The oil market collapse caused by the COVID-19 pandemic is set to delay several oil and gas developments in Western Europe, putting capital expenditure in the offshore sector on a continued downwards trajectory through 2022, data by Norway-based research firm Rystad reveals.

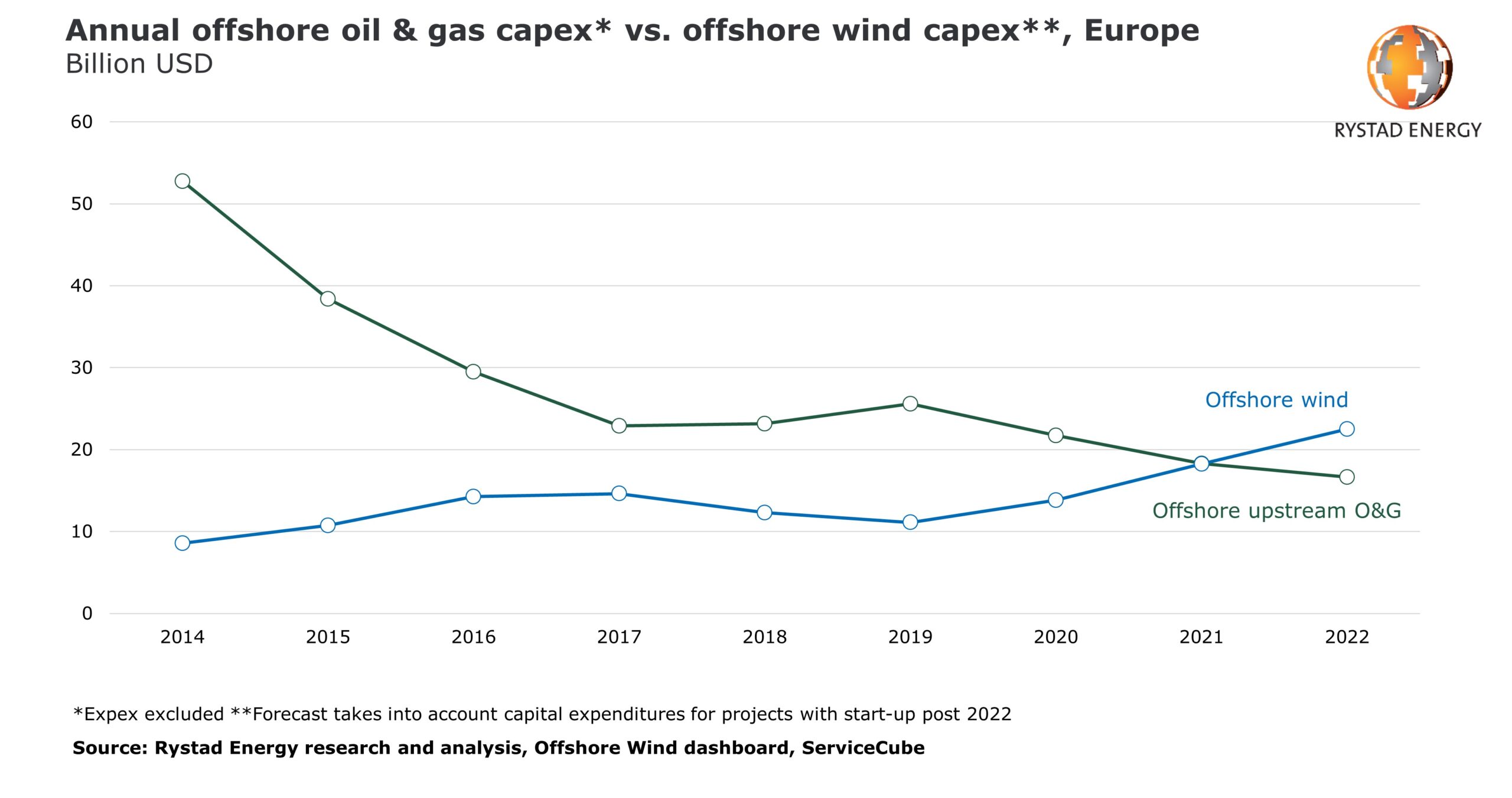

As multiple FIDs on projects and lower investments in offshore oil and gas have been postponed, while activity in the offshore wind sector has increased, Rystad Energy expects that the two markets will reach parity as soon as next year.

We anticipate that capital expenditure (capex) on offshore wind will surpass upstream O&G spending in Europe in 2022.

As explained, Capex towards offshore wind in Europe surpassed the $10 billion mark in 2015 and has since hovered in the range of $10 billion to $15 billion per year.

[smlsubform prepend=”GET THE SAFETY4SEA IN YOUR INBOX!” showname=false emailtxt=”” emailholder=”Enter your email address” showsubmit=true submittxt=”Submit” jsthanks=false thankyou=”Thank you for subscribing to our mailing list”]

Annual capex levels are expected to rise from around $11.1 billion in 2019 to around $13.8 billion in 2020, $18.2 billion in 2021 and more than $22 billion in 2022.

The abundant oil supply and reduced demand have taken their toll on the oil price, and consequently annual capex towards upstream offshore oil and gas in Europe is expected to decline from more than $25 billion in 2019 to less than $17 billion in 2022.

Offshore wind development in Europe is expected to flourish in the coming years as countries strive to reach their ambitious 2030-targets – and large investments will be required,

…says Alexander Flotre, Rystad Energy’s project manager for offshore wind.

Commissioning activity is expected to increase towards 2025, and projects expected to be operational in 2023-2025 are already driving up capital expenditure in 2020. This trend will continue in the coming years,

…Flotre adds.

Europe is expected to maintain its number one position through 2025 in terms installed capacity of offshore wind.

From an installed base of 21.9 gigawatts (GW) in 2019, European capacity is expected to increase to more than 53 GW by 2025, constituting an annual growth rate of 16%.

While Europe’s ambitious plans for 2030 will require new tender rounds in the coming years, most of the commissioning activity towards 2025 is expected to come from projects that have already been approved.