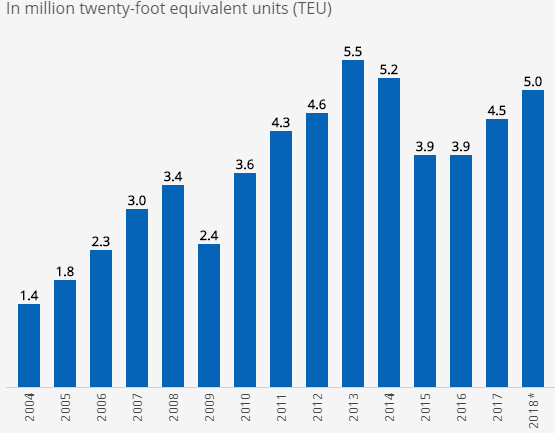

Fitch Ratings resulted to the fact that the Russian container port market continues recovering, despite the fact that future growth is likely to be silent. According to the estimations, 2018 full-year throughput growth in Russia reached about 10% to 5 million TEUs. Yet, the market seems predominately import-driven.

Fitch Ratings expect that Russian GDP growth will strengthen to 1.9% in 2020 from 1.5% in 2017 (and forecast 1.8% in 2018 and 1.5% in 2019), supported by stronger domestic demand, which could benefit container volumes.

In 2018, turnover at DeloPorts’ NUTEP container terminal increased by 10%, while Global Ports rose its container throughput by almost 16% in the first half of the year.

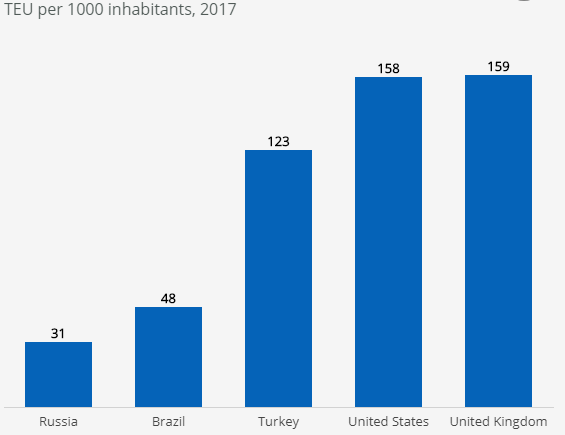

Moreover, the Russian market is still ‘under-containerised’ in comparison to other countries because Russia started the containerisation later.

Containerisation, measured as throughput per thousand inhabitants, is 31 TEU in Russia versus 123 TEU in Turkey and 158-159 TEU in the developed markets of the US and the UK.

However, volumes are still below the 2013 peak. Yet, Fitch expects development rates to be lower because it would be difficult to maintain the accelerated pace of 2017-2018.

In addition, the Russian container market is believed to be volatile as it has shown marks of fast recovery.

For example, in 2009 the volumes dropped by 28% due to the economic crisis, whereas in 2015 the volumes decreased by 25% because of a deterioration of the macroeconomic environment and sharp rouble depreciation. These were followed by periods of steady recovery.

Both of the examples were followed by periods of steady recovery.

Finally, many are the Russian port operators that upgrade theur handling in equipment and infrastructure based on the continuous market recovery.