in Asian petchem importing countries.

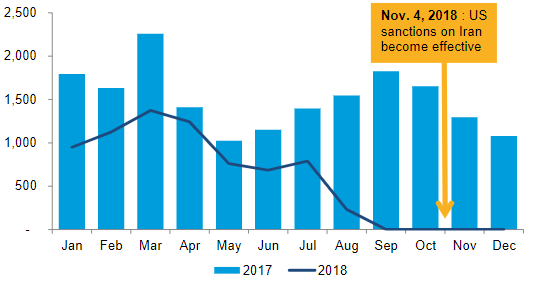

In early 2018, the outlook for South Korea’s petchem sector was bullish, mainly due to forecasts of higher ethylene demand. However, when the US imposed sanctions on Iran, the situation changed almost overnight. Up to that point, Iran accounted for 38% of South Korean imports in the first seven months of 2018.

Despite the 180-day temporary sanction waiver starting November 2018, South Korea stopped importing condensates from Iran in September due to the lack of clarity over insurance and other terms related to exporting vessels.

As a result of the sanctions, major importers such as SK Incheon Petchem, SK Energy, Hyundai Chemical and Hanwa Total Chemicals started looking for alternatives to secure sufficient feedstock. The shortfall in imports was mostly met by supplies from Qatar and Australia trading at a premium, which increased feedstock costs for South Korean buyers. Condensate supplies from Saudi Arabia and the US also increased amid rising demand.

Despite uncertainty surrounding sanctions, and with US condensates trading at a discount to Middle Eastern supplies, we believe South Korea will continue to import more condensates from the US in 2019 along with other sources in the mix. The switch from Iran to the US will have a positive effect on the tonne-mile demand increasing the voyage time from 14.5 days on Iran–South Korea route to 35.7 days on US (Texas)–South Korea route. The change in sources will bring more employment for MGC and LGC vessels improving their charter rates in 2019.

However, on the flip side smaller p/r vessels operating in Asia will have a tough time due to increased competition from larger vessels and weak intra-regional trade, putting pressure on already stressed earnings in 2019.